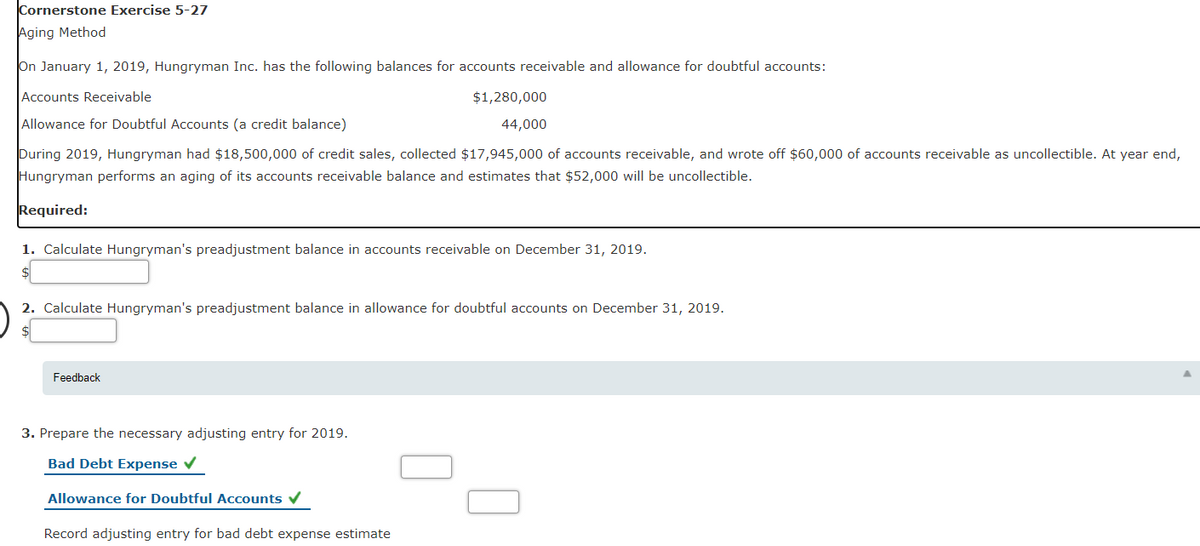

Cornerstone Exercise 5-27 Aging Method On January 1, 2019, Hungryman Inc. has the following balances for accounts receivable and allowance for doubtful accounts: Accounts Receivable $1,280,000 Allowance for Doubtful Accounts (a credit balance) 44,000 During 2019, Hungryman had $18,500,000 of credit sales, collected $17,945,000 of accounts receivable, and wrote off $60,000 of accounts receivable as uncollectible. At year end, Hungryman performs an aging of its accounts receivable balance and estimates that $52,000 will be uncollectible. Required: 1. Calculate Hungryman's preadjustment balance in accounts receivable on December 31, 2019. 2. Calculate Hungryman's preadjustment balance in allowance for doubtful accounts on December 31, 2019. Feedback 3. Prepare the necessary adjusting entry for 2019. Bad Debt Expense v Allowance for Doubtful Accounts Record adiusting entry for bad debt expense estimate

Cornerstone Exercise 5-27 Aging Method On January 1, 2019, Hungryman Inc. has the following balances for accounts receivable and allowance for doubtful accounts: Accounts Receivable $1,280,000 Allowance for Doubtful Accounts (a credit balance) 44,000 During 2019, Hungryman had $18,500,000 of credit sales, collected $17,945,000 of accounts receivable, and wrote off $60,000 of accounts receivable as uncollectible. At year end, Hungryman performs an aging of its accounts receivable balance and estimates that $52,000 will be uncollectible. Required: 1. Calculate Hungryman's preadjustment balance in accounts receivable on December 31, 2019. 2. Calculate Hungryman's preadjustment balance in allowance for doubtful accounts on December 31, 2019. Feedback 3. Prepare the necessary adjusting entry for 2019. Bad Debt Expense v Allowance for Doubtful Accounts Record adiusting entry for bad debt expense estimate

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter4: Internal Control And Cash

Section: Chapter Questions

Problem 20CE

Related questions

Question

Transcribed Image Text:Cornerstone Exercise 5-27

Aging Method

On January 1, 2019, Hungryman Inc. has the following balances for accounts receivable and allowance for doubtful accounts:

Accounts Receivable

$1,280,000

Allowance for Doubtful Accounts (a credit balance)

44,000

During 2019, Hungryman had $18,500,000 of credit sales, collected $17,945,000 of accounts receivable, and wrote off $60,000 of accounts receivable as uncollectible. At year end,

Hungryman performs an aging of its accounts receivable balance and estimates that $52,000 will be uncollectible.

Required:

1. Calculate Hungryman's preadjustment balance in accounts receivable on December 31, 2019.

2. Calculate Hungryman's preadjustment balance in allowance for doubtful accounts on December 31, 2019.

Feedback

3. Prepare the necessary adjusting entry for 2019.

Bad Debt Expense v

Allowance for Doubtful Accounts v

Record adjusting entry for bad debt expense estimate

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning