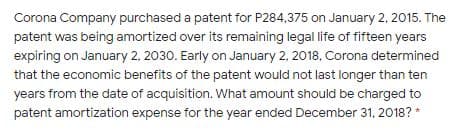

Corona Company purchased a patent for P284,375 on January 2, 2015. The patent was being amortized over its remaining legal life of fifteen years expiring on January 2, 2030. Early on January 2, 2018, Corona determined that the economic benefits of the patent would not last longer than ten years from the date of acquisition. What amount should be charged to patent amortization expense for the year ended December 31, 2018? *

Corona Company purchased a patent for P284,375 on January 2, 2015. The patent was being amortized over its remaining legal life of fifteen years expiring on January 2, 2030. Early on January 2, 2018, Corona determined that the economic benefits of the patent would not last longer than ten years from the date of acquisition. What amount should be charged to patent amortization expense for the year ended December 31, 2018? *

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 5RE: Mystic Pizza Company purchased a patent from Prime Pizza Plus on January 1, 2019, for 72,000. The...

Related questions

Question

What amount should be charged to patent amortization expense for the year ended December 31, 2018?

Transcribed Image Text:Corona Company purchased a patent for P284,375 on January 2, 2015. The

patent was being amortized over its remaining legal life of fifteen years

expiring on January 2, 2030. Early on January 2, 2018, Corona determined

that the economic benefits of the patent would not last longer than ten

years from the date of acquisition. What amount should be charged to

patent amortization expense for the year ended December 31, 2018? *

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College