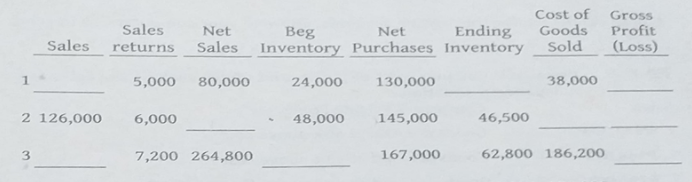

Cost of Goods Sold Gross Profit (Loss) Sales Net Ending Beg Inventory Purchases Inventory Net Sales returns Sales 5,000 80,000 24,000 130,000 38,000 2 126,000 6,000 48,000 145,000 46,500 3. 7,200 264,800 167,000 62,800 186,200

Q: Cost formula Information on Entity A's inventory of Product A is as fóllows: Units Total Cost P…

A: Solution: Under FIFO method of inventory costing, units purchased first is considered as sold first.…

Q: Cost of Goods Sold Gross Sales Net Sales Beg Inventory Purchases Inventory Ending Profit Net Sales…

A: Formula: Net sales = Sales - Sale returns

Q: Cost of goods sold: 28,000 16,000 125,000 Beginning inventory 2$ 120,000 Net purchases 141,000…

A: solution-1 Compute inventory turnover ratio Dec 2017 Formula- Inventory turnover ratio=Cost of good…

Q: The partial income statements of five different companies are as follows: 1 3 4 Net Sales…

A: Formulas : Net sales = Cost of goods sold + Gross profit Cost of goods sold = Opening Inventory +…

Q: Sales revenue Freight in Beginning inventory Purchases discounts 44,000 75,000 20,000 44,000 Sales…

A: Cost of goods available for sale means how much value or amount of goods are available

Q: Merchandise Inventory Olson, Capital Olson, Drawing Sales Sales Returns and Allowances Purchases…

A: The closing entries are very important as these are passed to write off temporary accounts whose…

Q: Cost of Gross Sales Net Beg Net Ending Goods Profit Sales returns Sales Inventory Purchases…

A: Formula: Net sales = Sales - Sales returns

Q: 5. Using T-accounts, compute for the missing amounts in the table belo Inventory, beg. Net purchases…

A: Formula: Ending inventory = Beginning inventory + Net purchases - Cost of sales

Q: If the beginning inventory 140 300 ID., cost of purchases 230 100 ID., selling and Administrative…

A: Inventory:- Inventory is considered as one of the most important current asset of particular…

Q: Sales Net Beg Net Ending Sales returns Sales Inventory Purchases Inventory 1 5,000 80,000 24,000…

A: Sales: It is an activity where the goods and services are sold to the customer for a certain price.…

Q: A company reports the following information beginning inventory 11,000 ending inventory 13,000…

A: For a seller, the cost of merchandise sold is considered as all the direct cost incurred to sell the…

Q: Sales Cost of goods sold Merchandise inventory (beginning) Total cost of merchandise purchases…

A: The income statement shows the net income or loss that is calculated by deducting the expenses from…

Q: I. The partial income statements of five different companies are as follows: 3. Net Sales…

A: Goods Available for Sale during a period = Opening Inventory + Net Purchases during a period Cost of…

Q: Sales Cost of Sales Net Beg Net Ending Goods returns Sales Inventory Purchases Inventory Sold 5,000…

A: Sales revenue: Sales revenue is the amount earned by the company by selling the goods or providing…

Q: Gross Sales Sales returns Goods Sold Net Ending Profit Beg Inventory Purchases Inventory Net Sales…

A: Formula: Net sales = Sales - Sales returns

Q: Cost of goods sold Beginning inventory Ending inventory $722,000 53,000 67,000

A: Formula: Inventory turnover ratio = Cost of goods sold / Average Inventory

Q: Presented below are the components in determining cost of goods sold. Determine the missing amounts.…

A: Cost of goods sold means the cost incurred on the manufacturing or purchase of goods which has been…

Q: Make the closing entries in the major general

A: Closing Entry: A closing entry is a journal entry passed at the end of an accounting period to…

Q: Cost of Goods Sold Gross Sales Net Ending Profit Beg Inventory Purchases Inventory Net Sales returns…

A: As requested to answer only last part so we are answering only last part.

Q: Adjusted Account Balances Merchandise inventory (ending) Other (non-inventory) assets Total…

A: Net Sales - Net Sales is the sales after deducting Sales Return and Sales Discounts from Gross…

Q: Multiple Step Income Statement Calculations Company A Company B Company C Company D $480 $2,000 200…

A: Company A 1. Purchases = Ending inventory + purchase return - beginning inventory + cost of goods…

Q: Beg Inv @ cost $11,160 Net Additional markups $600 Sales $94,056 Purchases @ retail $92,400…

A: Cost to retail ratio: Under the retail inventory method, closing inventory is valued using the cost…

Q: Presented below are the components in determining cost of goods sold. Determine the missing amounts.

A:

Q: Merchandise Inventory Sales 75,000.00 85,500.00 COGS 53,571.43 3,200.00 Gross Profit 21,428.57…

A: Inventory shrinkage: If the number of products in stock are lesser than those recorded on the…

Q: Account Cost of goods sold Inventory Company X $1,980,000 $ 175,000 Company Y $4,338,000 $ 295,000…

A: Days in inventory = 365 / (Cost of goods sold / Average inventory) where, Average inventory =…

Q: only Answerg question Cost of Gross Goods Profit Sales Net Beg Net Ending Sales returns Sales…

A: Since you have asked for part 2 only so we have answered the same for you. Sale is the amount of…

Q: Ending Inventory at Cost 739,160 3,930,000 Goods Available for Sale at retail Sales Discount Net…

A: Answer) Calculation of Net Sales Net Sales = Gross Sales – Sales Discount Net Sales = 2,843,000 –…

Q: Cost of Goods Sold Gross Profit (Loss) Sales Ending Net Sales Beg Inventory Purchases Inventory Net…

A: As posted multiple sub parts we are answering only first three sub parts kindly repost the…

Q: Supply the missing dollar amounts for each of the following independent cases: Selling and General…

A: Total available = Beginning inventory + purchases Cost of goods sold = Total available - Ending…

Q: Cost of Gross Goods Sold Sales Profit Ending Sales Inventory Purchases Inventory Net Beg Net Sales…

A: As requested to solve only 4th part so we are answering only fourth part.

Q: Tollowing rmation records of companies ame dustry: A B D Sales $300 $150 $ ? $ 90 Opening Inventory…

A: Gross profit is computed by the following formula : Gross profit = net sales - cost of goods sold…

Q: Cost of goods sold: Chocss) 199 865,000 $58,400 Ending inventory: 11.2% $34,000 Operating income:…

A: Accounting system defines various formulas to calculate and reconcile the figures recorded in the…

Q: In the table below there are missing figures. GHC GHC GHC GHC Opening inventory Closing inventory…

A: Gross profit is the profit from trading activity before adjusting the operational expenses. It is…

Q: Cost of goods sold is $108,000 ,ending inventory is $12,000 and purchases is $100,010. What is…

A: Cost of goods sold = Beginning inventory + Purchases - Ending inventory

Q: Bouquet Company used the conventldhU method to account for inventory. nventory Cost Retail 9,200,000…

A: Cost of goods sold refers to the total cost of goods that are manufactured and sold. It includes the…

Q: 240,000 30,000 200,000 100,000 15,000 55,000 Net Sales 12,000 Beginning Inventory Net Cost of…

A: In accounting terms, Net sales are defined as the revenues earned by the entity through business…

Q: Sales Ending Goods Sold Net Profit Beg Inventory Purchases Inventory Net Sales returns Sales (Loss)…

A: Net sales = Sales - Sales Return Net purchases = Purchases - Purchase Return Cost of goods sold =…

Q: If the beginning inventory 70 000 ID. , the cost of purchases 330 000 ID., purchases expenses 50 000…

A: Solution:- Calculation of cost of goods sold as follows under:-

Q: Cost of Goods Gross Sales Profit (Loss) Net Ending Beg Inventory Purchases Inventory Net Sales…

A: Net sales = Gross sales - Sales returns Cost of goods sold = Beginning inventory + Net purchases -…

Q: Inventory P 1,900,000 Sales…

A: Cost of Goods sold = Beginning Inventory + Purchases - Ending Inventory When goods are sold on FOB…

Q: Revenue Gross Sales $189,000 Less: Sales Returns and Allowances 11,600 177,400 Net Sales Cost of…

A: Vertical analysis is a technique of analyzing financial statements. In this analysis, every element…

Q: The following information are available for ABC Corp at May 31, 20X1: Cost of goods sold, 170,000…

A: In the given question, increase in inventory is given as 3,000. Increase in inventory means that…

Q: Cost of Gross Goods Sold Sales Net Ending Profit Beg Inventory Purchases Inventory Net Sales returns…

A: Formula: Net sales = Sales - Sales returns

Q: Inventory, beg. ₱50,000; Net purchases, ₱120,000; Cost of goods sold, ₱80,000. How much is the…

A: Inventory, End = Inventory, Beg + Net purchases - Cost of goods sold

Q: Sales Goods Sold Net Ending Profit Beg Inventory Purchases Inventory Net Sales returns Sales (Loss)…

A: Net sales in business are computed by deducting sales returns from the gross sales. Net Sales =…

Q: In the table below there are missing figures. GHC GHC GHC GHC Opening inventory Closing inventory…

A: Cost of sales represents the direct costs related to the manufacturing of goods/services. Cost…

Q: For each of the following, determine the missing amounts. Purchases Goods Available Cost of Goods…

A: The cost of goods sold is computed as difference between cost of goods available for sale and…

Enter the missing values of the attached image.

Answer full question.

Step by step

Solved in 4 steps

- LO1 If the ending inventory is overstated by 10,000, indicate what, if anything, is incorrect about the following: Cost of goods sold___________ Gross profit___________ Net income___________ Ending owners capital___________Calculate a) cost of goods sold, b) ending inventory, and c) gross margin for A76 Company, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for weighted average (AVG).Inventory Valuation Specific identification method Weighted average cost method FIFO method LIFO method LIFO liquidation LIFO conformity rule LIFO reserve Replacement cost Inventory profit Lower-of-cost-or-market (LCM) rule Inventory turnover ratio Number of days sales in inventory Moving average (Appendix) The name given to an average cost method when a weighted average cost assumption is used with a perpetual inventory system. An inventory costing method that assigns the same unit cost to all units available for sale during the period. A conservative inventory valuation approach that is an attempt to anticipate declines in the value of inventory before its actual sale. An inventory costing method that assigns the most recent costs to ending inventory. The current cost of a unit of inventory. An inventory costing method that assigns the most recent costs to cost of goods sold. A measure of how long it takes to sell inventory. The IRS requirement that when LIFO is used on a tax return, it must also be used in reporting income to stockholders. An inventory costing method that relies on matching unit costs with the actual units sold. The portion of the gross profit that results from holding inventory during a period of rising prices. The result of selling more units than are purchased during the period, which can have negative tax consequences if a company is using LIFO. The excess of the value of a companys inventory stated at FIFO over the value stated at LIFO. A measure of the number of times inventory is sold during the period.

- Lower-of-Cost-Net-Realizable-Value Method The following data are taken from the Browning Corporation’s inventory accounts: ItemCode Quantity UnitCost Net RealizableValue ACE 100 $27 $25 BDF 300 29 31 GHJ 400 22 18 MBS 200 23 27 Calculate the value of the company’s ending inventory using the lower-of-cost-or-net realizable value method applied to each item of inventory. Ending Inventory Value: $AnswerLower-of-Cost-or-Net Realizable Value Method The following data refer to the Ian Company’s ending inventory: ItemCode Quantity UnitCost NetRealizableValue ABX 80 $50 $55 TYG 200 38 42 JIL 175 28 24 GGH 90 44 38 Calculate the value of the company’s ending inventory by using the lower-of-cost-or-net realizable value applied to each item of inventory. Ending inventory computed by applying the lower-of-cost-or-net realizable value to each item of inventory is $AnswerBeginningInventory Purchases Cost of GoodsAvailable for Sale EndingInventory Cost ofgoods sold $81,000 $111,000 $ (a) $ (b) $121,000 $50,000 $ (c) $115,000 $34,000 $ (d) $ (e) $101,000 $161,000

- How much is the inventory fire loss? A. P189,400 B. P183,640 C. P164,920 D. P254,0001. In the statement of financial statement restated to current cost, what amount should be reported as inventory on December 31? a. 1080000 b. 2880000 c.975000 d. 870000 2. What amount should be reported as unrealized holding gain on inventory for the current year? a. 210000 b. 135000 c. 560000 d. 0 3. In the income statement restated to current cost, what amount should be reported as cost of goods sold for the current year? a. 2320000 b. 2880000 c. 2600000 d. 2375000 4. In the income statement restated to current cost, what amount should be reported as realized holding gain from the inventory sold for the current year? a. 225000 b. 135000 c. 350000 d. 505000Lower-of-Cost-or-Net Realizable Value Method The following data are taken from the Hilton Corporation’s inventory accounts: Item Code Quantity Unit Cost Net Realizable Value Product 1 XKE 100 $32 $28 XKF 400 43 44 Product 2 ZNJ 400 32 29 ZNS 300 43 48 Calculate the value of the company’s ending inventory using the lower-of-cost-or-net realizable method applied to each item of inventory. Applying the lower-of-cost-or-net realizable value method to each item of the inventory results in an ending inventory amount of $Answer

- Presented below are the components in determining cost of goods sold.Determine the missing amounts. BeginningInventory Purchases Cost of GoodsAvailable for Sale EndingInventory Cost ofGoods Sold (a) $78,100 $101,600 ? ? $121,000 (b) $54,700 ? $120,000 $33,800 ? (c) ? $110,000 $151,000 $28,800 ?Below are the components in determining cost of goods sold. Determine the missing amounts. BeginningInventory Purchases Cost of GoodsAvailable for Sale EndingInventory Cost ofGoods Sold (a) $84,900 $103,500 $118,000 (b) $52,700 $113,000 $36,700 (c) $109,000 $169,000 $30,700Given the following: Numberpurchased Costper unit Total January 1 inventory 40 $4 $160 April 1 60 7 420 June 1 50 8 400 November 1 55 9 495 205 A. Calculate the cost of ending inventory using the LIFO (ending inventory shows 61 units). Cost of ending inventory is: B. Calculate the cost of goods sold using the LIFO (ending inventory shows 61 units). Cost of goods sold is: