cost of inventory a

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 13RE: Refer to the information provided in RE8-4. If Paul Corporations inventory at January 1, 2019, had a...

Related questions

Question

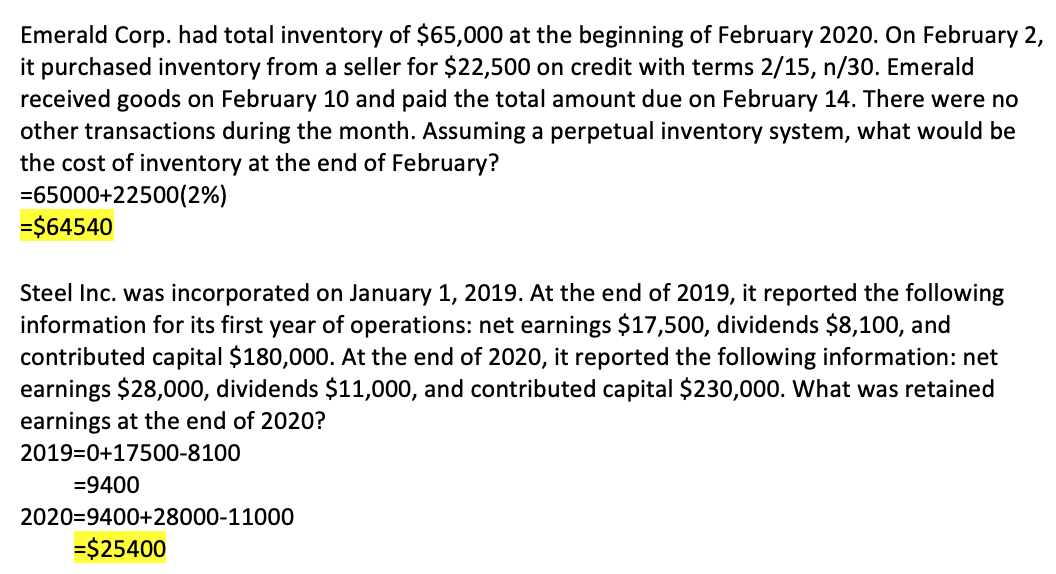

Transcribed Image Text:Emerald Corp. had total inventory of $65,000 at the beginning of February 2020. On February 2,

it purchased inventory from a seller for $22,500 on credit with terms 2/15, n/30. Emerald

received goods on February 10 and paid the total amount due on February 14. There were no

other transactions during the month. Assuming a perpetual inventory system, what would be

the cost of inventory at the end of February?

=65000+22500(2%)

=$64540

Steel Inc. was incorporated on January 1, 2019. At the end of 2019, it reported the following

information for its first year of operations: net earnings $17,500, dividends $8,100, and

contributed capital $180,000. At the end of 2020, it reported the following information: net

earnings $28,000, dividends $11,000, and contributed capital $230,000. What was retained

earnings at the end of 2020?

2019=0+17500-8100

=9400

2020=9400+28000-11000

=$25400

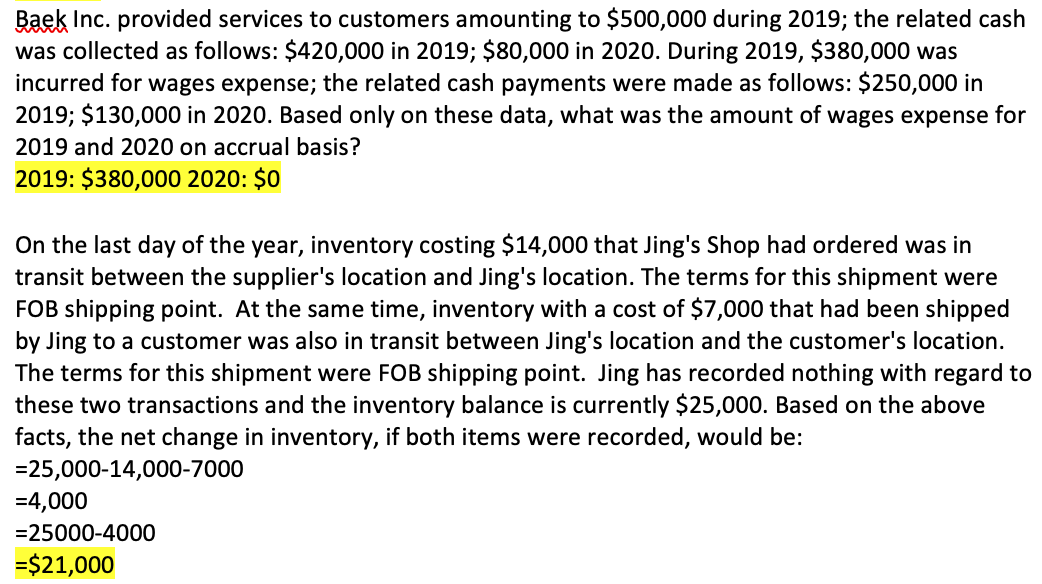

Transcribed Image Text:Baek Inc. provided services to customers amounting to $500,000 during 2019; the related cash

was collected as follows: $420,000 in 2019; $80,000 in 2020. During 2019, $380,000 was

incurred for wages expense; the related cash payments were made as follows: $250,000 in

2019; $130,000 in 2020. Based only on these data, what was the amount of wages expense for

2019 and 2020 on accrual basis?

2019: $380,000 2020: $0

On the last day of the year, inventory costing $14,000 that Jing's Shop had ordered was in

transit between the supplier's location and Jing's location. The terms for this shipment were

FOB shipping point. At the same time, inventory with a cost of $7,000 that had been shipped

by Jing to a customer was also in transit between Jing's location and the customer's location.

The terms for this shipment were FOB shipping point. Jing has recorded nothing with regard to

these two transactions and the inventory balance is currently $25,000. Based on the above

facts, the net change in inventory, if both items were recorded, would be:

=25,000-14,000-7000

=4,000

=25000-4000

=$21,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning