Cost of the principal residence (property was acquired in 2000) Fair market value of land as per tax declaration (based on the latest tax declaration) Fair market value of house as per tax declaration (based on the latest tax 2,000,000 3,000,000 2,000,000

Cost of the principal residence (property was acquired in 2000) Fair market value of land as per tax declaration (based on the latest tax declaration) Fair market value of house as per tax declaration (based on the latest tax 2,000,000 3,000,000 2,000,000

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 53P

Related questions

Question

51.)

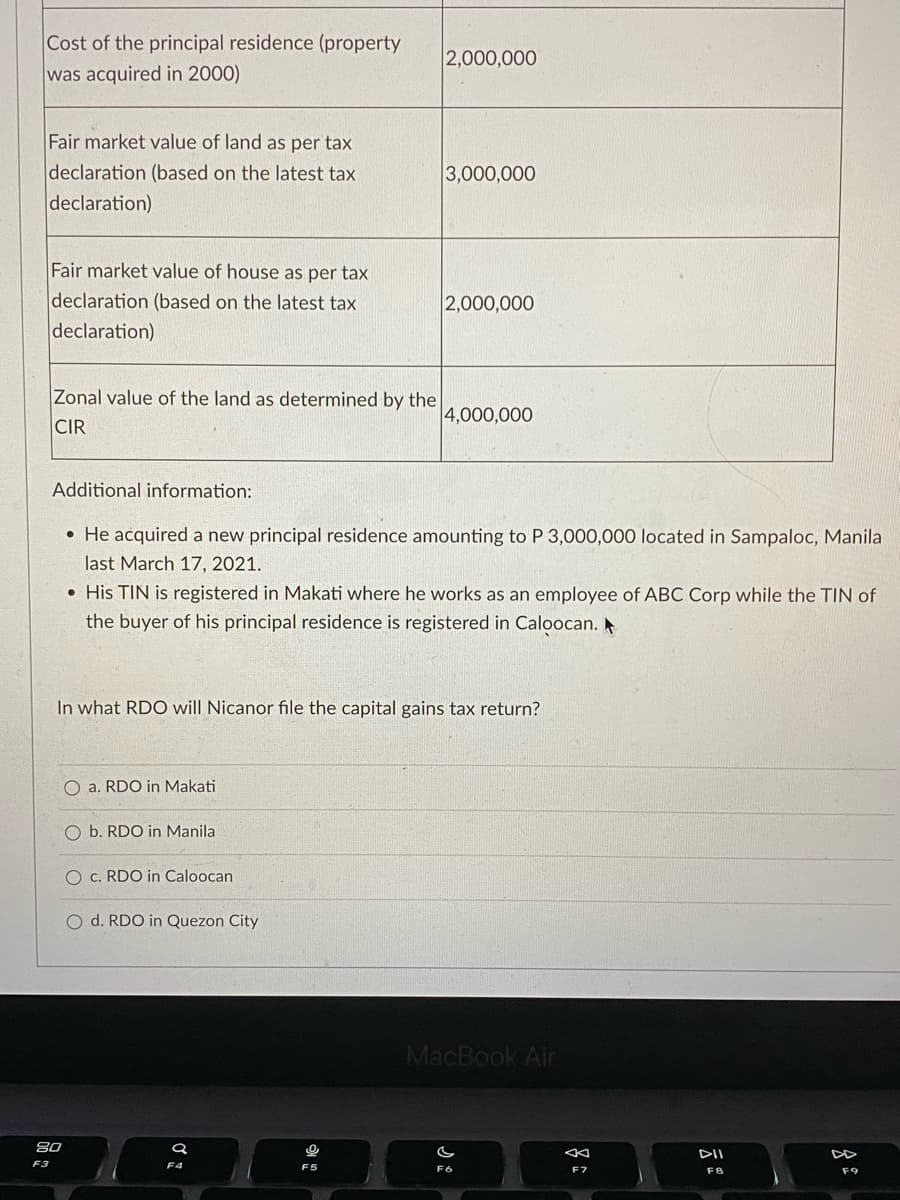

Transcribed Image Text:Cost of the principal residence (property

was acquired in 2000)

2,000,000

Fair market value of land as per tax

declaration (based on the latest tax

3,000,000

declaration)

Fair market value of house as per tax

declaration (based on the latest tax

2,000,000

declaration)

Zonal value of the land as determined by the

4,000,000

CIR

Additional information:

• He acquired a new principal residence amounting to P 3,000,000 located in Sampaloc, Manila

last March 17, 2021.

• His TIN is registered in Makati where he works as an employee of ABC Corp while the TIN of

the buyer of his principal residence is registered in Caloocan.

In what RDO will Nicanor file the capital gains tax return?

a. RDO in Makati

b. RDO in Manila

O c. RDO in Caloocan

O d. RDO in Quezon City

MacBook Air

80

DII

F3

F4

F6

F7

F8

F9

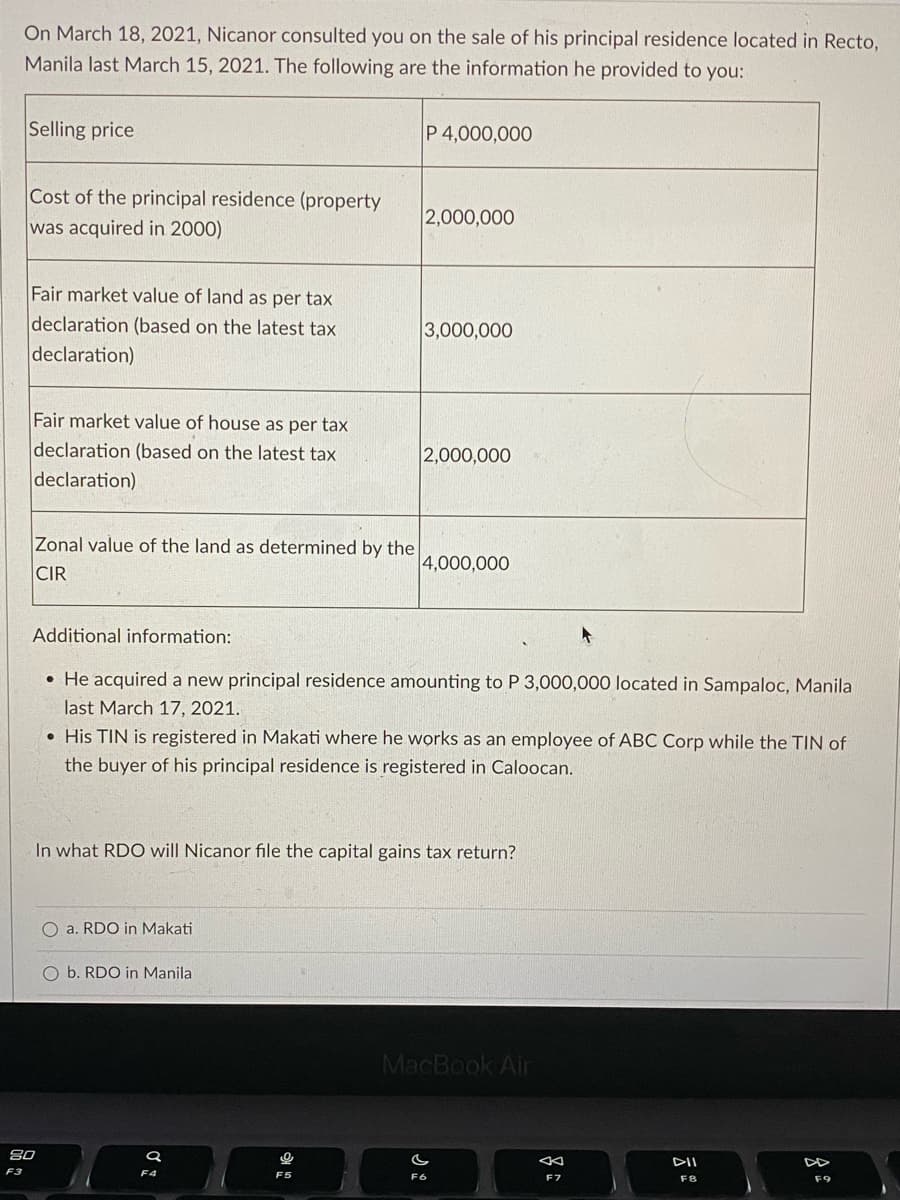

Transcribed Image Text:On March 18, 2021, Nicanor consulted you on the sale of his principal residence located in Recto,

Manila last March 15, 2021. The following are the information he provided to you:

Selling price

P 4,000,000

Cost of the principal residence (property

was acquired in 2000)

2,000,000

Fair market value of land as per tax

declaration (based on the latest tax

3,000,000

declaration)

Fair market value of house as per tax

declaration (based on the latest tax

2,000,000

declaration)

Zonal value of the land as determined by the

CIR

4,000,000

Additional information:

• He acquired a new principal residence amounting to P 3,000,000 located in Sampaloc, Manila

last March 17, 2021.

• His TIN is registered in Makati where he works as an employee of ABC Corp while the TIN of

the buyer of his principal residence is registered in Caloocan.

In what RDO will Nicanor file the capital gains tax return?

O a. RDO in Makati

O b. RDO in Manila

MacBook Air

80

DII

F3

F5

F7

F8

F9

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT