Could you help me with calculation of cost of debt which is 8,13%, i can see that was made excel calculation but can't understand. Maybe someone can explain through formula.

Could you help me with calculation of cost of debt which is 8,13%, i can see that was made excel calculation but can't understand. Maybe someone can explain through formula.

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter10: The Cost Of Capital

Section: Chapter Questions

Problem 1TCL: CALCULATING 3MS COST OF CAPITAL Use online resources to work on this chapters questions. Please note...

Related questions

Question

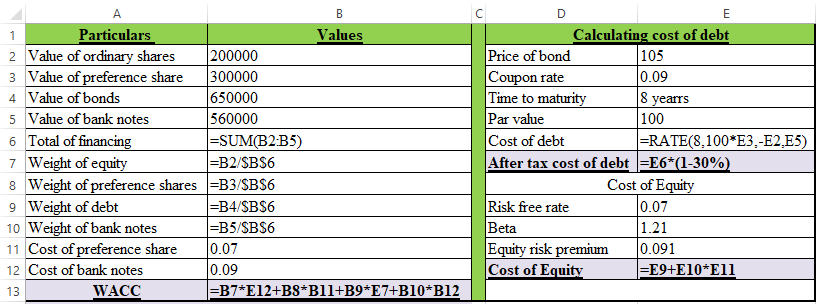

Could you help me with calculation of cost of debt which is 8,13%, i can see that was made excel calculation but can't understand. Maybe someone can explain through formula.

Transcribed Image Text:A

Particulars

2 Value of ordinary shares

200000

3 Value of preference share

300000

4 Value of bonds

650000

5 Value of bank notes

560000

6 Total of financing

=SUM(B2-B5)

7 Weight of equity

=B2/SBS6

8 Weight of preference shares =B3/SBS6

9 Weight of debt

=B4/SBS6

10 Weight of bank notes

=B5/SBS6

11 Cost of preference share

0.07

0.09

12 Cost of bank notes

WACC

13

=B7*E12+B8*B11+B9*E7+B10*B12

B

Values

E

Calculating cost of debt

105

0.09

8 yearrs

100

|=RATE(8,100*E3.-E2₂E5)

Price of bond

Coupon rate

Time to maturity

Par value

Cost of debt

After tax cost of debt =E6*(1-30%)

Cost of Equity

Risk free rate

0.07

Beta

1.21

Equity risk premium

0.091

Cost of Equity

=E9+E10*E11

![←

Opal Tr×

Slack

Opal T XD Dow Jc X CM Custon X ▸ (62) AF X

My Qu xb Search X b Answer x

G cost of x

+

→ с

✰ bartleby.com/questions-and-answers/are-given-the-following-information-about-jordan-plc-financial-position-statement-at-january-2017... Q

Opal Transfer | Sen... V Vonage Contact Ce... NEW TRANSFER The Hub - Login | C... Dow Jones - Busine... text Message Box Login...

Apps

Dashboard

Homework help starts here!

Q

ASK AN EXPERT

CHAT

VX MATH SOLVER

← Q&A Library

are given the following information about Jordan pl...

Students who've seen this question also like:

EXPERT

SOLUTION

✓

Type here to search

Question

are given the following information about Jordan plc:

Financial position statement at January 2017

£000 £000

Non-current assets 1,511

Current assets 672

Total assets 2,183

Equity finance

Ordinary shares (50p) 200

Reserves 150

Non-current liabilities

7% preference shares 300

9% bonds (redeemable after 8 years) 650

9% bank notes 560

Current liabilities 323

Total liabilities 2183

You are also given the following information:

• Yield on Treasury bills 7%

•Jordan plc equity beta 1.21

• Equity risk premium 9.1%

• Current ex-div ordinary share price £2.35

• Current ex-div preference share price 66p

• Current ex-interest bond price £105

• Corporate tax rate 30%

Required:

(a). calculate the company's weighted average cost of capital (WACC) using market weightings.

(b). critically discuss whether you consider that companies, by integrating a sensible level of gearing

into their capital structure, can minimise their weighted average cost of capital.

חו

W

Cornerstones of Financial Accou...

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

BUY

Chapter 9: L...

Problem 103.10

[B]Not helpful? See similar books

Similar questions

To this solution

Section: Ch...

Stuck on your

homework?

15°C

V

-

T

☐

Paraphrasing Tool |...

(¹) ENG

=S

21:54

20/05/2022

X

:](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F37cee5b4-7232-4bc9-a381-db8f85a59b51%2F78fe602d-a5a6-479b-baf0-eab7dc2ef94d%2F7q7udo9_processed.png&w=3840&q=75)

Transcribed Image Text:←

Opal Tr×

Slack

Opal T XD Dow Jc X CM Custon X ▸ (62) AF X

My Qu xb Search X b Answer x

G cost of x

+

→ с

✰ bartleby.com/questions-and-answers/are-given-the-following-information-about-jordan-plc-financial-position-statement-at-january-2017... Q

Opal Transfer | Sen... V Vonage Contact Ce... NEW TRANSFER The Hub - Login | C... Dow Jones - Busine... text Message Box Login...

Apps

Dashboard

Homework help starts here!

Q

ASK AN EXPERT

CHAT

VX MATH SOLVER

← Q&A Library

are given the following information about Jordan pl...

Students who've seen this question also like:

EXPERT

SOLUTION

✓

Type here to search

Question

are given the following information about Jordan plc:

Financial position statement at January 2017

£000 £000

Non-current assets 1,511

Current assets 672

Total assets 2,183

Equity finance

Ordinary shares (50p) 200

Reserves 150

Non-current liabilities

7% preference shares 300

9% bonds (redeemable after 8 years) 650

9% bank notes 560

Current liabilities 323

Total liabilities 2183

You are also given the following information:

• Yield on Treasury bills 7%

•Jordan plc equity beta 1.21

• Equity risk premium 9.1%

• Current ex-div ordinary share price £2.35

• Current ex-div preference share price 66p

• Current ex-interest bond price £105

• Corporate tax rate 30%

Required:

(a). calculate the company's weighted average cost of capital (WACC) using market weightings.

(b). critically discuss whether you consider that companies, by integrating a sensible level of gearing

into their capital structure, can minimise their weighted average cost of capital.

חו

W

Cornerstones of Financial Accou...

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

BUY

Chapter 9: L...

Problem 103.10

[B]Not helpful? See similar books

Similar questions

To this solution

Section: Ch...

Stuck on your

homework?

15°C

V

-

T

☐

Paraphrasing Tool |...

(¹) ENG

=S

21:54

20/05/2022

X

:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning