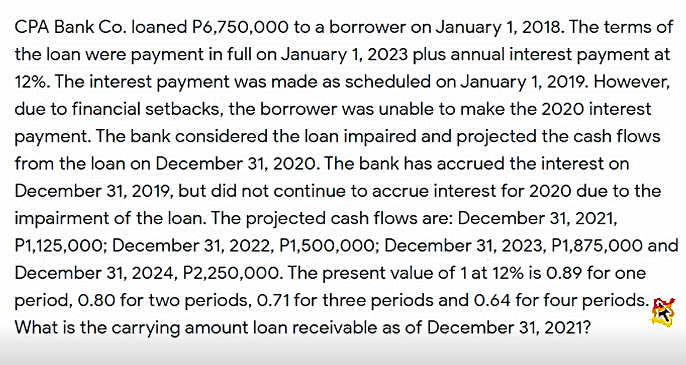

CPA Bank Co. loaned P6,750,000 to a borrower on January 1, 2018. The terms of the loan were payment in full on January 1, 2023 plus annual interest payment at 12%. The interest payment was made as scheduled on January 1, 2019. However, due to financial setbacks, the borrower was unable to make the 2020 interest payment. The bank considered the loan impaired and projected the cash flows from the loan on December 31, 2020. The bank has accrued the interest on December 31, 2019, but did not continue to accrue interest for 2020 due to the impairment of the loan. The projected cash flows are: December 31, 2021, P1,125,000; December 31, 2022, P1,500,000; December 31, 2023, P1,875,000 and December 31, 2024, P2,250,000. The present value of 1 at 12% is 0.89 for one period, 0.80 for two periods, 0.71 for three periods and 0.64 for four periods. What is the carrying amount loan receivable as of December 31, 2021?

CPA Bank Co. loaned P6,750,000 to a borrower on January 1, 2018. The terms of the loan were payment in full on January 1, 2023 plus annual interest payment at 12%. The interest payment was made as scheduled on January 1, 2019. However, due to financial setbacks, the borrower was unable to make the 2020 interest payment. The bank considered the loan impaired and projected the cash flows from the loan on December 31, 2020. The bank has accrued the interest on December 31, 2019, but did not continue to accrue interest for 2020 due to the impairment of the loan. The projected cash flows are: December 31, 2021, P1,125,000; December 31, 2022, P1,500,000; December 31, 2023, P1,875,000 and December 31, 2024, P2,250,000. The present value of 1 at 12% is 0.89 for one period, 0.80 for two periods, 0.71 for three periods and 0.64 for four periods. What is the carrying amount loan receivable as of December 31, 2021?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 63.2C: Income, Cash Flow, and Future Losses On January L 2017, Cermack National Bank loaned 55,000,000...

Related questions

Question

Transcribed Image Text:CPA Bank Co. loaned P6,750,000 to a borrower on January 1, 2018. The terms of

the loan were payment in full on January 1, 2023 plus annual interest payment at

12%. The interest payment was made as scheduled on January 1, 2019. However,

due to financial setbacks, the borrower was unable to make the 2020 interest

payment. The bank considered the loan impaired and projected the cash flows

from the loan on December 31, 2020. The bank has accrued the interest on

December 31, 2019, but did not continue to accrue interest for 2020 due to the

impairment of the loan. The projected cash flows are: December 31, 2021,

P1,125,000; December 31, 2022, P1,500,000; December 31, 2023, P1,875,000 and

December 31, 2024, P2,250,000. The present value of 1 at 12% is 0.89 for one

period, 0.80 for two periods, 0.71 for three periods and 0.64 for four periods.

What is the carrying amount loan receivable as of December 31, 2021?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning