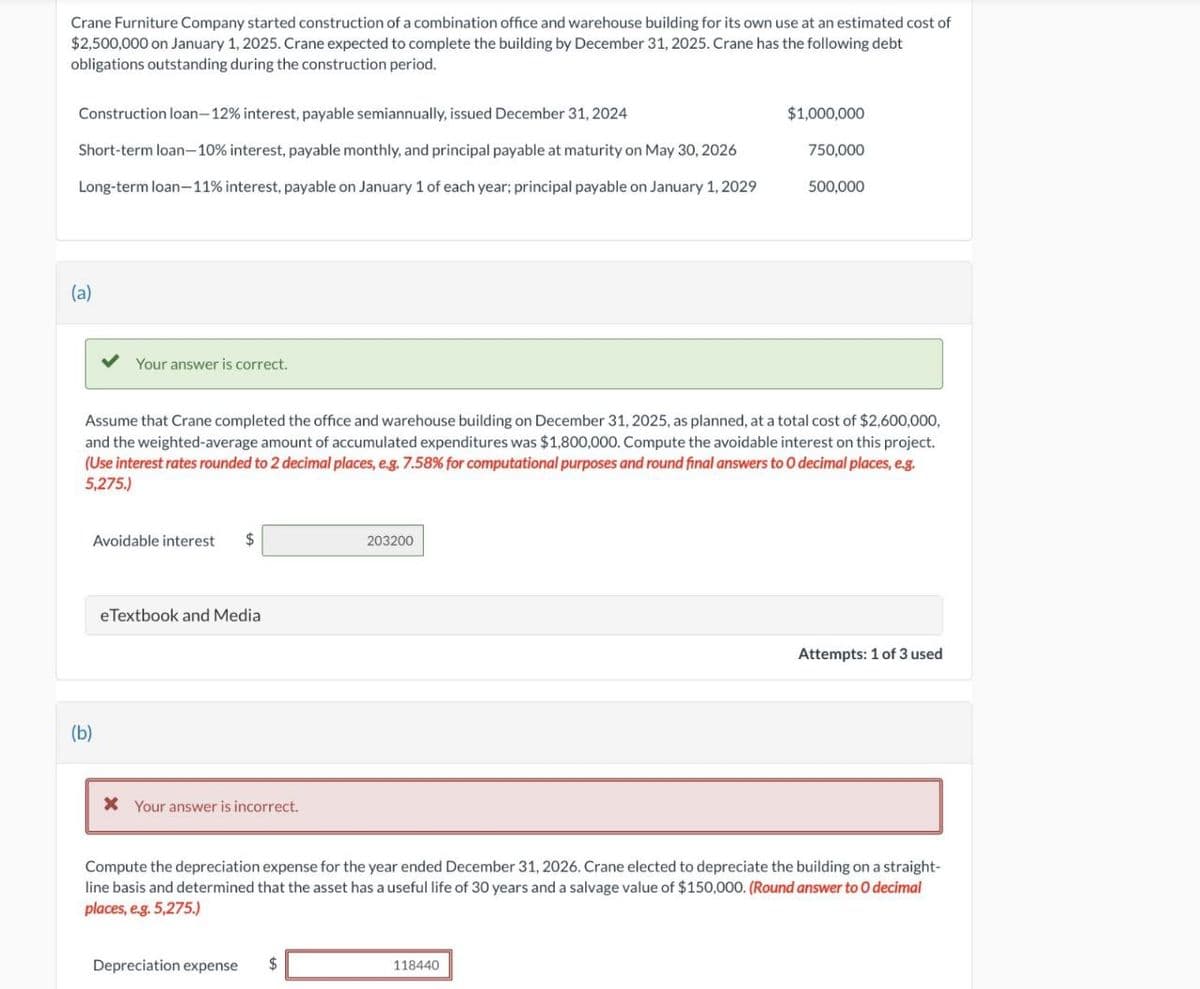

Crane Furniture Company started construction of a combination office and warehouse building for its own use at an estimated cost of $2,500,000 on January 1, 2025. Crane expected to complete the building by December 31, 2025. Crane has the following debt obligations outstanding during the construction period. Construction loan-12% interest, payable semiannually, issued December 31, 2024 Short-term loan-10% interest, payable monthly, and principal payable at maturity on May 30, 2026 Long-term loan-11% interest, payable on January 1 of each year; principal payable on January 1, 2029 $1,000,000 750,000 500,000 (a) Your answer is correct. Assume that Crane completed the office and warehouse building on December 31, 2025, as planned, at a total cost of $2,600,000, and the weighted-average amount of accumulated expenditures was $1,800,000. Compute the avoidable interest on this project. (Use interest rates rounded to 2 decimal places, e.g. 7.58% for computational purposes and round final answers to O decimal places, e.g. 5,275.) (b) Avoidable interest $ 203200 eTextbook and Media Attempts: 1 of 3 used × Your answer is incorrect. Compute the depreciation expense for the year ended December 31, 2026. Crane elected to depreciate the building on a straight- line basis and determined that the asset has a useful life of 30 years and a salvage value of $150,000. (Round answer to O decimal places, e.g. 5,275) Depreciation expense $ 118440

Crane Furniture Company started construction of a combination office and warehouse building for its own use at an estimated cost of $2,500,000 on January 1, 2025. Crane expected to complete the building by December 31, 2025. Crane has the following debt obligations outstanding during the construction period. Construction loan-12% interest, payable semiannually, issued December 31, 2024 Short-term loan-10% interest, payable monthly, and principal payable at maturity on May 30, 2026 Long-term loan-11% interest, payable on January 1 of each year; principal payable on January 1, 2029 $1,000,000 750,000 500,000 (a) Your answer is correct. Assume that Crane completed the office and warehouse building on December 31, 2025, as planned, at a total cost of $2,600,000, and the weighted-average amount of accumulated expenditures was $1,800,000. Compute the avoidable interest on this project. (Use interest rates rounded to 2 decimal places, e.g. 7.58% for computational purposes and round final answers to O decimal places, e.g. 5,275.) (b) Avoidable interest $ 203200 eTextbook and Media Attempts: 1 of 3 used × Your answer is incorrect. Compute the depreciation expense for the year ended December 31, 2026. Crane elected to depreciate the building on a straight- line basis and determined that the asset has a useful life of 30 years and a salvage value of $150,000. (Round answer to O decimal places, e.g. 5,275) Depreciation expense $ 118440

Chapter16: Accounting Periods And Methods

Section: Chapter Questions

Problem 45P

Related questions

Question

None

Transcribed Image Text:Crane Furniture Company started construction of a combination office and warehouse building for its own use at an estimated cost of

$2,500,000 on January 1, 2025. Crane expected to complete the building by December 31, 2025. Crane has the following debt

obligations outstanding during the construction period.

Construction loan-12% interest, payable semiannually, issued December 31, 2024

Short-term loan-10% interest, payable monthly, and principal payable at maturity on May 30, 2026

Long-term loan-11% interest, payable on January 1 of each year; principal payable on January 1, 2029

$1,000,000

750,000

500,000

(a)

Your answer is correct.

Assume that Crane completed the office and warehouse building on December 31, 2025, as planned, at a total cost of $2,600,000,

and the weighted-average amount of accumulated expenditures was $1,800,000. Compute the avoidable interest on this project.

(Use interest rates rounded to 2 decimal places, e.g. 7.58% for computational purposes and round final answers to O decimal places, e.g.

5,275.)

(b)

Avoidable interest $

203200

eTextbook and Media

Attempts: 1 of 3 used

× Your answer is incorrect.

Compute the depreciation expense for the year ended December 31, 2026. Crane elected to depreciate the building on a straight-

line basis and determined that the asset has a useful life of 30 years and a salvage value of $150,000. (Round answer to O decimal

places, e.g. 5,275)

Depreciation expense

$

118440

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College