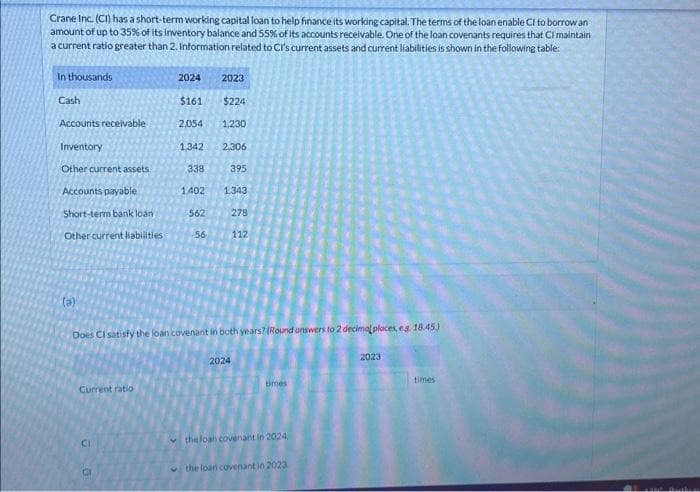

Crane Inc. (CI) has a short-term working capital loan to help finance its working capital. The terms of the loan enable CI to borrow an amount of up to 35% of its inventory balance and 55% of its accounts receivable. One of the loan covenants requires that Cl maintain a current ratio greater than 2. Information related to CI's current assets and current liabilities is shown in the following table: In thousands Cash Accounts receivable Inventory Other current assets Accounts payable Short-term bank loan Other current liabilities (a) Current ratio 2024 2023 $161 $224 2054 1.230 1,342 2,306 395 1402 1,343 278 112 CI 338 562 Does CI satisfy the loan covenant in both years? (Round answers to 2 decimal places, eg 18.45) 56 2024 times the loan covenant in 2024 the loan covenant in 2023 2023 times

Crane Inc. (CI) has a short-term working capital loan to help finance its working capital. The terms of the loan enable CI to borrow an amount of up to 35% of its inventory balance and 55% of its accounts receivable. One of the loan covenants requires that Cl maintain a current ratio greater than 2. Information related to CI's current assets and current liabilities is shown in the following table: In thousands Cash Accounts receivable Inventory Other current assets Accounts payable Short-term bank loan Other current liabilities (a) Current ratio 2024 2023 $161 $224 2054 1.230 1,342 2,306 395 1402 1,343 278 112 CI 338 562 Does CI satisfy the loan covenant in both years? (Round answers to 2 decimal places, eg 18.45) 56 2024 times the loan covenant in 2024 the loan covenant in 2023 2023 times

Chapter16: Working Capital Policy And Short-term Financing

Section: Chapter Questions

Problem 19P

Related questions

Question

Transcribed Image Text:Crane Inc. (CI) has a short-term working capital loan to help finance its working capital. The terms of the loan enable CI to borrow an

amount of up to 35% of its inventory balance and 55% of its accounts receivable. One of the loan covenants requires that CI maintain

a current ratio greater than 2. Information related to CI's current assets and current liabilities is shown in the following table:

In thousands

Cash

Accounts receivable

Inventory

Other current assets,

Accounts payable

Short-term bank loan

Other current liabilities

(a)

Current ratio

2024

CI

$161

2,054

1,342

338

1.402

562

56

2023

$224

1,230

2,306

395

1.343

Does CI satisfy the loan covenant in both years? (Round answers to 2 decimal places, eg. 18.45)

278

112

2024

times

the loan covenant in 2024

the loan covenant in 2023

2023

times

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College