CRANE INC. Condensed Income Statements For the Year Fnded Decenber 31, 2022 FIFO LIFO Sales Revenues 755300 755300 Cost of Goods Sold Beginning Inventory 8000 Cost of Goods Purchased 466000 466000 Cast of Goods Available for Sale v 474000 474000 i Ending inventory Cost of Goods Sold

CRANE INC. Condensed Income Statements For the Year Fnded Decenber 31, 2022 FIFO LIFO Sales Revenues 755300 755300 Cost of Goods Sold Beginning Inventory 8000 Cost of Goods Purchased 466000 466000 Cast of Goods Available for Sale v 474000 474000 i Ending inventory Cost of Goods Sold

Financial & Managerial Accounting

14th Edition

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Inventories

Section: Chapter Questions

Problem 6.3TIF: Communication Golden Eagle Company began operations on April 1 by selling a single product. Data on...

Related questions

Question

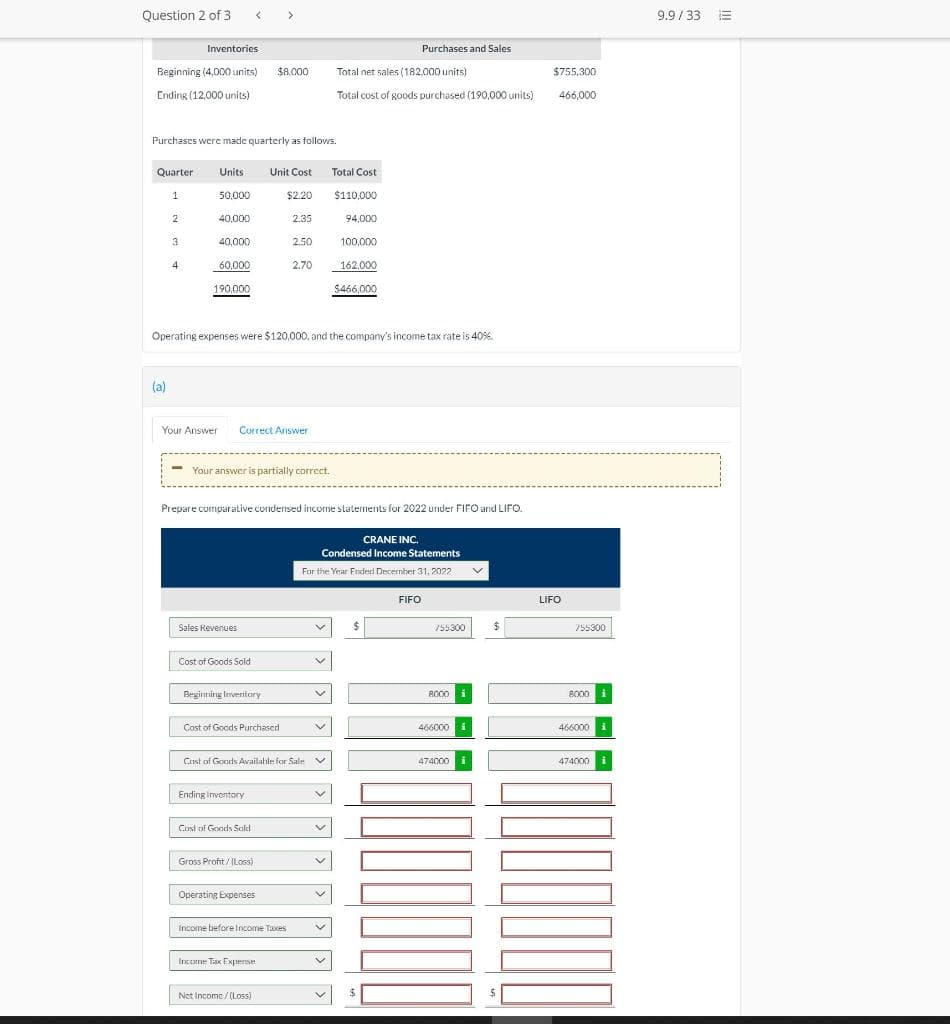

Transcribed Image Text:Question 2 of 3

>

9.9/ 33

Inventories

Purchases and Sales

Beginning (4,000 units)

$8.000

Total net sales (182,000 units)

$755,300

Ending (12,000 units)

Total cost of goods purchased (190,000 units)

466,000

Purchases were made quarterly as follows.

Quarter

Units

Unit Cost

Total Cost

1

50,000

$2.20

$110,000

2

40,000

2.35

94,000

40,000

2.50

100,000

4

60,000

2.70

162.000

190.000

$466,000

Operating expenses were $120,000, and the company's income tax rate is 40%.

(a)

Your Answer

Correct Answer

Your answer is partially correct.

Prepare comparative conderised income staternents for 2022 under FIFO and LIFO.

CRANE INC.

Condensed Income Statements

For the Year Fnderd December 31, 2022

FIFO

LIFO

Sales Revenues

755300

755300

Cost of Goods Sold

Beginning Inventory

a000 i

8000 i

Cost of Goods Purchased

466000

466000

Cast of Goods Avwailahıle for Sale v

474000

474000 i

Ending inventory

Cost of Goods Sold

Gross Profit / ILos)

Operating Expenses

Income before income Taxes

Incne Tax Expense

Net Income/(Loss)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning