Crane Co. as lessee records a finance lease of machinery on January 1, 2021. The seven annual lease payments of $819,000 are made at the end of each year. The present value of the lease payments at 9% is $4,122,000. Crane uses the effective-interest method of amortization and sum-of-the-years'-digits depreciation (no residual value)

Crane Co. as lessee records a finance lease of machinery on January 1, 2021. The seven annual lease payments of $819,000 are made at the end of each year. The present value of the lease payments at 9% is $4,122,000. Crane uses the effective-interest method of amortization and sum-of-the-years'-digits depreciation (no residual value)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 5RE: Use the information in RE20-3. Prepare the journal entries that Garvey Company would make in the...

Related questions

Question

Crane Co. as lessee records a finance lease of machinery on January 1, 2021. The seven annual lease payments of $819,000 are made at the end of each year. The present value of the lease payments at 9% is $4,122,000. Crane uses the effective-interest method of amortization and sum-of-the-years'-digits

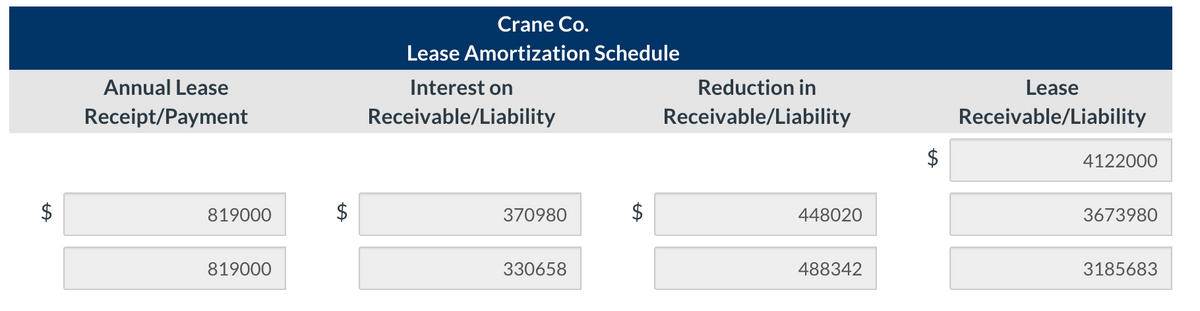

Transcribed Image Text:Crane Co.

Lease Amortization Schedule

Annual Lease

Interest on

Reduction in

Lease

Receipt/Payment

Receivable/Liability

Receivable/Liability

Receivable/Liability

4122000

819000

$

370980

$

448020

3673980

819000

330658

488342

3185683

%24

%24

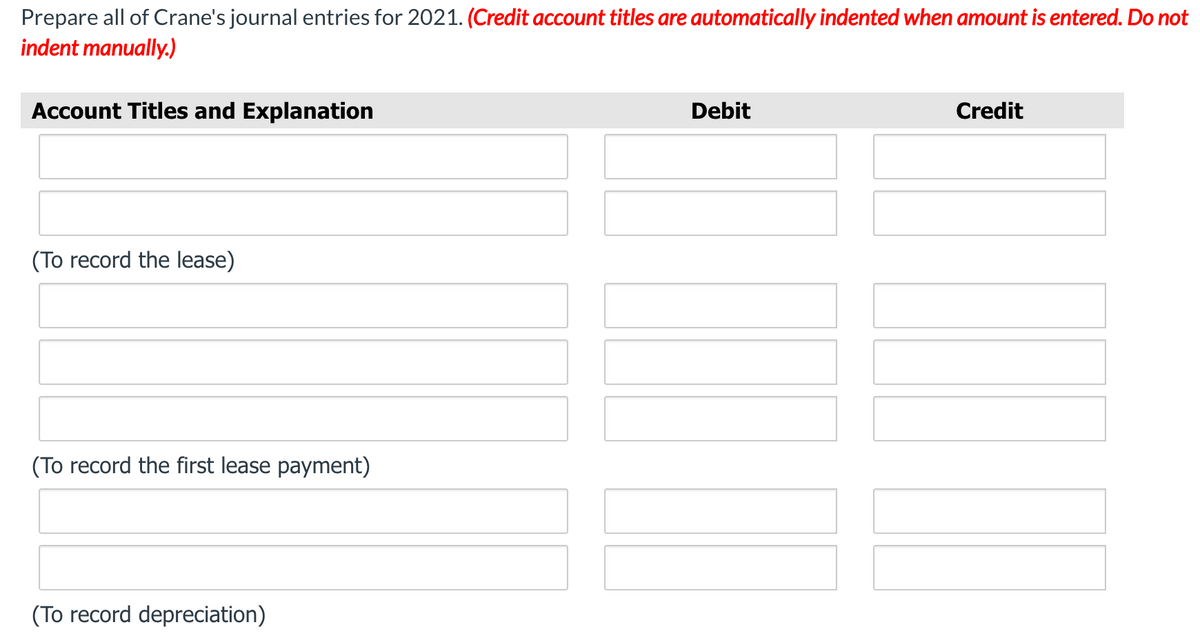

Transcribed Image Text:Prepare all of Crane's journal entries for 2021. (Credit account titles are automatically indented when amount is entered. Do not

indent manually.)

Account Titles and Explanation

Debit

Credit

(To record the lease)

(To record the first lease payment)

(To record depreciation)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning