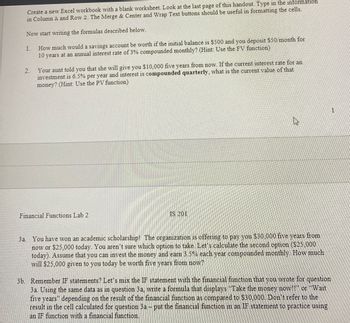

Create a new Excel workbook with a blank worksheet. Look at the last page of this handout. Type in the information in Column A and Row 2. The Merge & Center and Wrap Text buttons should be useful in formatting the cells. Now start writing the formulas described below. 1. 2. How much would a savings account be worth if the initial balance is $500 and you deposit $50 month for 10 years at an annual interest rate of 3% compounded monthly? (Hint: Use the FV function) Your aunt told you that she will give you $10,000 five years from now. If the current interest rate for an investment is 6.5% per year and interest is compounded quarterly, what is the current value of that money? (Hint: Use the PV function) Financial Functions Lab 2 IS 201 3a. You have won an academic scholarship! The organization is offering to pay you $30,000 five years from now or $25,000 today. You aren't sure which option to take. Let's calculate the second option ($25,000 today). Assume that you can invest the money and earn 3.5% each year compounded monthly. How much will $25,000 given to you today be worth five years from now? 3b. Remember IF statements? Let's mix the IF statement with the financial function that you wrote for question 3a. Using the same data as in question 3a, write a formula that displays "Take the money now!!" or "Wait five years depending on the result of the financial function as compared to $30,000. Don't refer to the result in the cell calculated for question 3a - put the financial function in an IF statement to practice using an IF function with a financial function.

Create a new Excel workbook with a blank worksheet. Look at the last page of this handout. Type in the information in Column A and Row 2. The Merge & Center and Wrap Text buttons should be useful in formatting the cells. Now start writing the formulas described below. 1. 2. How much would a savings account be worth if the initial balance is $500 and you deposit $50 month for 10 years at an annual interest rate of 3% compounded monthly? (Hint: Use the FV function) Your aunt told you that she will give you $10,000 five years from now. If the current interest rate for an investment is 6.5% per year and interest is compounded quarterly, what is the current value of that money? (Hint: Use the PV function) Financial Functions Lab 2 IS 201 3a. You have won an academic scholarship! The organization is offering to pay you $30,000 five years from now or $25,000 today. You aren't sure which option to take. Let's calculate the second option ($25,000 today). Assume that you can invest the money and earn 3.5% each year compounded monthly. How much will $25,000 given to you today be worth five years from now? 3b. Remember IF statements? Let's mix the IF statement with the financial function that you wrote for question 3a. Using the same data as in question 3a, write a formula that displays "Take the money now!!" or "Wait five years depending on the result of the financial function as compared to $30,000. Don't refer to the result in the cell calculated for question 3a - put the financial function in an IF statement to practice using an IF function with a financial function.

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Sorry, our expert can’t provide a solution for this question. Your question has been credited back for next time.

Your Question:

Plese Give Step by Step Answer

I give Thumb up

Transcribed Image Text:Create a new Excel workbook with a blank worksheet. Look at the last page of this handout. Type in the information

in Column A and Row 2. The Merge & Center and Wrap Text buttons should be useful in formatting the cells.

Now start writing the formulas described below.

1.

2.

How much would a savings account be worth if the initial balance is $500 and you deposit $50 month for

10 years at an annual interest rate of 3% compounded monthly? (Hint: Use the FV function)

Your aunt told you that she will give you $10,000 five years from now. If the current interest rate for an

investment is 6.5% per year and interest is compounded quarterly, what is the current value of that

money? (Hint: Use the PV function)

Financial Functions Lab 2

IS 201

3a. You have won an academic scholarship! The organization is offering to pay you $30,000 five years from

now or $25,000 today. You aren't sure which option to take. Let's calculate the second option ($25,000

today). Assume that you can invest the money and earn 3.5% each year compounded monthly. How much

will $25,000 given to you today be worth five years from now?

3b. Remember IF statements? Let's mix the IF statement with the financial function that you wrote for question

3a. Using the same data as in question 3a, write a formula that displays "Take the money now!!" or "Wait

five years depending on the result of the financial function as compared to $30,000. Don't refer to the

result in the cell calculated for question 3a - put the financial function in an IF statement to practice using

an IF function with a financial function.

Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education