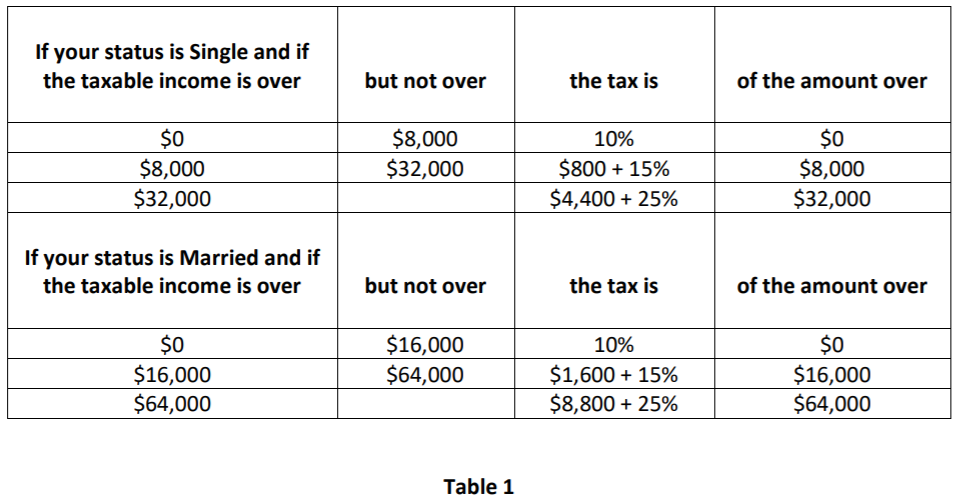

Create the Taxes Application. The application computes taxes for the schedule given in Table 1. The program output should be formatted as shown in the Sample Run. SAMPLE RUN: Are you married or single (M or S)? M What is your income? 43858 Your tax payable is: 5778.7 Are you married or single (M or S)? M What is your income? 16000 Your tax payable is: 1600.0 Are you married or single (M or S)? S What is your income? 9200 Your tax payable is: 980.0 Are you married or single (M or S)? S What is your income? 61458 Your tax payable is: 11764.5 Are you married or single (M or S)? M What is your income? 72566 Your tax payable is: 10941.5

Max Function

Statistical function is of many categories. One of them is a MAX function. The MAX function returns the largest value from the list of arguments passed to it. MAX function always ignores the empty cells when performing the calculation.

Power Function

A power function is a type of single-term function. Its definition states that it is a variable containing a base value raised to a constant value acting as an exponent. This variable may also have a coefficient. For instance, the area of a circle can be given as:

Intro to Python

Taxes Application

Create the Taxes Application. The application computes taxes for the schedule given in Table 1. The program output should be formatted as shown in the Sample Run.

SAMPLE RUN:

Are you married or single (M or S)? M

What is your income? 43858

Your tax payable is: 5778.7

Are you married or single (M or S)? M

What is your income? 16000

Your tax payable is: 1600.0

Are you married or single (M or S)? S

What is your income? 9200

Your tax payable is: 980.0

Are you married or single (M or S)? S

What is your income? 61458

Your tax payable is: 11764.5

Are you married or single (M or S)? M

What is your income? 72566

Your tax payable is: 10941.5

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 5 images