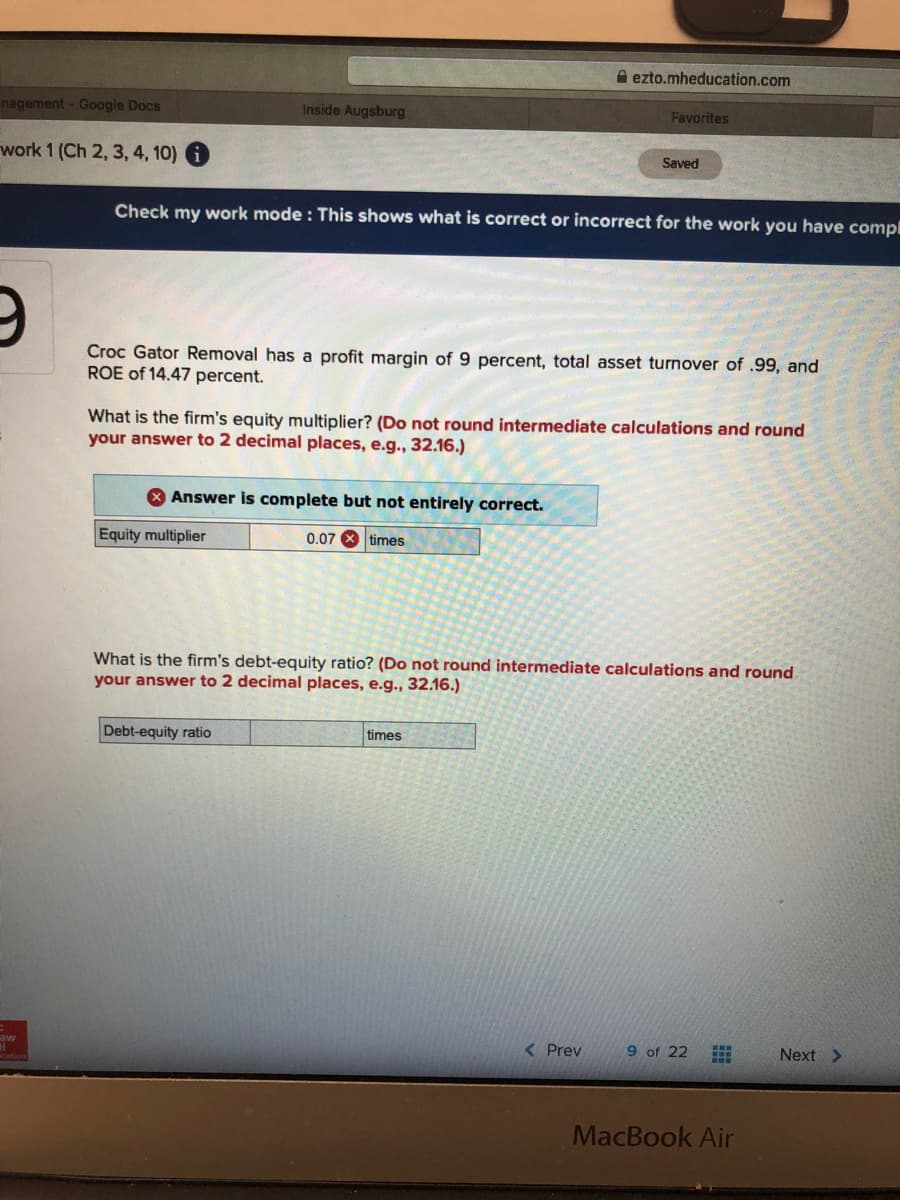

Croc Gator Removal has a profit margin of 9 percent, total asset turnover of .99, and ROE of 14.47 percent. What is the firm's equity multiplier? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. Equity multiplier 0.07 times

Croc Gator Removal has a profit margin of 9 percent, total asset turnover of .99, and ROE of 14.47 percent. What is the firm's equity multiplier? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. Equity multiplier 0.07 times

Chapter2: Analysis Of Financial Statements

Section: Chapter Questions

Problem 10PROB

Related questions

Question

Transcribed Image Text:A ezto.mheducation.com

nagement - Google Docs

Inside Augsburg

Favorites

work 1 (Ch 2, 3, 4, 10)

Saved

Check my work mode : This shows what is correct or incorrect for the work you have compl

Croc Gator Removal has a profit margin of 9 percent, total asset turnover of .99, and

ROE of 14.47 percent.

What is the firm's equity multiplier? (Do not round intermediate calculations and round

your answer to 2 decimal places, e.g.., 32.16.)

8 Answer is complete but not entirely correct.

Equity multiplier

0.07 X times

What is the firm's debt-equity ratio? (Do not round intermediate calculations and round

your answer to 2 decimal places, e.g., 32.16.)

Debt-equity ratio

times

aw

< Prev

9 of 22

Next >

MacBook Air

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you