culars Debit ? Credit as on Ist April, 2016 5,00,000 hases and Returns 31,00,000 45

culars Debit ? Credit as on Ist April, 2016 5,00,000 hases and Returns 31,00,000 45

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter11: Stockholders' Equity

Section: Chapter Questions

Problem 11.6P

Related questions

Question

Please answer it competely

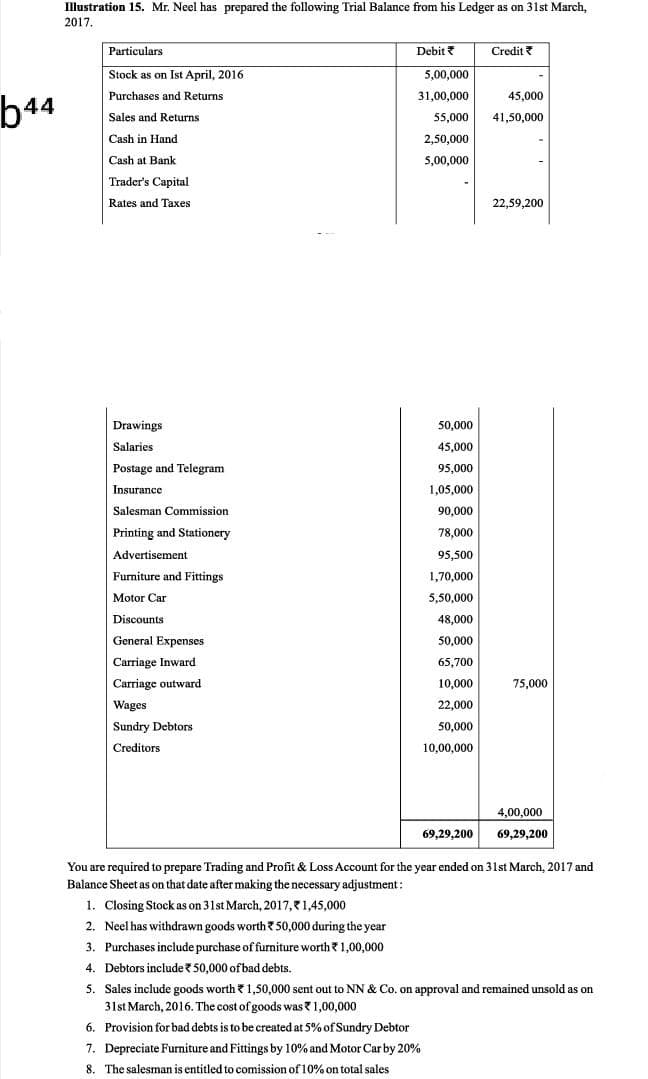

Transcribed Image Text:Illustration 15. Mr. Neel has prepared the following Trial Balance from his Ledger as on 31st March,

2017.

Particulars

Credit ?

Debit ?

Stock as on Ist April, 2016

5,00,000

Purchases and Returns

31,00,000

45,000

b44

Sales and Returns

55,000

41,50,000

Cash in Hand

2,50,000

Cash at Bank

5,00,000

Trader's Capital

Rates and Taxes

22,59,200

Drawings

50.000

Salaries

45,000

Postage and Telegram

95,000

Insurance

1,05,000

Salesman Commission

90,000

Printing and Stationery

78,000

Advertisement

95,500

Furniture and Fittings

1,70,000

Motor Car

5,50,000

Discounts

48,000

General Expenses

50,000

Carriage Inward

65,700

Carriage outward

10,000

75,000

Wages

22,000

Sundry Debtors

50,000

Creditors

10,00,000

4,00,000

69,29,200

69,29,200

You are required to prepare Trading and Profit & Loss Account for the year ended on 31st March, 2017 and

Balance Sheet as on that date after making the necessary adjustment:

1. Closing Stock as on 31st March, 2017,1,45,000

2. Neel has withdrawn goods worth?50,000 during the year

3. Purchases include purchase of furniture worth? 1,00,000

4. Debtors include 50,000 ofbad debts.

5. Sales include goods worth 1,50,000 sent out to NN & Co. on approval and remained unsold as on

31st March, 2016. The cost of goods was?1,00,000

6. Provision for bad debts is to be created at 5% of Sundry Debtor

7. Depreciate Furniture and Fittings by 10% and Motor Car by 20%

8. The salesman is entitled to comission of 10% on total sales

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning