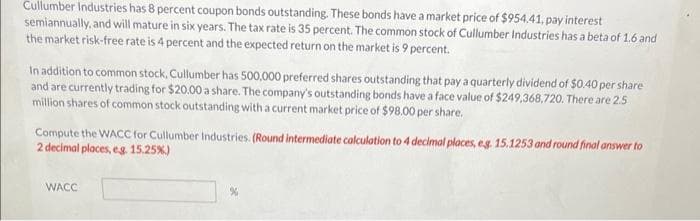

Cullumber Industries has 8 percent coupon bonds outstanding. These bonds have a market price of $954.41, pay interest semiannually, and will mature in six years. The tax rate is 35 percent. The common stock of Cullumber Industries has a beta of 1.6 and the market risk-free rate is 4 percent and the expected return on the market is 9 percent. In addition to common stock, Cullumber has 500,000 preferred shares outstanding that pay a quarterly dividend of $0.40 per share and are currently trading for $20.00 a share. The company's outstanding bonds have a face value of $249,368,720. There are 2.5 million shares of common stock outstanding with a current market price of $98.00 per share. Compute the WACC for Cullumber Industries. (Round intermediate calculation to 4 decimal places, eg. 15.1253 and round final answer to 2 decimal places, e.g. 15.25%) WACC %

Cullumber Industries has 8 percent coupon bonds outstanding. These bonds have a market price of $954.41, pay interest semiannually, and will mature in six years. The tax rate is 35 percent. The common stock of Cullumber Industries has a beta of 1.6 and the market risk-free rate is 4 percent and the expected return on the market is 9 percent. In addition to common stock, Cullumber has 500,000 preferred shares outstanding that pay a quarterly dividend of $0.40 per share and are currently trading for $20.00 a share. The company's outstanding bonds have a face value of $249,368,720. There are 2.5 million shares of common stock outstanding with a current market price of $98.00 per share. Compute the WACC for Cullumber Industries. (Round intermediate calculation to 4 decimal places, eg. 15.1253 and round final answer to 2 decimal places, e.g. 15.25%) WACC %

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Concept explainers

Debenture Valuation

A debenture is a private and long-term debt instrument issued by financial, non-financial institutions, governments, or corporations. A debenture is classified as a type of bond, where the instrument carries a fixed rate of interest, commonly known as the ‘coupon rate.’ Debentures are documented in an indenture, clearly specifying the type of debenture, the rate and method of interest computation, and maturity date.

Note Valuation

It is the process to determine the value or worth of an asset, liability, debt of the company. It can be determined by many processes or techniques. Many factors can impact the valuation of an asset, liability, or the company, like:

Question

6

Transcribed Image Text:Cullumber Industries has 8 percent coupon bonds outstanding. These bonds have a market price of $954.41, pay interest

semiannually, and will mature in six years. The tax rate is 35 percent. The common stock of Cullumber Industries has a beta of 1.6 and

the market risk-free rate is 4 percent and the expected return on the market is 9 percent.

In addition to common stock, Cullumber has 500,000 preferred shares outstanding that pay a quarterly dividend of $0.40 per share

and are currently trading for $20.00 a share. The company's outstanding bonds have a face value of $249,368,720. There are 2.5

million shares of common stock outstanding with a current market price of $98.00 per share.

Compute the WACC for Cullumber Industries. (Round intermediate calculation to 4 decimal places, e.g. 15.1253 and round final answer to

2 decimal places, e.g. 15.25%)

WACC

Transcribed Image Text:please, i need help. i put these two

answers but they are wrong. 8.95 %

and 8.56% are both wrong. im on my

last attempt.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education