Current Attempt in Progress Blossom Enterprises purchased equipment on March 15, 2021, for $67,970. The company also paid the following amounts: $520 for freight charges; $187 for insurance while the equipment was in transit; $1,729 for a one-year insurance policy: $1,986 to train employees to use the new equipment; and $2,923 for testing and installation. The company began to use the equipment on April 1. Blossom has estimated the equipment will have a 10-year useful life with no residual value. It expects to consume the equipment's future economic benefits evenly over the useful life. The company has a December 31 year end.

Current Attempt in Progress Blossom Enterprises purchased equipment on March 15, 2021, for $67,970. The company also paid the following amounts: $520 for freight charges; $187 for insurance while the equipment was in transit; $1,729 for a one-year insurance policy: $1,986 to train employees to use the new equipment; and $2,923 for testing and installation. The company began to use the equipment on April 1. Blossom has estimated the equipment will have a 10-year useful life with no residual value. It expects to consume the equipment's future economic benefits evenly over the useful life. The company has a December 31 year end.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter10: Property, Plant And Equipment: Acquisition And Subsequent Investments

Section: Chapter Questions

Problem 6RE

Related questions

Question

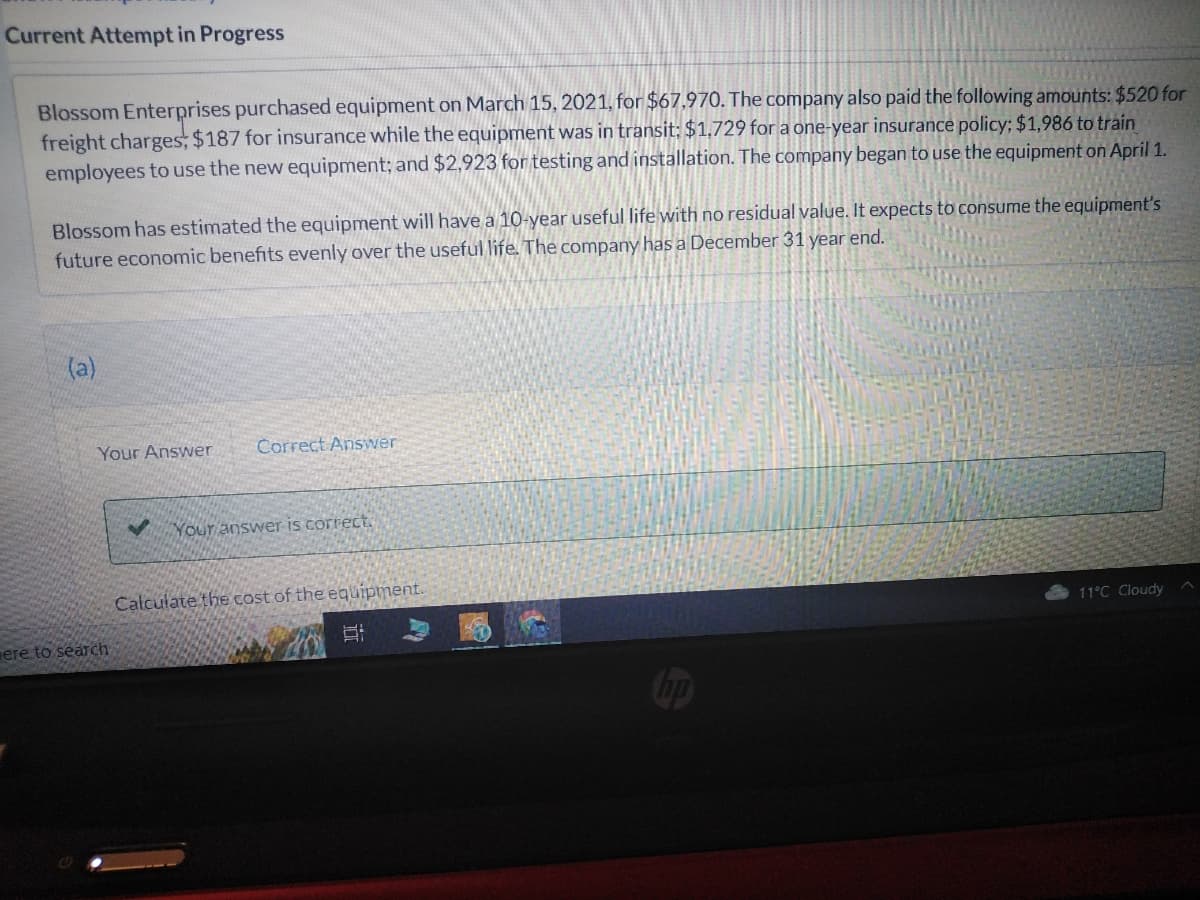

Transcribed Image Text:Current Attempt in Progress

Blossom Enterprises purchased equipment on March 15, 2021, for $67,970. The company also paid the following amounts: $520 for

freight charges, $187 for insurance while the equipment was in transit; $1,729 for a one-year insurance policy; $1,986 to train

employees to use the new equipment; and $2,923 for testing and installation. The company began to use the equipment on April 1.

Blossom has estimated the equipment will have a 10-year useful life with no residual value. It expects to consume the equipment's

future economic benefits evenly over the useful life. The company has a December 31 year end.

(a)

Your Answer

ere to search

✓

Correct Answer

Your answer is correct.

Calculate the cost of the equipment.

10

11°C Cloudy

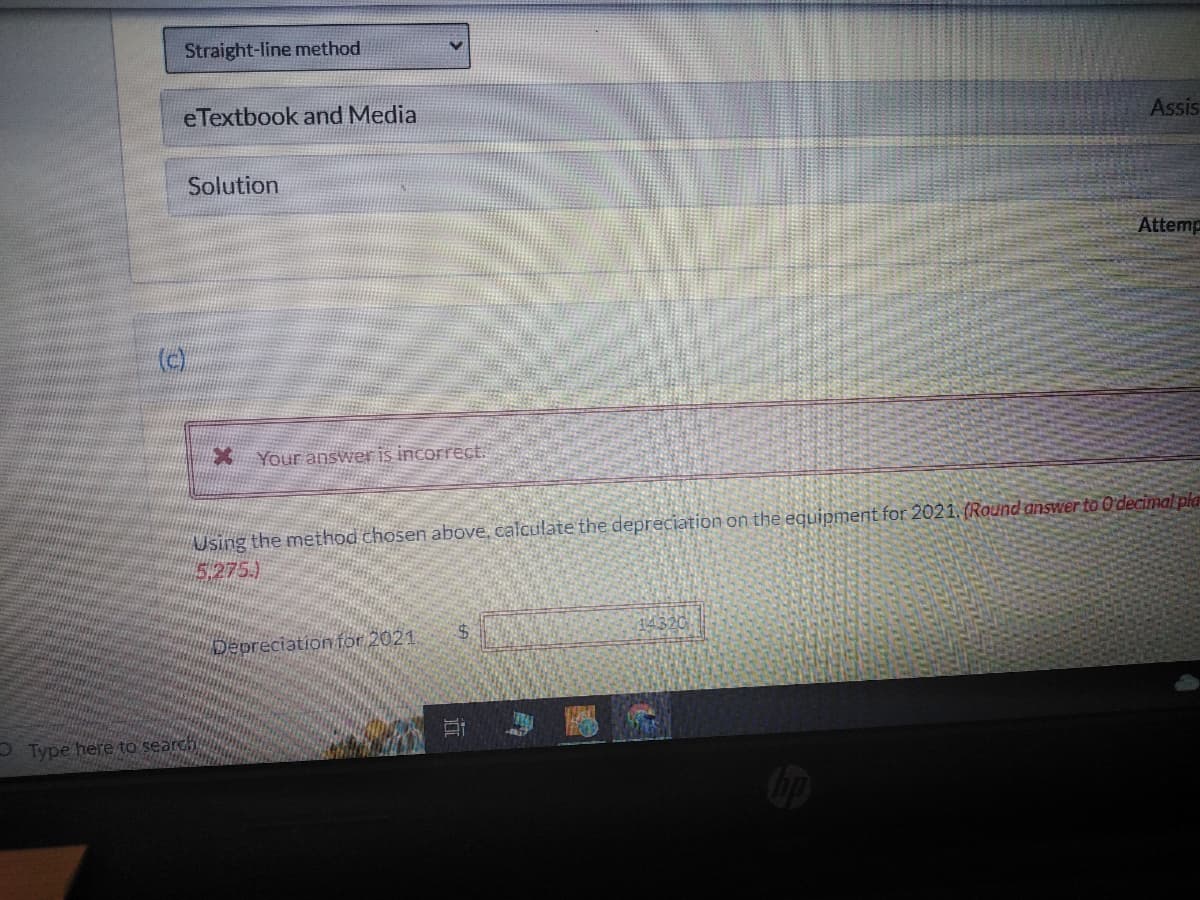

Transcribed Image Text:Straight-line method

eTextbook and Media

(c)

Solution

* Your answer is incorrect.

Type here to search

Using the method chosen above, calculate the depreciation on the equipment for 2021. (Round answer to O'decimal pla

(5.275.)

Depreciation for 2021.

$

Assis

Ai

Attemp

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT