Current Attempt in Progress Henry's Lawn Equipment sells high-quality lawn mowers and offers a 3-year warranty on all new lawn mowers sold. In 2025, Henry sold $325,500 of new specialty mowers for golf greens for which Henry's service department does not have the equipment to do the service. Henry has entered into an agreement with Mower Mavens to provide all warranty service on the special mowers sold in 2025. Henry wishes to measure the fair value of the agreement to determine the warranty liability for sales made in 2025. The controller for Henry's Lawn Equipment estimates the following expected warranty cash outflows associated with the mowers sold in 2025. Year 2026 2027 Cash Flow Estimate $2,600 4,120 4,760 $3,070 5,060 Probability Assessment 20% 60% 20% 30% 50%

Current Attempt in Progress Henry's Lawn Equipment sells high-quality lawn mowers and offers a 3-year warranty on all new lawn mowers sold. In 2025, Henry sold $325,500 of new specialty mowers for golf greens for which Henry's service department does not have the equipment to do the service. Henry has entered into an agreement with Mower Mavens to provide all warranty service on the special mowers sold in 2025. Henry wishes to measure the fair value of the agreement to determine the warranty liability for sales made in 2025. The controller for Henry's Lawn Equipment estimates the following expected warranty cash outflows associated with the mowers sold in 2025. Year 2026 2027 Cash Flow Estimate $2,600 4,120 4,760 $3,070 5,060 Probability Assessment 20% 60% 20% 30% 50%

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter8: Current And Contingent Liabilities

Section: Chapter Questions

Problem 31CE

Related questions

Question

Transcribed Image Text:Current Attempt in Progress

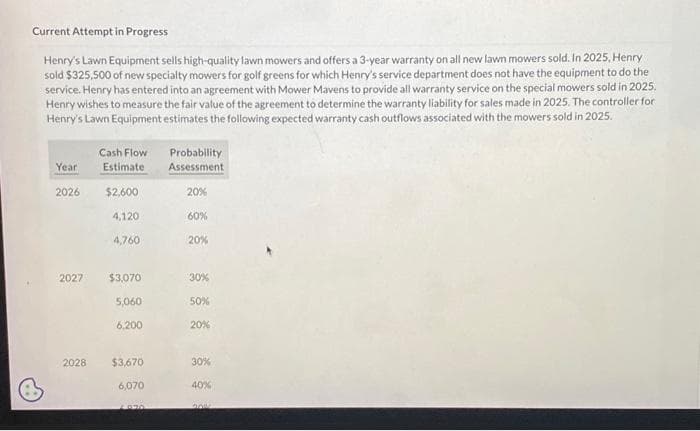

Henry's Lawn Equipment sells high-quality lawn mowers and offers a 3-year warranty on all new lawn mowers sold. In 2025, Henry

sold $325,500 of new specialty mowers for golf greens for which Henry's service department does not have the equipment to do the

service. Henry has entered into an agreement with Mower Mavens to provide all warranty service on the special mowers sold in 2025.

Henry wishes to measure the fair value of the agreement to determine the warranty liability for sales made in 2025. The controller for

Henry's Lawn Equipment estimates the following expected warranty cash outflows associated with the mowers sold in 2025.

Year

2026

2027

2028

Cash Flow

Estimate

$2,600

4,120

4,760

$3,070

5,060

6.200

$3,670

6,070

4030

Probability

Assessment

20%

60%

20%

30%

50%

20%

30%

40%

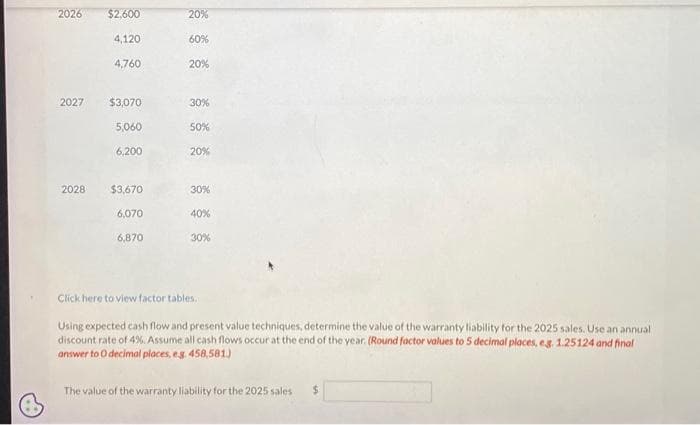

Transcribed Image Text:2026

2027

2028

$2,600

4,120

4,760

$3,070

5,060

6,200

$3,670

6,070

6,870

20%

60%

20%

30%

50%

20%

30%

40%

30%

Click here to view factor tables.

Using expected cash flow and present value techniques, determine the value of the warranty liability for the 2025 sales. Use an annual

discount rate of 4%. Assume all cash flows occur at the end of the year. (Round factor values to 5 decimal places, e.g. 1.25124 and final

answer to 0 decimal places, e.g. 458,581.)

The value of the warranty liability for the 2025 sales $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning