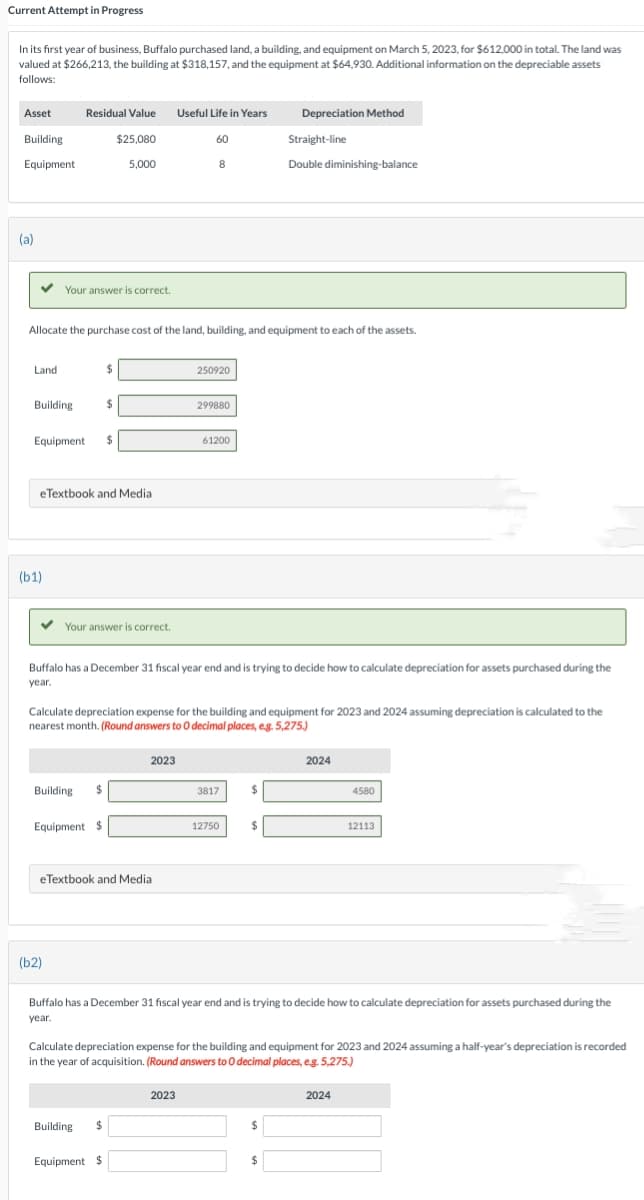

Current Attempt in Progress In its first year f business, Buffalo purchased land, a building, and equipment on March 5, 2023, for $612,000 in total. The land was valued at $266,213, the building at $318,157, and the equipment at $64,930. Additional information on the depreciable assets follows: Asset Building Equipment (a) ✓ Your answer is correct. Land Building Residual Value Useful Life in Years $25,080 5,000 Allocate the purchase cost of the land, building, and equipment to each of the assets. (b1) Equipment $ eTextbook and Media. ✓ Your answer is correct. $ Building $ $ Equipment $ (b2) eTextbook and Media Building $ 60 Buffalo has a December 31 fiscal year end and is trying to decide how to calculate depreciation for assets purchased during the year. 2023 Equipment $ 8 Calculate depreciation expense for the building and equipment for 2023 and 2024 assuming depreciation is calculated to the nearest month. (Round answers to 0 decimal places, e.g. 5,275.) 250920 299880 2023 61200 3817 12750 $ Depreciation Method $ Straight-line Double diminishing-balance Buffalo has a December 31 fiscal year end and is trying to decide how to calculate depreciation for assets purchased during the year. $ Calculate depreciation expense for the building and equipment for 2023 and 2024 assuming a half-year's depreciation is recorded in the year of acquisition. (Round answers to O decimal places, e.g. 5,275.) $ 2024 4580 12113 2024

Current Attempt in Progress In its first year f business, Buffalo purchased land, a building, and equipment on March 5, 2023, for $612,000 in total. The land was valued at $266,213, the building at $318,157, and the equipment at $64,930. Additional information on the depreciable assets follows: Asset Building Equipment (a) ✓ Your answer is correct. Land Building Residual Value Useful Life in Years $25,080 5,000 Allocate the purchase cost of the land, building, and equipment to each of the assets. (b1) Equipment $ eTextbook and Media. ✓ Your answer is correct. $ Building $ $ Equipment $ (b2) eTextbook and Media Building $ 60 Buffalo has a December 31 fiscal year end and is trying to decide how to calculate depreciation for assets purchased during the year. 2023 Equipment $ 8 Calculate depreciation expense for the building and equipment for 2023 and 2024 assuming depreciation is calculated to the nearest month. (Round answers to 0 decimal places, e.g. 5,275.) 250920 299880 2023 61200 3817 12750 $ Depreciation Method $ Straight-line Double diminishing-balance Buffalo has a December 31 fiscal year end and is trying to decide how to calculate depreciation for assets purchased during the year. $ Calculate depreciation expense for the building and equipment for 2023 and 2024 assuming a half-year's depreciation is recorded in the year of acquisition. (Round answers to O decimal places, e.g. 5,275.) $ 2024 4580 12113 2024

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter8: Operating Assets: Property, Plant, And Equipment, And Intangibles

Section: Chapter Questions

Problem 8.8MCP

Related questions

Question

Please help me with all answers

Transcribed Image Text:Current Attempt in Progress

In its first year of business, Buffalo purchased land, a building, and equipment on March 5, 2023, for $612,000 in total. The land was

valued at $266,213, the building at $318,157, and the equipment at $64,930. Additional information on the depreciable assets

follows:

Asset

Building

Equipment

(a)

✓ Your answer is correct.

Land

Building

Residual Value

$25,080

5,000

(b1)

Allocate the purchase cost of the land, building, and equipment to each of the assets.

Equipment $

eTextbook and Media

$

$

✓ Your answer is correct.

Building $

Equipment $

(b2)

eTextbook and Media

Useful Life in Years

2023

Building $

Equipment $

60

8

Buffalo has a December 31 fiscal year end and is trying to decide how to calculate depreciation for assets purchased during the

year.

250920

Calculate depreciation expense for the building and equipment for 2023 and 2024 assuming depreciation is calculated to the

nearest month. (Round answers to O decimal places, e.g. 5,275.)

2023

299880

61200

3817

Depreciation Method

12750

Straight-line

Double diminishing-balance

$

$

2024

Buffalo has a December 31 fiscal year end and is trying to decide how to calculate depreciation for assets purchased during the

year.

Calculate depreciation expense for the building and equipment for 2023 and 2024 assuming a half-year's depreciation is recorded

in the year of acquisition. (Round answers to O decimal places, e.g. 5,275.)

4580

12113

2024

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning