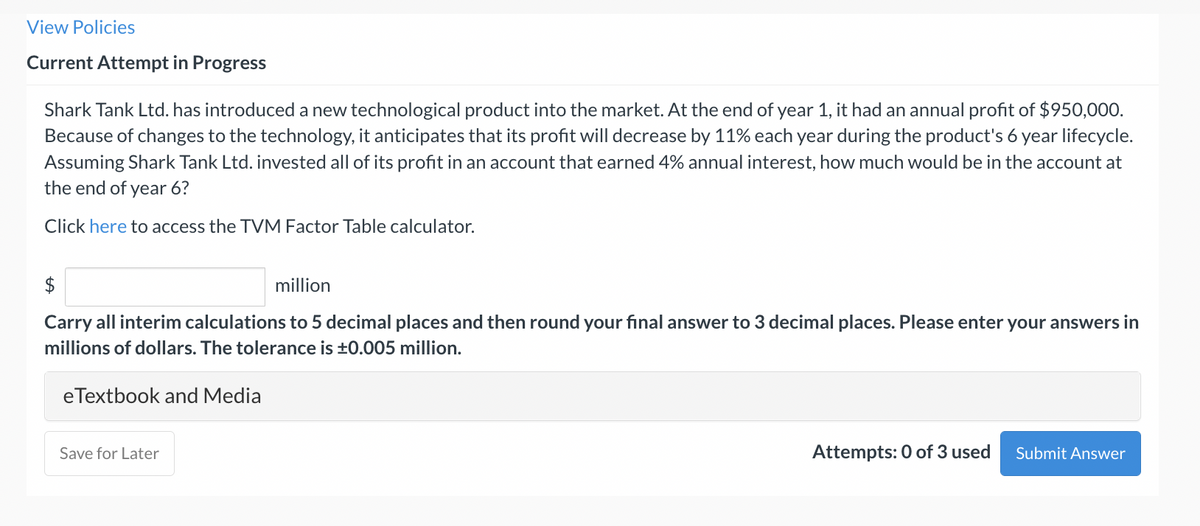

Current Attempt in Progress Shark Tank Ltd. has introduced a new technological product into the market. At the end of year 1, it had an annual profit of $950,000. Because of changes to the technology, it anticipates that its profit will decrease by 11% each year during the product's 6 year lifecycle. Assuming Shark Tank Ltd. invested all of its profit in an account that earned 4% annual interest, how much would be in the account at the end of year 6? Click here to access the TVM Factor Table calculator. $ million Carry all interim calculations to 5 decimal places and then round your final answer to 3 decimal places. Please enter your answers in millions of dollars. The tolerance is ±0.005 million. eTextbook and Media Save for Later Attempts: 0 of 3 used Submit Answer

Current Attempt in Progress Shark Tank Ltd. has introduced a new technological product into the market. At the end of year 1, it had an annual profit of $950,000. Because of changes to the technology, it anticipates that its profit will decrease by 11% each year during the product's 6 year lifecycle. Assuming Shark Tank Ltd. invested all of its profit in an account that earned 4% annual interest, how much would be in the account at the end of year 6? Click here to access the TVM Factor Table calculator. $ million Carry all interim calculations to 5 decimal places and then round your final answer to 3 decimal places. Please enter your answers in millions of dollars. The tolerance is ±0.005 million. eTextbook and Media Save for Later Attempts: 0 of 3 used Submit Answer

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter21: Supply Chains And Working Capital Management

Section: Chapter Questions

Problem 12P: Strickler Technology is considering changes in its working capital policies to improve its cash flow...

Related questions

Question

2

Transcribed Image Text:View Policies

Current Attempt in Progress

Shark Tank Ltd. has introduced a new technological product into the market. At the end of year 1, it had an annual profit of $950,000.

Because of changes to the technology, it anticipates that its profit will decrease by 11% each year during the product's 6 year lifecycle.

Assuming Shark Tank Ltd. invested all of its profit in an account that earned 4% annual interest, how much would be in the account at

the end of year 6?

Click here to access the TVM Factor Table calculator.

$

million

Carry all interim calculations to 5 decimal places and then round your final answer to 3 decimal places. Please enter your answers in

millions of dollars. The tolerance is ±0.005 million.

eTextbook and Media

Save for Later

Attempts: 0 of 3 used

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning