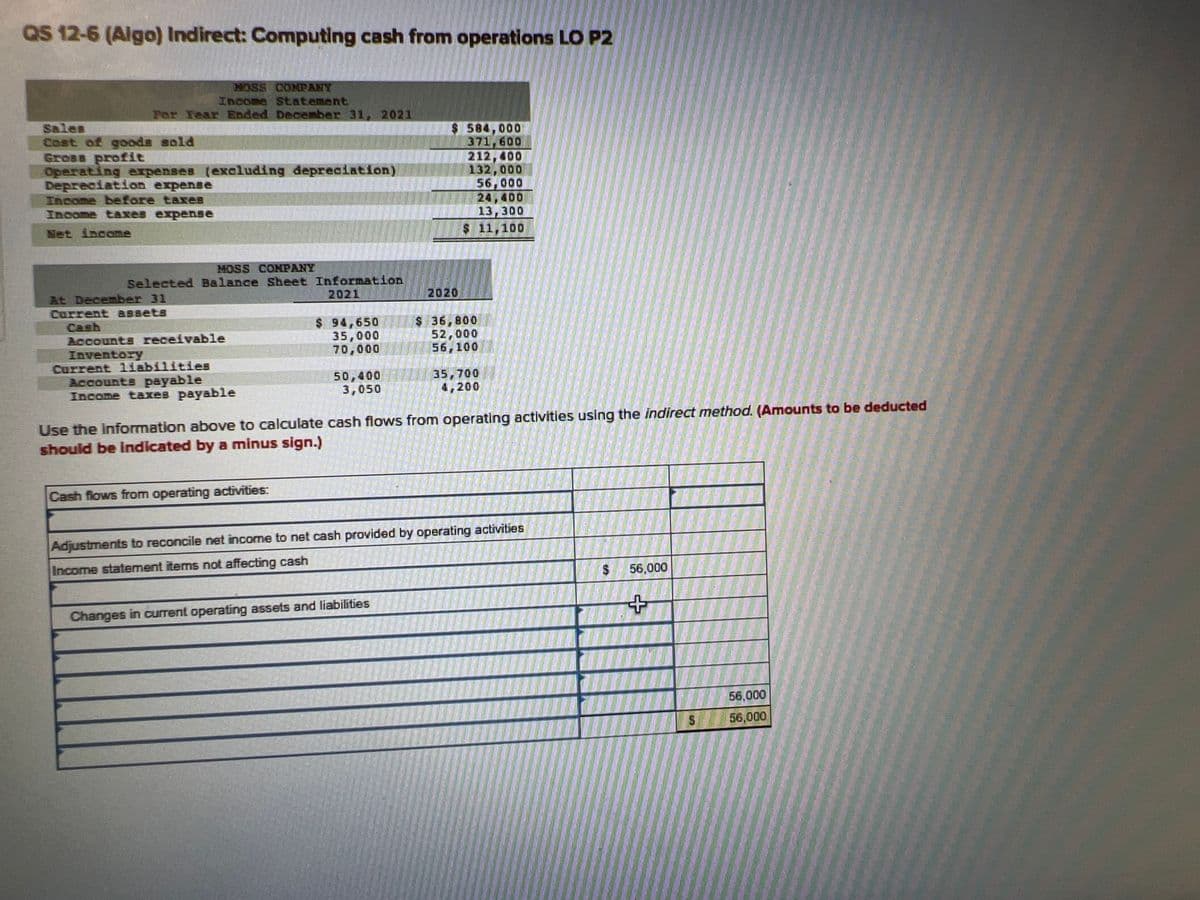

Current liabilities Accounts payable Income taxes payable Use the information above to calculate cash flows from operating activities using the indirect method. (Amounts to be deducted 50,400 3,050 35,700 4,200

Current liabilities Accounts payable Income taxes payable Use the information above to calculate cash flows from operating activities using the indirect method. (Amounts to be deducted 50,400 3,050 35,700 4,200

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter21: The Statement Of Cash Flows

Section: Chapter Questions

Problem 14P: (Appendix 21.1) Operating Cash Flows Refer to the information for Lamberson Company in P21-6....

Related questions

Question

Transcribed Image Text:QS 12-6 (Algo) Indirect: Computing cash from operations LO P2

NOSS COMPANY

Income Statement

For Year Ended December 31, 2021

WAY TINHALT

Sales

Cost of goods sold

Gross profit

Operating expenses (excluding depreciation)

Depreciation expense

Income before taxes

Income taxes expense

Net income

2005

MOSS COMPANY

Selected Balance Sheet Information

2021

At December 31

Current assets

Cash

Accounts receivable

Inventory

Current liabilities

Accounts payable

Income taxes payable

$ 94,650

35,000

70,000

Cash flows from operating activities:

50,400

3,050

$ 584,000

371,600

2020

Changes in current operating assets and liabilities

212,400

132,000

56,000

24,400

13,300

$ 11,100

$36,800

52,000

56,100

Use the information above to calculate cash flows from operating activities using the indirect method. (Amounts to be deducted

should be indicated by a minus sign.)

35,700

4,200

Adjustments to reconcile net income to net cash provided by operating activities

Income statement items not affecting cash

$

56,000

+

S

56,000

56,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning