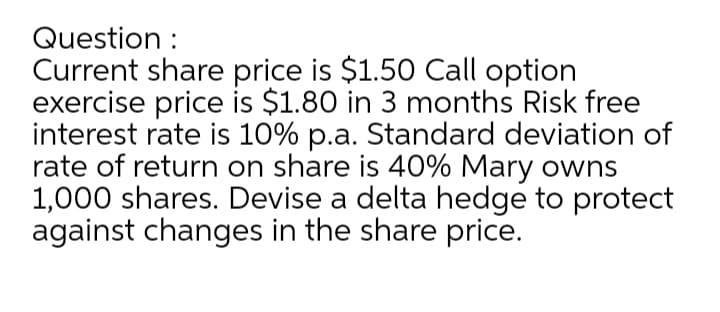

Current share price is $1.50 Call option exercise price is $1.80 in 3 months Risk free interest rate is 10% p.a. Standard deviation of rate of return on share is 40% Mary owns 1,000 shares. Devise a delta hedge to protect against changes in the share price.

Q: An investor buys $20,000 worth of a stock priced at $25 per share using

A: Given information : Purchase worth = $20,000 Price of stock = $25 Initial margin = 80% Broker charge…

Q: You buy a share of MMM Stock for $21.40. You expect it to pay dividends of $1.07, $1.1449 and…

A: The formula to compute dividend yield as follows: Dividend yield=D1P0

Q: of TIC Ltd. are currently priced at $ 415 and call option exercisable in three months' time has an…

A: The given problem can be solved using black Scholes Model.

Q: Company SilverBrigde has a stock price of €75. SilverBridge is exposed to a competitive risk which…

A: GIVEN ÷ Stock price = €75 Strike price = €70

Q: (Preferred stock valuation) You own 200 shares of Somner Resources' preferred stock, which currently…

A: Current market price = $ 40 Annual dividend = $ 3.40 Required yield = 10%

Q: Share of mars ltd is currently sold at 20$, divident payment is nil. After one year its price may go…

A: Expected quantum of return tells how much profit and loss an investor has anticipated on his/her…

Q: The common shares of Twitter, Incorporated (TWTR) recently traded on the NYSE for $75 per share. You…

A: Black Scholes Merton model Black-Scholes is a pricing model that uses six factors, including…

Q: Assume the firm's stock now sells for $20 per share. The company wants to sell some 20-year, $1,000…

A: Each bond will have attached 50 warrants, Each warrant will have a market value of $3.75 Par value…

Q: You purchase 100 shares of stock for $42 a share. The stock pays a $2.5 per share dividend at…

A: Purchase price of stock=$42Dividend=$2.5Ending stock price=$45Inflation rate=4%

Q: Share of mars ltd is currently sold at 20$, divident payment is nil. After one year its price may go…

A: The expected quantum of return is the expected quantity of the gain from the change in the market…

Q: An investor sells short 500 shares of stock at 10 per share and covers the short position one year…

A: Short selling can be defined as the process of selling off the shares in expectation that price of…

Q: CEPS Group preferred stock pays an OMR 8.5 annual dividend. What is the maximum price you are…

A: Preferred stocks are the equity securities where the holder of the security have fixed dividend…

Q: What is the yield to maturity of a share of Six Flags B $1.88 preferred stock if the investor buys…

A: Given information: Preferred stock dividend is $1.88 Stock price is $32.00

Q: A 90-day put option for 10,000 ABC ordinary shares has an exercise price of 32 per share. The…

A: Exercise price is 32 per share Risk-free rate is 5% Market Value per share is 30 Total number of…

Q: Marissa purchases Stock K when the ask price is 25. The bid-ask spread is 0.55, and the commission…

A: Bid-ask spread is the difference between the bid price and the ask price. Bid price is the price…

Q: A preferred stock from Duquesne Light Company (DQUPRA) pays $2.50 in annual dividends. If the…

A: Those stocks which are prioritized over common stocks at the time of payment of dividends but did…

Q: Brown's Founders has preferred stock outstanding which pays a dividend of $5 at the end of each…

A: Given: Dividend per share = $5 Price of preferred share = $60

Q: ares of TIC Ltd. are currently priced at $ 415 and put option exercisable in three months' time has…

A: The given problem relates to Black Scholes model.

Q: The common shares of Twitter, Inc. (TWTR) recently traded on the NYSE for $21.10 per share. You have…

A: First, we will check the conditions provided in the question to decide whether it is a call or a put…

Q: Acme stock price is currently $10 per share. Acme's warrants have a price of $7 per warrant. Each…

A: Warrant premium is the difference between the minimum value and the current trading price of a…

Q: You buy a share of MMM Stock for $21.40. You expect it to pay dividends of $1.07, $1.1449 and…

A: Dividend yield = Annual dividend / current market price

Q: (Valuing common Stock) Assume the following: • The investor’s required rate of return is 15 percent.…

A: Price earning ratio is no. of times a company's share is trading compared to its earning per share.

Q: Assume that you own a dividend-paying stock currently worth $150. You plan to sell the stock in 250…

A: Since you have not mentioned the specific question we will just answer the first question in case…

Q: You purchase 100 shares of stock for $40 a share. The stock pays a $2 per share dividend at…

A: The percentage return that an investor is earning from a particular investment in a particular time…

Q: chase 100 shares of stock for $40 a share. The stock pays a $4 per share dividend at year-end.…

A: Rate of return can be calculated from the difference between the beginning price and ending price…

Q: JPS plc's current share price is £3.63. An investor is wondering whether to buy shares in JPS or…

A: A warrant on a stock gives the holder the right but not the obligation to buy and sell the…

Q: Contract size (in number of shares) 1,000 Strike price for an ABC Inc. share 124 Current value of an…

A: Options are the financial derivatives which gives the buyer the right to buy or sell an asset but…

Q: Brown's Founders & Co. has preferred stock outstanding which pays a dividend of $5 at the end of…

A: The current price of a preference share is the discounted value of all the dividends a preference…

Q: ares of TIC Ltd. are currently priced at $ 415 and call option exercisable in three months' time has…

A: The given problem relates to Black Scholes Model.

Q: An investor buys $20,000 worth of a stock priced at $25 per share using 80% initial margin. The…

A: Purchase worth = $20,000 Price of stock = $25 Initial margin = 80% Broker charge = 5% Maintenance…

Q: (Preferred stock valuation) Kendra Corporation's preferred shares are trading for $32 in the market…

A: Share price Share price is the current market price of the share. It is the price of the share at…

Q: The shares of Echo Corporation are currently selling for $125 a share. The shares are expected to go…

A: Discount Factor = 1(1+r)n where, r= discount rate n= number of years

Q: You purchase 150 shares for $30 a share ($4,500), and after a year the price falls to $25. Calculate…

A: Given: Purchase 150 shares (Purchase price) =$30Price falls (share price after falls)=$25No. of…

Q: The common shares of Twitter, Incorporated (TWTR) recently traded on the NYSE for $75 per share. You…

A: Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: investor sells a stock short for $97 a share. The company pays a $4.70 annual cash dividend. After a…

A: Net profit = Short price - Total cover cost Total cover cost = cover price + annual dividend Initial…

Q: Assume the firm's stock now sells for $20 per share. The company wants to sell some 20-year, $1,000…

A: Computation::-

Q: (Preferred stock valuation) selling for Pioneer's preferred stock is $34 in the market and pays a…

A: In the given question we require to calculate the value of preferred stock from following details:…

Q: Contract size (in number of shares) 100,000 Market value of an ABC Inc. share 32 Exercise price for…

A: Black Scholes Merton formula With volatility, the value of call option is calculated using Black…

Q: An investor buys $ 16,000 worth of a stock priced at $ 18 per share using 70 % initial margin . The…

A: The initial margin on an investment is the starting amount that an investor who wishes to open a…

Q: return

A: Introduction: Return on investment can be defined as earnings which is made from an investment. It…

Q: Express Surgery Center's (ESC) preferred stock, which has a par value equal to $110 per share, pays…

A: Par value of preferred stock is $110 Annual dividend rate is 9% Required rate of return is 15%…

Q: (Preferred stock valuation) Pioneer's preferred stock is selling for $30 in the market and pays a…

A: Value of preferred share = Annual dividend / Cost of capital

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

- The shares of TIC Ltd. are currently priced at $ 415 and call option exercisable in three months' time has an exercise rate of $ 400. Risk free interest rate is 5% p.a. and standard deviation (volatility) of share price is 22%. Based on the assumption that TIC Ltd. is not going to declare any dividend over the next three months, what is the price of call option? Solve it on excel.Misuraca Enterprise’s current stock price is $45 per share. Call optionsfor this stock exist that permit the holder to purchase one share at an exercise price of $50.These options will expire at the end of 1 year, at which time Misuraca’s stock will be sellingat one of two prices, $35 or $55. The risk-free rate is 5.5%. As an assistant to the firm’streasurer, you have been asked to perform the following tasks to arrive at the value of thefirm’s call options.a. Find the range of values for the ending stock price and the call option at the option’sexpiration in 1 year.b. Equalize the range of payoffs for the stock and the option.c. Create a riskless hedged investment. What is the value of the portfolio in 1 year?d. What is the cost of the stock in the riskless portfolio?e. What is the present value of the riskless portfolio?f. From your answers in parts d and e, what is the value of the firm’s call option?Kendra Corporation's preferred shares are trading for $27 in the market and pay a $4.10 annual dividend. Assume that the market's required yield is 14 percent. a. What is the stock's value to you, the investor? b. Should you purchase the stock?

- its urgent An investor currently holds 1,000 shares of QQQ, the Power Shares NASDAQ 100 ETF, priced at $105.78/share. The investor would like to hedge the risk associated with the position in the short-term. QQQ puts with a strike price of 102.50 and expiring in two months currently have a premium of $1.18. Call options with the same expiration and a strike price of 107 currently have a premium of $1.03. Explain how the investor could hedge the downside risk of QQQ by either purchasing the 102.50 put, or by creating a range forward (purchasing the 102.50 put and selling the 107 call). Compare and contrast the two alternative hedges. Remember, each option contract covers 100 shares, the investor would need 10 contracts to cover their position in QQQ.(a) Donald is considering the merits of two securities. He is interested in the common shares ofA Co. and B Inc. The expected monthly rate of return of securities is shown below:State of Affair Probability Stock A Stock BBoom 0.1 40% -20%Normal 0.5 20% 8%Recession 0.4 -10% 15%At the time of purchase, the market value is $70/share for A and $50/share for B. Donaldplans to invest 10,000 shares of Stock A and 6,000 shares in Stock B.(i) Compute the portfolio weights of Stock A and Stock B. (ii) Compute the expected returns of Stock A and Stock B. (iii) Assume that the covariance between Stock A and Stock B is -28%2(0.0028). Computethe expected rate of return and variance of rate of return of Donald’s portfolio.(iv) If the risk-free rate is 2%, the market risk premium is 18% and the beta of Stock A is0.75, estimate the required and expected rates of return of Stock A. Should Donaldinvest in Stock A? Show the calculations.Pioneer's preferred stock is selling for $44 in the market and pays a $3.10 annual dividend. a. If the market's required yield is 8 percent, what is the value of the stock for that investor? b. Should the investor acquire the stock?

- A speculator sells a stock short for $71 a share. The company pays a $2.50 annual cash dividend.After a year has passed, the seller covers the short position at $63. If the margin requirement is55 percent, what is the percentage return earned on the investment? Redo the calculations, assuming the price of the stock is $78 when the investor closes theposition. Based on your calculations to both scenarios, what generalization can be inferred?Assume a $100 million AUM Long/Short Equity fund manager enters the following trades at the beginning and end of the year. Bought $100 million of ABC at an opening price per share of $100, beta of 1.5, current price of $110. Sold short $100 million of XYZ at an opening price of $100, beta of 1.0, current price of $105. There is a $2 per share dividend on ABC and a $1 dividend on XYZ. Borrow fee is 1%. What is the actual trading profit or loss of the fund?A stock sells for $15 per share. You purchase 100 shares for $15 a share (i.e., for $1,500), andafter a year the price rises to $18.75 a) What will be the percentage return on your investment ifyou bought the stock on margin and the margin requirement was 65 percent? (Ignore commissions, dividends, and interest expense.) b) Rather than selling for $18.75, determine the percentage return on your investment if the price of the stock falls to $12.30 Based on your answers to both questions, what generalization on the use of marginaccounts can be inferred?

- Give typing answer with explanation and conclusion The XYZ Corporation stock currently sells for $52/share. The premium for a put option expiring in four weeks is $2.07. Suppose you buy 5 contracts of this put option. What is your maximum gain? (Hint: One option is called a contract, and each contract represents 100 shares of the underlying stock. Exchanges quote options prices in terms of the per-share price, not the total price an investor pays to own the contract.) A) $22,715 B) $26,000 C) $24,965 D) $23,750An investor buys $8,000 worth of a stock priced at $40 per share using 50% initial margin. The broker charges 6% on the margin loan and requires a 30% maintenance margin. In 1 year the investor has interest payable and gets a margin call. At the time of the margin call the stock's price must have been ________. Question 32 options: $29.77 $32.45 $20 $30.291. You purchase 100 shares for $50 a share ($5,000), and after a yearthe price rises to $60. What will be the percentage return on yourinvestment if you bought the stock on margin and the marginrequirement was? a.25 percent b.50 percent c.75 percent 2. Repeat Problem 1 to determine the percentage return on yourinvestment but in this case suppose the price of the stock falls to$40 per share. What generalization can be inferred from youranswers to Problems 1 and 2? 3. How many years will it take for 197000 dollars to grow to 554000 dollars if it is invested in an account with a quoted annual interest rate of 8 percent with monthly compounding interest?