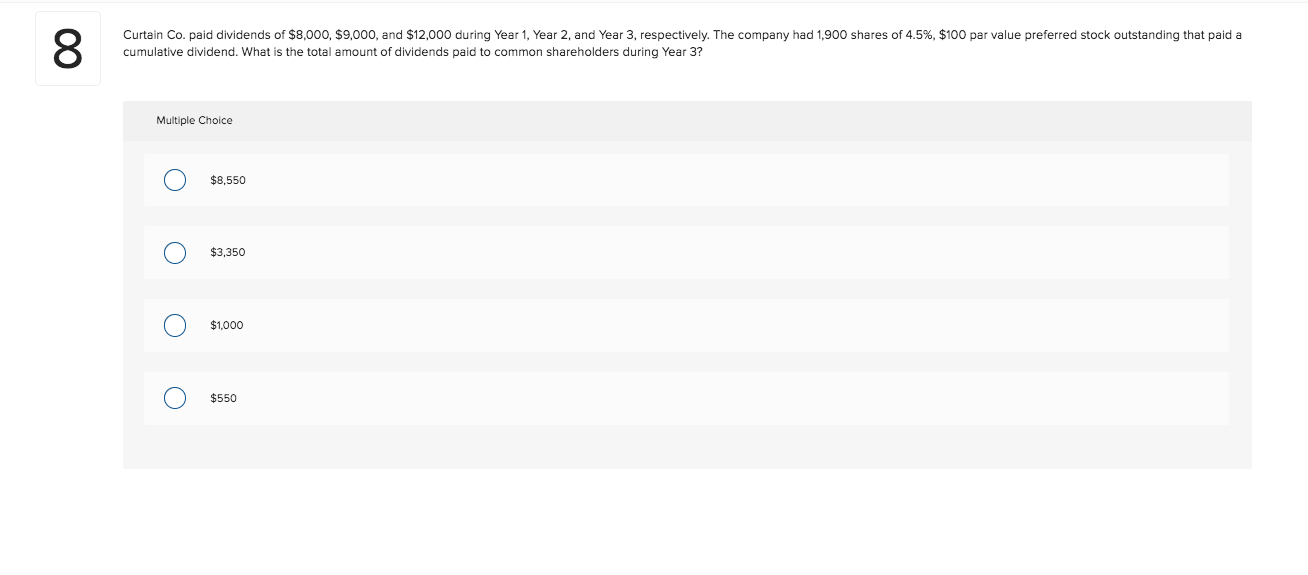

Curtain Co. paid dividends of $8,000, $9,000, and $12,000 during Year 1, Year 2, and Year 3, respectively. The company had 1,900 shares of 4.5%, $100 par value preferred stock outstanding that paid a cumulative dividend. What is the total amount of dividends paid to common shareholders during Year 3? Multiple Choice $8,550 $3,350 $1,000 $550 00

Q: Oceanic Company has 25,000 shares of cumulative preferred 2% stock, $50 par and 50,000 shares of $25…

A: Annual dividend payable to preferred stock = 25,000 * $50 * 2% = $25,000

Q: Beta Co. sold 10,000 shares of common stock, which has a par value of $25, for $27 per share.The…

A: Stockholders' equity section of a balance sheet includes paid in capital and retained earnings.

Q: Rendivir Company had the following transactions during the year: January 1 Ordinary shares…

A: Here in this question, we are required to calculate weighted average number of share outstanding.…

Q: Sweet Company's outstanding stock consists of 1,400 shares of noncumulative 6% preferred stock with…

A: Dividends are the part or share of profits that is being divided or distributed to shareholders of…

Q: Determine the dividends in arrears for preferred stock for the second year.

A: Cash dividends: The amount of cash provided by a corporation out of its distributable profits to…

Q: Dana’s company has 20,000 shares of $100 per, 2% cumulative preferred stock and 100,000 shares of…

A: Dividend distribution is a method of distributing profit among the stockholder of the organization.…

Q: Halverstein Company's outstanding stock consists of 14,000 shares of cumulative 5% preferred stock…

A: Cumulative preference shareholders are those shareholders on which dividend will be paid in next…

Q: Calculate the total Dividends AND the Dividends per share that the Preferred and Common Shareholders…

A: Preference Shares are shares that are given preference over and above equity shares. While…

Q: Sweet Company’s outstanding stock consists of 1,000 shares of cumulative 5% preferred stock with a…

A: Dividend on cumulative preference shares is accumulated over the years, It means cumulative…

Q: The board of directors of Mountain Hotels has declared a dividend of $1,700,000. The company has…

A: Preferred dividends = 100,000 shares x $1.30 = $130,000

Q: Swilley Furniture Company has 50,000 shares of cumulative preferred 2% stock, $75 par, and 100,000…

A:

Q: Sabas Company has 40,000 shares of $100 par, 1% preferred stock and 100,000 shares of $50 par common…

A: Annual preferred dividends 40000 =40000*100*1%

Q: XYZ company's outstanding stock consists 10,000 shares of common stock with a $10 par value and…

A: Annual Dividend to Preferred shareholders = No. of preferred share outstanding x Par value per share…

Q: Sabas Company has 20,000 shares of $100 par, 2% cumulative preferred stock and 100,000 shares of $50…

A: Dividend distribution is a method of distributing profit among the stockholder of the organization.…

Q: Swifty Corporation's balance sheet reported the following: Capital stock outstanding, 4,500 shares,…

A: Journal entry refers to the recording of daily transactions of an organization. It has a credit and…

Q: Sabas Company has 20,000 shares of $100 par, 2% cumulative preferred stock and 100,000 shares of $50…

A: Common stockholders or shareholders are the shareholders who actually known as the real owner of the…

Q: DY Corporation declared the regular quarterly dividend of P2 per share. It had issued12,000 shares…

A: Shares outstanding = Shares issued - Treasury stock Shares outstanding = 12,000 - 2,000 Shares…

Q: York's outstanding stock consists of 60,000 shares of cumulative 8.0% preferred stock with a $5 par…

A: Annual Dividend to Preferred shareholders = No. of preferred share outstanding x Par value per share…

Q: Sweet Company's outstanding stock consists of 1,400 shares of noncumulative 6% preferred stock with…

A: A dividend is a payment given by a company to its shareholders. When a company makes a profit or has…

Q: Mapleleaf Industries declared a $0.90 per share cash dividend. The company has 140.000 shares…

A:

Q: Sabas Company has 20,000 shares of $100 par, 2% cumulative preferred stock and 100,000 shares of $50…

A: Dividend means the amount of profit distributed to the stock holder of the company. First dividend…

Q: Sabas Company has 20,000 shares of $100 par, 2% cumulative preferred stock and 100,000 shares of $50…

A: Annual Dividend to Preferred shareholders = No. of preferred share outstanding x Par value per share…

Q: Stair Step Company has 20,000 shares of $100 par, 2% cumulative preferred stock, and 100,000 shares…

A: Dividend paid every year for preference shares 20,000 shares * $100 * 2% = $40,000. In year 1 only…

Q: Calgate Company had the following shares outstanding and retained earnings at the end of the current…

A: Cumulative Preference Share: When a corporation goes into liquidation, cumulative preference shares…

Q: Sandpiper Company has 10,000 shares of cumulative preferred 3% stock, $50 par and 50,000 shares of…

A: Dividends are paid in two types Stock dividends and Cash dividends. Stock dividend means a payment…

Q: The Howe Company's stockholders' equity account is as follows Common stock (800,00 shares at $4…

A: Since you have posted a question with multiple sub-parts, we will solve the first three subparts for…

Q: Sabas Company has 20,000 shares of $100 par, 2% cumulative preferred stock and 100,000 shares of $50…

A: Annual Dividend to Preferred shareholders = No. of preferred share outstanding x Par value per share…

Q: Sanchez Company has 38,000 shares of 5% preferred stock of $100 par and 112,000 shares of $50 par…

A: Year 1 Year 2 Year 3 Total amount of dividend distributed $ 5,38,000 $…

Q: Seacrest Company has 20,000 shares of cumulative preferred 3% stock, $150 par and 50,000 shares of…

A: Annual Dividend to Preferred shareholders = No. of preferred share outstanding x Par value per share…

Q: Gore, Inc. has 50,000 shares of $100 par, 1% preferred stock and 100,000 shares of $50 par common…

A: By issuing the financial instruments, the capital of the company can be increased. The financial…

Q: On January 1, Year 1, a company had the following transactions: Issued 10,000 shares of $2.00 par…

A: Cumulative Dividend - Cumulative Preferred shares has right of dividend every year. If in any year…

Q: Sabas Company has 20,000 shares of $100 par, 2% cumulative preferred stock of and 100,000 shares of…

A: There is a mistake in the question, the dividend of year 3 is 90,000 so I am giving the solution…

Q: A company has 1,000 shares of $100 par value, 4.5% cumulative and non- participating preferred stock…

A: Preferred stock: This is a form of ownership in which the holders would get a part of the ownership…

Q: Year 1: $10,000 Year 2: 45,000 Year 3: 90,000 Determine the dividends per share for preferred and…

A: Generally, companies distribute a portion of there profit as dividend while retaining the remaining…

Q: company has 1,000 shares of $50 par value, 4.5% cumulative, preferred stock and 10,000 shares of $10…

A: As per IAS 33, Earnings per share standard Cumulative Preferred stockholders will be eligible for…

Q: Torino Company has 10,000 shares of $5 par value, 4% cumulative preferred stock and 100,000 shares…

A: A shareholder, also known as a stockholder, is an individual, corporation, or institution who owns…

Q: The Phibbs Company paid total cash dividends of $200,000 on 25,000 outstanding common shares. On the…

A: In this question, we need to calculate dividend yield of the Phibbs Company with the given data. Let…

Q: Sanchez Company has 34,000 shares of 2% preferred stock of $100 par and 115,000 shares of $50 par…

A: Annual Dividend to Preferred shareholders = No. of preferred share outstanding x Par value per share…

Q: Sandpiper Company has 15,000 shares of cumulative preferred 3% stock, $100 par and S50,000 shares of…

A: Annual Dividend to Preferred shareholders = No. of preferred share outstanding x Par value per share…

Q: Raphael Corporation’s balance sheet shows the following stockholders’ equity section.…

A: Annual Dividend to Preferred shareholders = Total Par value preferred stock x rate of dividend =…

Q: Rendivir Company had the following transactions during the year: January 1 Ordinary shares…

A: Weighted average shares issued on May 1 = 40000 shares x 8/12 moths…

Q: The board of directors of Mountain Hotels has declared a dividend of $1,700,000. The company has…

A: The preferred stockholders have right to received stated dividend before payment of dividend to…

Q: Sabas Company has 20,000 shares of $100 par, 2% cumulative preferred stock and 100,000 shares of $50…

A:

Q: The Mark Company has $230,000 to pay dividends. The company has 25,000 shares of 6%, $50 par,…

A: PLEASE LIKE THE ANSWER 3) Non-participating and Non-cumulative Preference Stock Common…

Q: Stair Step Company has 20,000 shares of $100 par, 2% cumulative preferred stock and 100,000 shares…

A: A dividend seems to be a monetary or non-monetary payment provided by a corporation to its…

Q: Mensa Corporation has 3,000 shares of 7%, $100 par value preferred stock outstanding at December 31,…

A: Dividend: Dividend is sum of amount paid by company to its shareholders. Such amount is paid from…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Given the following year-end information, compute Greenwood Corporations basic and diluted earnings per share. Net income, 15,000 The income tax rate, 30% 4,000 shares of common stock were outstanding the entire year. shares of 10%, 50 par (and issuance price) convertible preferred stock were outstanding the entire year. Dividends of 2,500 were declared on this stock during the year. Each share of preferred stock is convertible into 5 shares of common stock.COMMON AND PREFERRED CASH DIVIDENDS Ramirez Company currently has 100,000 shares of 1 par common stock outstanding and 5,000 shares of 50 par preferred stock outstanding. On July 10, the board of directors declared a semiannual dividend of 0.30 per share on common stock to shareholders of record on August 1, payable on August 5. On July 15, the board of directors declared a semiannual dividend of 5 per share on preferred stock to shareholders of record on August 5, payable on August 10. Prepare journal entries for the declaration and payment of the common and preferred stock cash dividends.Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 20 par common stock at 30, receiving cash. b. Issued 4, 000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 37 5. The bonds are classified as a held-to-maturity long -term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0 .60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 45, including commission. p. Recorded the payment of semiannual interest on the bonds issue d in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method . q. Accrued interest for three months on the Dream Inc. bonds purchased in (I). r. Pinkberry Co. recorded total earnings of 240 ,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39. 02 per share on December 31, 2016. The investment is adjusted to fair value , using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments h ad a beginning balance of zero. Instructions 1. Journalize the selected transactions. 2. After all of the transaction s for the year ended December 31, 201 6, had been poste d [including the transactions recorded in part (1) and all adjusting entries), the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step in come statement for the year ended December 31, 201 6, concluding with earnings per share . In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. ( Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 20 6. c. Prepare a balance sheet in report form as of December 31, 2016.

- Chen Corporation began 2012 with the following stockholders equity balances: The following selected transactions and events occurred during the year: a. Issued 10,000 shares of common stock for 60,000. b. Purchased 1,200 shares of treasury stock for 4,800. c. Sold 2,000 shares of treasury stock for 11,000. d. Generated net income of 94,000. e. Declared and paid the full years dividend on preferred stock and a dividend of 1.00 per share on common stock outstanding at the end of the year. Chen Corporation maintains several paid-in capital accounts (Paid-in Capital in Excess of Par, Paid-in Capital from Treasury Stock, etc.) in its ledger, but combines them all as Additional paid-in capital when preparing financial statements. Open the file STOCKEQ from the website for this book at cengagebrain.com. Enter the formulas in the appropriate cells on the worksheet. Then fill in the columns to show the effect of each of the selected transactions and events listed earlier. Enter your name in cell A1. Save the completed worksheet as STOCKEQ2. Print the worksheet. Also print your formulas. Check figure: Total stockholders equity balance at 12/31/12 (cell G21). 398,800.Chen Corporation began 2012 with the following stockholders equity balances: The following selected transactions and events occurred during the year: a. Issued 10,000 shares of common stock for 60,000. b. Purchased 1,200 shares of treasury stock for 4,800. c. Sold 2,000 shares of treasury stock for 11,000. d. Generated net income of 94,000. e. Declared and paid the full years dividend on preferred stock and a dividend of 1.00 per share on common stock outstanding at the end of the year. Chen Corporation maintains several paid-in capital accounts (Paid-in Capital in Excess of Par, Paid-in Capital from Treasury Stock, etc.) in its ledger, but combines them all as Additional paid-in capital when preparing financial statements. In the space provided below, prepare the stockholders equity section of Chen Corporations balance sheet as of December 31, 2012. Use proper headings and provide full disclosure of all appropriate information. Chens corporate charter authorizes the issuance of 1,000 shares of preferred stock and 100,000 shares of common stock.Brunleigh Corporation earned net income of $200,000 this year. The company began the year with 10,000 shares of common stock and issued 5,000 more on April 1. They issued $7,500 in preferred dividends for the year. What is Brunleigh Corporations weighted average number of shares for the year?

- Errol Corporation earned net income of $200,000 this year. The company began the year with 10,000 shares of common stock and issued 5,000 more on April 1. They issued $7,500 in preferred dividends for the year. What is the numerator of the EPS calculation for Errol?Chen Corporation began 2012 with the following stockholders equity balances: The following selected transactions and events occurred during the year: a. Issued 10,000 shares of common stock for 60,000. b. Purchased 1,200 shares of treasury stock for 4,800. c. Sold 2,000 shares of treasury stock for 11,000. d. Generated net income of 94,000. e. Declared and paid the full years dividend on preferred stock and a dividend of 1.00 per share on common stock outstanding at the end of the year. Chen Corporation maintains several paid-in capital accounts (Paid-in Capital in Excess of Par, Paid-in Capital from Treasury Stock, etc.) in its ledger, but combines them all as Additional paid-in capital when preparing financial statements.Jupiter Corporation earned net income of $90,000 this year. The company began the year with 600 shares of common stock and issued 500 more on April 1. They issued $5,000 in preferred dividends for the year. What is Jupiter Corporations weighted average number of shares for the year?

- Silva Company is authorized to issue 5,000,000 shares of $2 par value common stock. In its IPO, the company has the following transaction: Mar. 1, issued 500,000 shares of stock at $15.75 per share for cash to investors. Journalize this transaction.Nutritious Pet Food Companys board of directors declares a cash dividend of $5,000 on June 30. At that time, there are 3,000 shares of $5 par value 5% preferred stock outstanding and 7,000 shares of $1 par value common stock outstanding (none held in treasury). What is the journal entry to record the declaration of the dividend?Bastion Corporation earned net income of $200,000 this year. The company began the year with 10,000 shares of common stock and issued 5,000 more on April 1. They issued $7,500 in preferred dividends for the year. What is the EPS for the year for Bastion?