d are applying for a $600,000 mortgage to purchase a new house. Th for this proposed mortgage is $2.839.48. They have told you that they also have a car pa per month, annual car insurance of $1,850, an RRSP contribution of $150 per month by weekly loan payment of $75 and total monthly credit card payments of $320. Their p $5,884 per year. Their combined income is $155.394 per year and heat on this house What is their TDS?

d are applying for a $600,000 mortgage to purchase a new house. Th for this proposed mortgage is $2.839.48. They have told you that they also have a car pa per month, annual car insurance of $1,850, an RRSP contribution of $150 per month by weekly loan payment of $75 and total monthly credit card payments of $320. Their p $5,884 per year. Their combined income is $155.394 per year and heat on this house What is their TDS?

Chapter9: Acquisitions Of Property

Section: Chapter Questions

Problem 34P

Related questions

Question

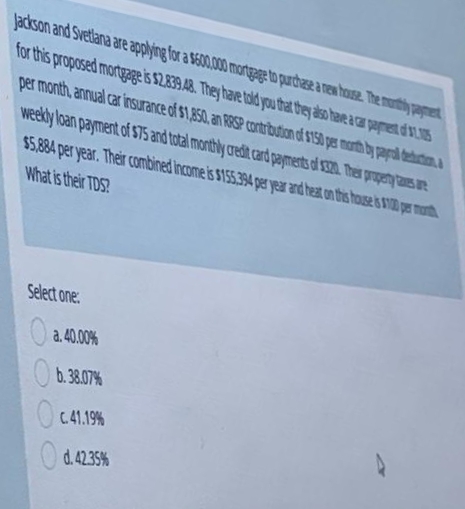

Transcribed Image Text:Jackson and Svetlana are applying for a $600,000 mortgage to purchase a new house. The monthly payment

for this proposed mortgage is $2.839.48. They have told you that they also have a car payment of $1.305

per month, annual car insurance of $1,850, an RRSP contribution of $150 per month by papall deduction a

weekly loan payment of $75 and total monthly credit card payments of $320. Their property taxes are

$5,884 per year. Their combined income is $155.394 per year and heat on this house is $100 per month

What is their TDS?

Select one:

a.40.00%

b. 38.07%

c.41.19%

d.42.35%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you