d) Assume the preferred stock is participating. At an exit value of $20,000,000, what is the payoff to the common stockholders (i.e. Founders & Management)? e) If the VC owned non-participating convertible preferred stock with a 2x liquidation preference at what exit value is the VC indifferent between either converting or not converting?

d) Assume the preferred stock is participating. At an exit value of $20,000,000, what is the payoff to the common stockholders (i.e. Founders & Management)? e) If the VC owned non-participating convertible preferred stock with a 2x liquidation preference at what exit value is the VC indifferent between either converting or not converting?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 5MC

Related questions

Question

Pls answer d and e using info in screenshot

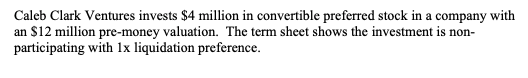

Transcribed Image Text:Caleb Clark Ventures invests $4 million in convertible preferred stock in a company with

an $12 million pre-money valuation. The term sheet shows the investment is non-

participating with 1x liquidation preference.

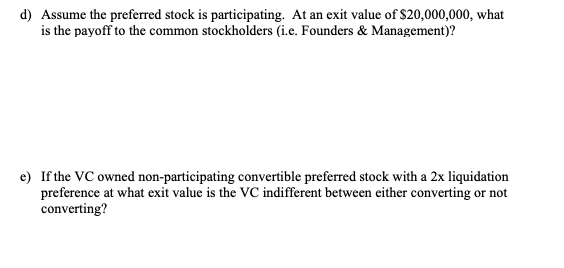

Transcribed Image Text:d) Assume the preferred stock is participating. At an exit value of $20,000,000, what

is the payoff to the common stockholders (i.e. Founders & Management)?

e) If the VC owned non-participating convertible preferred stock with a 2x liquidation

preference at what exit value is the VC indifferent between either converting or not

converting?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning