d. At the end of three years, how much is an initial $100 deposit worth, assuming a quar- terly compounded annual interest rate of (i) 100 percent? (ii) 10 percent? e. Why do your answers to Part (d) differ from those to Part (a)? f. At the end of 10 years, how much is a $100 initial deposit worth, assuming an annual interest rate of 10 percent compounded (i) annually? (ii) semiannually? (iii) quarterly? (iv) continuously?

d. At the end of three years, how much is an initial $100 deposit worth, assuming a quar- terly compounded annual interest rate of (i) 100 percent? (ii) 10 percent? e. Why do your answers to Part (d) differ from those to Part (a)? f. At the end of 10 years, how much is a $100 initial deposit worth, assuming an annual interest rate of 10 percent compounded (i) annually? (ii) semiannually? (iii) quarterly? (iv) continuously?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA3: Time Value Of Money

Section: Chapter Questions

Problem 13E

Related questions

Question

Kindly answer last three parts of Question 1. (d, e, f)

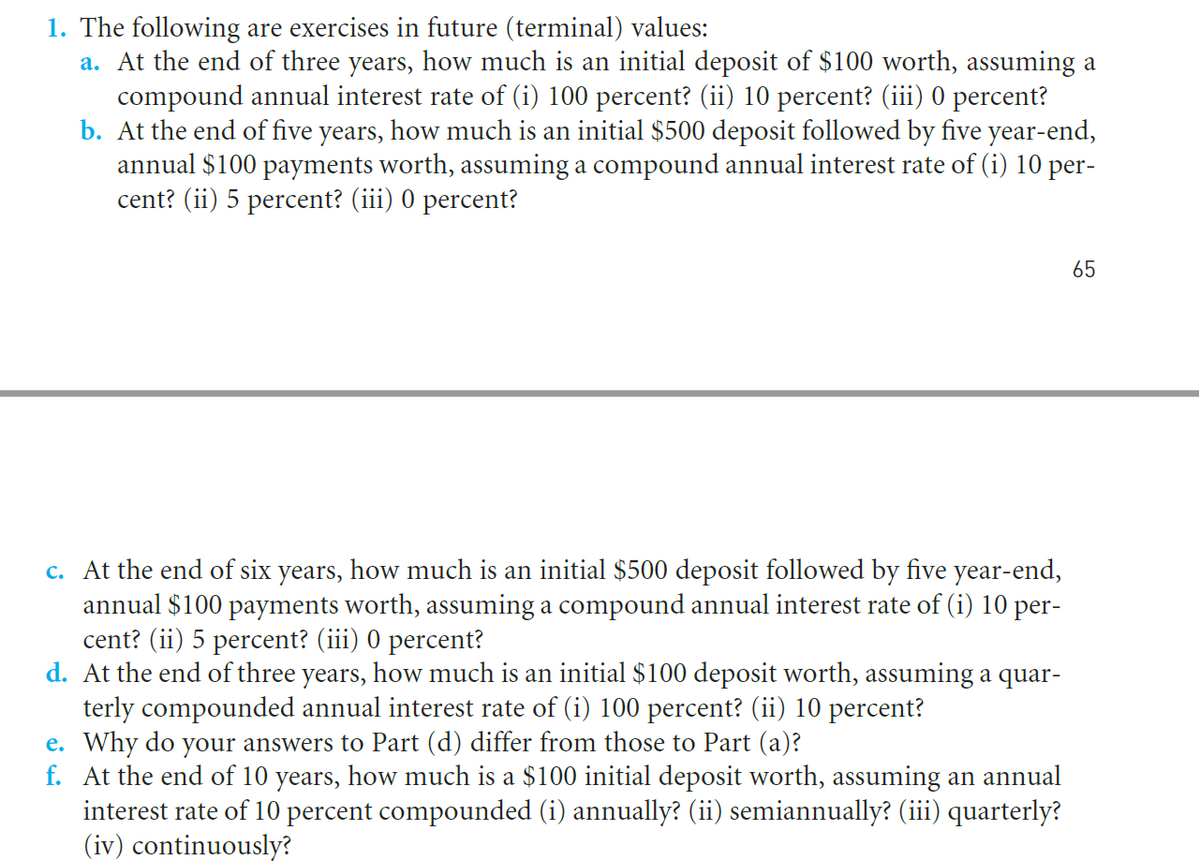

Transcribed Image Text:1. The following are exercises in future (terminal) values:

a. At the end of three years, how much is an initial deposit of $100 worth, assuming a

compound annual interest rate of (i) 100 percent? (ii) 10 percent? (iii) 0 percent?

b. At the end of five years, how much is an initial $500 deposit followed by five year-end,

annual $100 payments worth, assuming a compound annual interest rate of (i) 10 per-

cent? (ii) 5 percent? (iii) 0 percent?

65

c. At the end of six years, how much is an initial $500 deposit followed by five year-end,

annual $100 payments worth, assuming a compound annual interest rate of (i) 10 per-

cent? (ii) 5 percent? (iii) 0 percent?

d. At the end of three years, how much is an initial $100 deposit worth, assuming a quar-

terly compounded annual interest rate of (i) 100 percent? (ii) 10 percent?

e. Why do your answers to Part (d) differ from those to Part (a)?

f. At the end of 10 years, how much is a $100 initial deposit worth, assuming an annual

interest rate of 10 percent compounded (i) annually? (ii) semiannually? (iii) quarterly?

(iv) continuously?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 2 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College