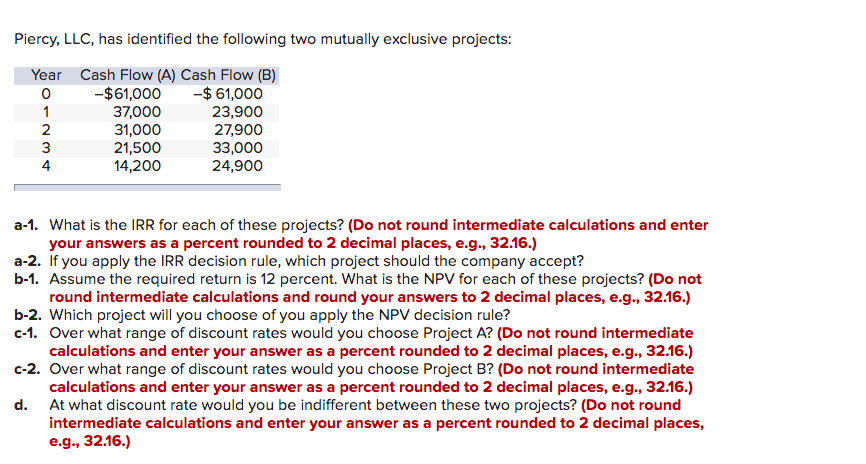

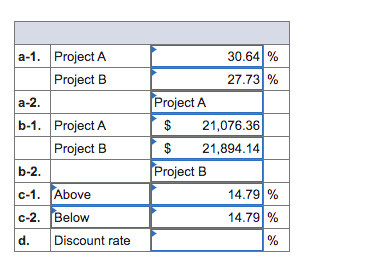

d. At what discount rate would you be indifferent between these two projects? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)

Q: A clothing company has determined that if the price of a T-shirt is K40, then 150 will be demanded b...

A: When Price (P) = 40, Demand (Q) = 150 When Price (P) = 45, Demand (Q) = 100 Let the price demand equ...

Q: a. Calculate the yield to maturity (YTM) for the bond. b. What relationship exists between the coupo...

A: Yield To Maturity: It refers to the total rate earned by the bondholder for holding the bond till m...

Q: As a financial manager you are very concerned about the dividend yiled and dividend payout ratioas t...

A: Stock price is defined as the maximum price that an investor is willing to pay for a stock. These pr...

Q: What is an efficient market and why is it important for derivatives markets?

A: Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only one...

Q: With a required rate of return of 17%, the IRR of a standard capital budgeting project is equal to 1...

A: Internal rate of return is the rate which the NPV of the project is zero. Net present value is the d...

Q: Select all the options that would be part of the initial investment of a project consisting in estab...

A: The initial investment will consist of all one-time expenses and payments that are incurred in makin...

Q: An amount of 100,000 was borrowed and was to be repaid in 10 instalments at the end of every quarter...

A: Here, Borrowed amount (PV) is 100,000 No. of Quarterly Payment (n) is 10 Uniform Gradient Amount (G)...

Q: A bond will sell at ____________ if the required return is greater than the coupon rate. Select one...

A: Required return relation with price and coupon rate If required return is greater than coupon rate t...

Q: The selling price of the preference shares is P150. the business is subject to a 30% income tax rate...

A: The cost of preference share = Annual dividend/Current price of the share Annual dividend = Par valu...

Q: Consider a project with inflows of $20,000 and outflows of $13,000. If the tax rate is 33%, and if t...

A: Annual inflow (A) = $20000 Annual outflow (O) = $13000 Tax rate (T) = 33% Let D = Depreciation

Q: Use the compound interest formula to compute the balance in the following account after the stated p...

A: We need to use compound interest formula to calculate balance in the account after 14 years A =P(1+i...

Q: xactly 140 years ago my great grandmother deposited $190 in a large bank. She forgot all about the d...

A: Here we can use the concept of time value of money. As per the concept money earns interest and henc...

Q: A 25 years old Engineer wants to retire at age 65 with $1,000,000 in his 401k account. If his 401K ...

A: A monthly deposit of a fixed amount at equal intervals for a fixed period of time is a type of annui...

Q: Find the present value of a perpetuity of P15,000 payable semi-annually if money is worth 8% compoun...

A: A perpetuity is a series of continuous payments made at regular intervals. It can also be understood...

Q: What is the NPV of the investment? (Rounded to the nearest whole dollar)

A: Net Present Value: It represents the project's or investment's profitability in dollar amounts. It ...

Q: 1. What are the current financial issues that can affect the operating environment of a multinationa...

A: 1. Multinational corporations are much more common today than they used to be. Many companies have f...

Q: If P30,000 is deposited each year for 9 years. How much annuity can a person get annually from the b...

A: An annuity refers to a fixed amount or stream of payments or deposits made. Therefore, it helps in p...

Q: A nominal rate of interest of 7% compounded continuously is equivalent to an effective annual rate o...

A: Interest rate (r) = 7% Mathematics constant (e) = 2.7182818284590452353602874713527

Q: Cost of common stock equity-CAPM Netflix commor stock has a beta, b, of 1.4. The risk-free rate is 9...

A: We need to use CAPM equation to calculate cost of equity or required rate of return. Re =Rf +β*(Rm-...

Q: Yawi has a medium-size trucking company that distributes appliances within Metro Manila. Fuel consum...

A: The discounted cash inflows or outflows of future payments or receipts are known as the equivalent p...

Q: Big Rock has several investment portfolios with a local mutual fund company. One of the company’s di...

A: Sharpe ratio is calculated by dividing the difference of return on asset with risk free return by st...

Q: Mary Joy Dela PAz purchased a house worth 188,686 with a down payment of 36,866 and monthly payments...

A: Given: Particulars Amount Cost of house 188686 Down payment 36866 Years 15 Interest rate ...

Q: Gyutaro wishes his sister to receive P600,000.00 twelve years from now. What amount should he invest...

A: The present value is calculated by discounting the future values by 1+r factor for the given require...

Q: If you invest your P3,000 every year at 4% interest rate, how many months does it take to be worth P...

A: Annual investment (A) = P 3000 r = 4% n = Years to accumulate P 117247.80

Q: a) Use rate of return (ROR) analysis to determine which of the mutually exclusive projects listed be...

A: Mutually exclusive projects are those available set of investment alternatives who are closely relat...

Q: In the credit market model with asymmetric information, determine how a consumer will respond to an ...

A: Asymmetric information In credit market, asymmetric information means the lenders or the borrowers h...

Q: If the yield curve in the bond market shows a flat curve, what do you think about the prediction of ...

A: Yield Curve - It is a line on graph withbond yield in Y-axis and Maturity in X-axis. These curves u...

Q: rejecting it? LO 3 8. Calculating IRR What is the IRR of the following set of cash flows? Year Cash ...

A: Net Present Value: Net present value (NPV) is the excess of present value of cash inflows over the p...

Q: annual cash flow f

A: Annual cash flows refer to the income of the company before deducting any interest, taxes, depreciat...

Q: Your bank pays 12% interest, compounded quarterly. How much should you deposit now to yield an annui...

A: Present value is the amount that should be deposited to the given yield at each of the three months.

Q: Cost of Abalone Country Australia Chile Ireland New Zealand South Africa CLP Abalone Cost AUD 93,500...

A: Data given: $1 US = 104 Yen Offer price = 9.46 million Yen Working Note #1 Offer price in USD: 9.4...

Q: A car was bought on an installment basis with a monthly installment of P30,000 for 60 months. If the...

A: Present Value of Ordinary Annuity refers to a concept that determines the value of cash flows at pre...

Q: The present value of an annuity of “Y" pesos payable annually for 8 years, wit the first payment at ...

A: We can use the concept of time value of money here. As per the concept of time value of money the wo...

Q: Rose Gardens is looking into investing opportunities. The following are potential opportunities: Zi...

A: Dividend is the amount which is paid as a reward to the shareholders of the company for the risk the...

Q: 1. Discuss: Firms often involve themselves in projects that do not result directly in profits. For e...

A: Direct profit is defined as the amount of money earned from sales after deducting direct costs. This...

Q: 13. Calculating Profitability Index following set of cash flows if the relevant discount rate is 10 ...

A: Profitability Index = (NPV + Initial Investment ) / Initial Investment NPV can be calculated by ...

Q: A stock that pays an annual dividend of $0.52 per share has a current price of $30.50. Find the divi...

A: Annual dividend = $0.52 Current price = $30.50

Q: A group of engineers formed a corporation and the opportunity to invest P8,000,000. Their plan is to...

A: A capital budgeting project is one in which a huge amount of funds are invested. They are generally ...

Q: You have researched your dream around-the-world vacation and determined that the total cost of the v...

A: Monthly saving (S) = $200 r = 9.5% per annum = 0.7917% per month Let n = Number of months needed to ...

Q: Which of the following statements is CORRECT? Assume that the project being considered has normal ca...

A: WACC is the required rate of return, where as IRR is the actual rate of return of the project. NPV i...

Q: Which of the following statements is false? A. Other things being equal, an increase in a bon...

A: A bond is a fixed income instrument, that is used by borrowers to raise money at a certain interest ...

Q: A company has an ROE of 12% and payouts 44% of its earnings as dividends. It is planning to pay a $...

A: Dividend is the part or share of profits that is being distributed to shareholders of the company. D...

Q: Frank plans to set aside money for his young daughter's college tuition. He will deposit money in an...

A: This is a case of ordinary annuity. It means that deposits are being made at the end of the relevant...

Q: /hich of the following statements most accurately characterizes the pecking order theory of capital ...

A: The pecking order theory of capital structure is an important theory of capital structure. The theor...

Q: their payment every year. Compute the annual payment to settle their debt if the rate of interest is...

A: A stream of equal cash flows paid or received periodically is termed as annuity. Annuity is either r...

Q: a. Explain what a corporate bond is b. Outline three characteristics of the bond market d. Explain t...

A: Bonds are the liability of the company which they have to pay after the expiry of the bond’s duratio...

Q: P8-2 Risk versus Return Rank the following three stocks by their risk-return relationship, best to w...

A: Solution:- Risk-return relationship means the ratio of risk to the return of a stock. Risk is measur...

Q: The market excess return is 12% and the risk-free rate is 3%. Assume CAPM is a good description of s...

A: CAPM refers to capital asset pricing model. In this model, the main aim is to determine the minimum ...

Q: To be able to take her dream vacation, Maya decides to save for 4 years. She opens a savings account...

A: We need to use simple interest formula to calculate simple interest Simple interest =Principal*Rate*...

Q: 4. Calculating AAR You're trying to determine whether or not to expand vour business by building a n...

A: The accounting rate of return is the rate of return which is expected from the investment made by th...

Part D please

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- Bruin, Inc., has identified the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) 0 –$ 28,700 –$ 28,700 1 14,100 4,150 2 12,000 9,650 3 9,050 14,900 4 4,950 16,500 a-1 What is the IRR for each of these projects? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) a-2 Using the IRR decision rule, which project should the company accept? Project A Project B a-3 Is this decision necessarily correct? Yes No b-1 If the required return is 12 percent, what is the NPV for each of these projects? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b-2 Which project will the company choose if it applies the NPV decision rule? Project A Project B c.…Bruin, Incorporated, has identified the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) 0 −$ 28,000 −$ 28,000 1 13,400 3,800 2 11,300 9,300 3 8,700 14,200 4 4,600 15,800 a-1. What is the IRR for each of these projects? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b-1. If the required return is 10 percent, what is the NPV for each of these projects? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) c. At what discount rate would the company be indifferent between these two projects? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)please answer second subpart because an expert already answered the first Bruin, Inc., has identified the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) 0 –$ 28,700 –$ 28,700 1 14,100 4,150 2 12,000 9,650 3 9,050 14,900 4 4,950 16,500 a-1 What is the IRR for each of these projects? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) a-2 Using the IRR decision rule, which project should the company accept? Project A Project B a-3 Is this decision necessarily correct? Yes No b-1 If the required return is 12 percent, what is the NPV for each of these projects? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b-2 Which project will the company choose if it applies the…

- CRAYON corporation has identified the following two mutually exclusive projects: YEAR Cash flow ( A) Cash flow ( B) 0 -$300,000 -$300,000 1 68,950 135,000 2 83,900 105,500 3 93,200 75,000 4 105,600 55,600 5 115,600 45,600 What is the IRR for each of this project (range: 10-16%)? Using the IRR decision rule, which project should the company accept? How do you interpret IRR of a project? If the required return is 15%, what is the NPV of these projects? Which project will the company choose if it applies the NPV decision rule? How do you interpret NPV of a project? Calculate the Payback period and discounted pay back period of these projects! Which project should the company accept? What are the differences of payback period and discounted payback…Garage, Inc., has identified the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) 0 -$43,500 -$43,500 1 21,400 6,400 2 18,500 14,700 3 13,800 22,800 4 7,600 25,200 What is the IRR for each of these projects? Using the IRR decision rule, which project should the company accept? Is this decision necessarily correct? If the required return is 11 percent, what is the NPV for each of these projects? Which project will the company choose if it applies the NPV decision rule? Over what range of discount rates would the company choose project? A? Project B? At what discount rate would the company be indifferent between these two projects? Explain.can you please answer the second part from question b towards the end because an expert already answered the first part Bruin, Inc., has identified the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) 0 –$ 28,700 –$ 28,700 1 14,100 4,150 2 12,000 9,650 3 9,050 14,900 4 4,950 16,500 a-1 What is the IRR for each of these projects? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) a-2 Using the IRR decision rule, which project should the company accept? Project A Project B a-3 Is this decision necessarily correct? Yes No b-1 If the required return is 12 percent, what is the NPV for each of these projects? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b-2…

- The following are the cash flows of two independent projects: Year Project A Project B 0 $ (270 ) $ (270 ) 1 150 170 2 150 170 3 150 170 4 150 a. If the opportunity cost of capital is 12%, calculate the NPV for both projects. (Do not round intermediate calculations. Round your answers to 2 decimal places.)Bruin, Incorporated, has identified the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) 0 −$ 66,000 −$ 66,000 1 42,000 28,400 2 36,000 32,400 3 24,000 38,000 4 15,200 24,400 a-1. What is the IRR for each of these projects? a-2. If you apply the IRR decision rule, which project should the company accept? b-1. Assume the required return is 12 percent. What is the NPV for each of these projects? b-2. Which project will you choose of you apply the NPV decision rule? c-1. Over what range of discount rates would you choose Project A? c-2. Over what range of discount rates would you choose Project B? d. At what discount rate would you be indifferent between these two projects?Bruin, Incorporated, has identified the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) 0 −$ 28,500 −$ 28,500 1 13,900 4,050 2 11,800 9,550 3 8,950 14,700 4 4,850 16,300 a-1. What is the IRR for each of these projects? a-2. Using the IRR decision rule, which project should the company accept? multiple choice 1 Project A Project B a-3. Is this decision necessarily correct? multiple choice 2 Yes No b-1. If the required return is 11 percent, what is the NPV for each of these projects? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b-2. Which project will the company choose if it applies the NPV decision rule? multiple choice 3 Project A Project B c. At what discount rate would the company be indifferent between these two projects? (Do not round intermediate…

- Cummings Products Company is considering two mutually exclusive investments whose expected net cash flows are as follows: EXPECTED NET CASH FLOWS Year Project A Project B 0 -$300 -$405 1 -387 134 2 -193 134 3 -100 134 4 600 134 5 600 134 6 850 134 7 -180 134 Construct NPV profiles for Projects A and B. 1.What is each project's IRR? Do not round intermediate calculations. Round your answers to two decimal place Project A % Project B % Calculate the two projects' NPVs, if you were told that each project's cost of capital was 10%. Do not round intermediate calculations. Round your answers to the nearest cent.Project A $Project B $Which project, if either, should be selected?-Select-Project AProject BItem 6Calculate the two projects' NPVs, if the cost of capital was 17%. Do not round intermediate calculations. Round your answers to the nearest cent.Project A $Project B $What would be the proper choice?-Select-Project…a company is deciding between two mutually exclusive projects. the cash flows are shown below. year 0 project a -$1,000 project b -$1,000 ywar 1 project a 550 project b 400 year 2 project a 550 projecy b 600 year 3 project a 550 project b 900 if the cosy of capital is 10% which project should the compsny selectcompany is analyzing two mutually exclusive projects, S and L, with the following cash flows: 0 1 2 3 4 Project S -$1,000 $875.54 $260 $5 $5 Project L -$1,000 $10 $260 $380 $839.00 The company's WACC is 9.5%. What is the IRR of the better project? (Hint: The better project may or may not be the one with the higher IRR.) Round your answer to two decimal places. %