d. If amesway sells $1.2 million in new stock and places the proceeds in marketable securities, what happens to its current and quick ratios? New current ratio: New quick ratio:

d. If amesway sells $1.2 million in new stock and places the proceeds in marketable securities, what happens to its current and quick ratios? New current ratio: New quick ratio:

Chapter3: Evaluation Of Financial Performance

Section: Chapter Questions

Problem 8P

Related questions

Question

"Sub-Parts To Be Solved???"

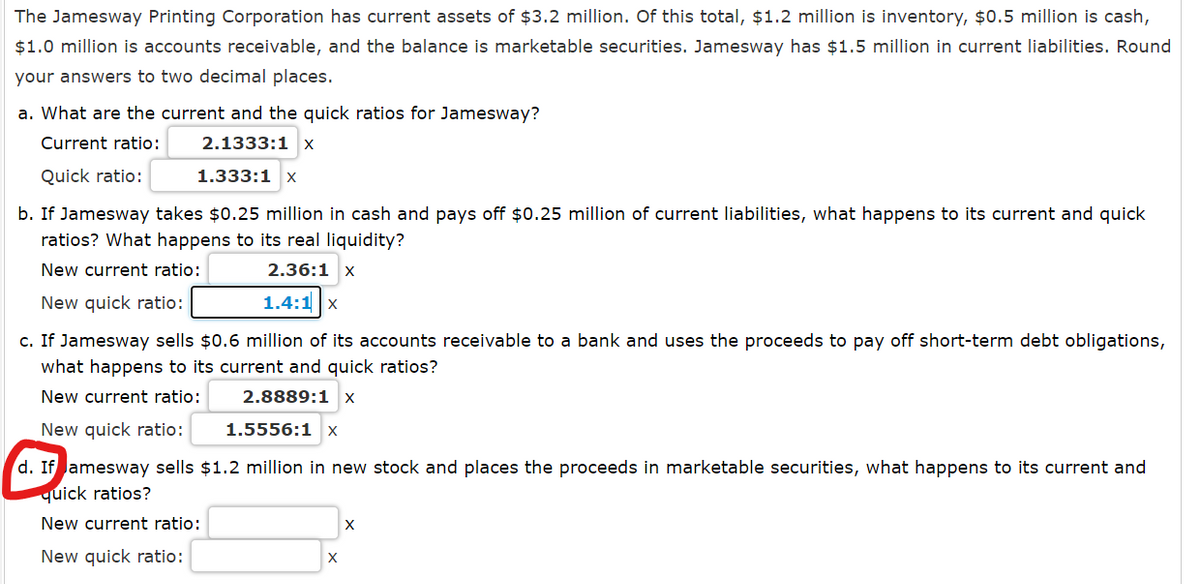

Transcribed Image Text:The Jamesway Printing Corporation has current assets of $3.2 million. Of this total, $1.2 million is inventory, $0.5 million is cash,

$1.0 million is accounts receivable, and the balance is marketable securities. Jamesway has $1.5 million in current liabilities. Round

your answers to two decimal places.

a. What are the current and the quick ratios for Jamesway?

Current ratio:

2.1333:1 x

Quick ratio:

1.333:1 x

b. If Jamesway takes $0.25 million in cash and pays off $0.25 million of current liabilities, what happens to its current and quick

ratios? What happens to its real liquidity?

New current ratio:

2.36:1 x

New quick ratio:

1.4:1 x

c. If Jamesway sells $0.6 million of its accounts receivable to a bank and uses the proceeds to pay off short-term debt obligations,

what happens to its current and quick ratios?

New current ratio:

2.8889:1 x

New quick ratio:

1.5556:1 x

d. If amesway sells $1.2 million in new stock and places the proceeds in marketable securities, what happens to its current and

quick ratios?

New current ratio:

New quick ratio:

X

Expert Solution

Step 1

Current Ratio & Quick Ratio are calculated to know short-term solvency positions of the company. It shows efficiency of company to meet its short-term liabilities. Ideal Current-Ratio is considered 2:1 and Quick-Ratio is 1:1.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning