d. If the company can issue $1,000-par-value, 12% coupon, 11-year bonds that can be sold for $1,180 each, and flotation costs would amount to $40 per bond, the after-tax cost of debt financing is %. (Round to two decimal places.)

d. If the company can issue $1,000-par-value, 12% coupon, 11-year bonds that can be sold for $1,180 each, and flotation costs would amount to $40 per bond, the after-tax cost of debt financing is %. (Round to two decimal places.)

Chapter15: Dividend Policy

Section: Chapter Questions

Problem 13P

Related questions

Question

What is the answer of d?

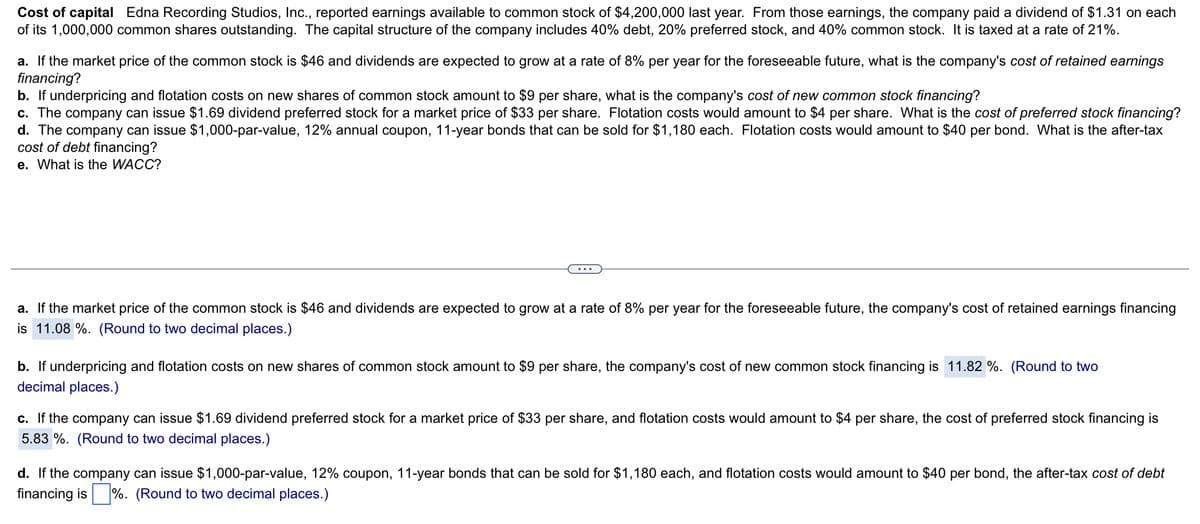

Transcribed Image Text:Cost of capital Edna Recording Studios, Inc., reported earnings available to common stock of $4,200,000 last year. From those earnings, the company paid a dividend of $1.31 on each

of its 1,000,000 common shares outstanding. The capital structure of the company includes 40% debt, 20% preferred stock, and 40% common stock. It is taxed at a rate of 21%.

a. If the market price of the common stock is $46 and dividends are expected to grow at a rate of 8% per year for the foreseeable future, what is the company's cost of retained earnings

financing?

b. If underpricing and flotation costs on new shares of common stock amount to $9 per share, what is the company's cost of new common stock financing?

c. The company can issue $1.69 dividend preferred stock for a market price of $33 per share. Flotation costs would amount to $4 per share. What is the cost of preferred stock financing?

d. The company can issue $1,000-par-value, 12% annual coupon, 11-year bonds that can be sold for $1,180 each. Flotation costs would amount to $40 per bond. What is the after-tax

cost of debt financing?

e. What is the WACC?

a. If the market price of the common stock is $46 and dividends are expected to grow at a rate of 8% per year for the foreseeable future, the company's cost of retained earnings financing

is 11.08 %. (Round to two decimal places.)

b. If underpricing and flotation costs on new shares of common stock amount to $9 per share, the company's cost of new common stock financing is 11.82 %. (Round to two

decimal places.)

c. If the company can issue $1.69 dividend preferred stock for a market price of $33 per share, and flotation costs would amount to $4 per share, the cost of preferred stock financing is

5.83 %. (Round to two decimal places.)

d. If the company can issue $1,000-par-value, 12% coupon, 11-year bonds that can be sold for $1,180 each, and flotation costs would amount to $40 per bond, the after-tax cost of debt

financing is%. (Round to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning