d. What amounts will Mega Mart report on the 2010 W-2s for each employee?

Accounting

27th Edition

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Chapter11: Current Liabilities And Payroll

Section: Chapter Questions

Problem 11.4BPR

Related questions

Question

please only D..

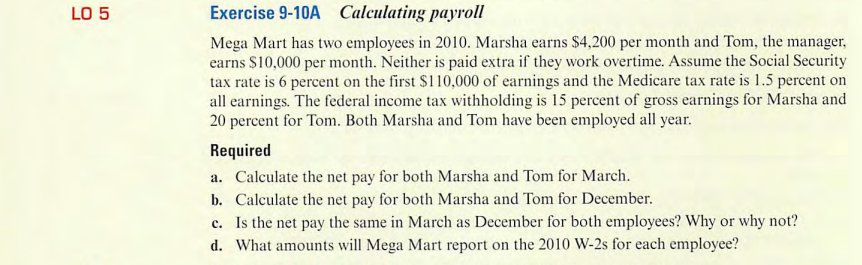

Transcribed Image Text:LO 5

Exercise 9-10A Calculating payroll

Mega Mart has two employees in 2010. Marsha earns $4,200 per month and Tom, the manager,

earns $10,000 per month. Neither is paid extra if they work overtime. Assume the Social Security

tax rate is 6 percent on the first $110,000 of earnings and the Medicare tax rate is 1.5 percent on

all earnings. The federal income tax withholding is 15 percent of gross earnings for Marsha and

20 percent for Tom. Both Marsha and Tom have been employed all year.

Required

a. Calculate the net pay for both Marsha and Tom for March.

b.

Calculate the net pay for both Marsha and Tom for December.

c. Is the net pay the same in March as December for both employees? Why or why not?

d. What amounts will Mega Mart report on the 2010 W-2s for each employee?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning