d. When documenting their understanding of a client's internal controls, auditors are required to use narratives. e. To issue an unqualified opinion on internal control over financial reporting, there must be no identified material weaknesses and no restrictions on the scope of the audit.

d. When documenting their understanding of a client's internal controls, auditors are required to use narratives. e. To issue an unqualified opinion on internal control over financial reporting, there must be no identified material weaknesses and no restrictions on the scope of the audit.

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter2: The Auditor’s Responsibilities Regarding Fraud And Mechanisms To Address Fraud: Regulation And Corporate Governance

Section: Chapter Questions

Problem 18RQSC

Related questions

Question

KINDLY ANSWER THE TRUE OR FALSE PART NUMBER 4 AND 5. THANK YOU!

Transcribed Image Text:A Auditing (2021-2022) 3-B

O Microsoft Word - Auditing_Assig x

4 Chapter 3_Auditor's Responsibilit x +

O File | C:/Users/Owner/Downloads/Auditing_Assignment%201_092021.pdf

Error :

M

Microsoft Word - Auditing_Assignment 1_To be printed

1 /1||

+ |

67%

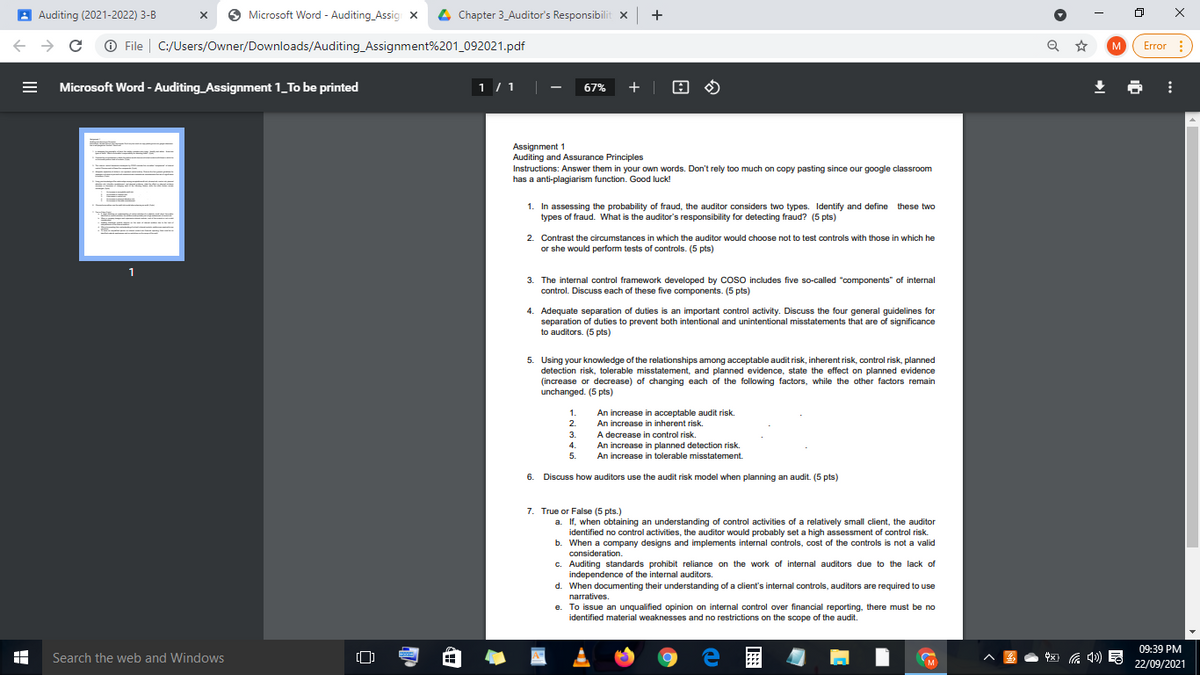

Assignment 1

Auditing and Assurance Principles

Instructions: Answer them in your own words. Don't rely too much on copy pasting since our google classroom

has a anti-plagiarism function. Good luck!

1. In assessing the probability of fraud, the auditor considers two types. Identify and define these two

types of fraud. What is the auditor's responsibility for detecting fraud? (5 pts)

2. Contrast the circumstances in which the auditor would choose not to test controls with those in which he

or she would perform tests of controls. (5 pts)

1

3. The internal control framework developed by coso includes five so-called "components" of internal

control. Discuss each of these five components. (5 pts)

4. Adequate separation of duties is an important control activity. Discuss the four general guidelines for

separation of duties to prevent both intentional and unintentional misstatements that are of significance

to auditors. (5 pts)

5. Using your knowledge of the relationships among acceptable audit risk, inherent risk, control risk, planned

detection risk, tolerable misstatement, and planned evidence, state the effect on planned evidence

(increase or decrease) of changing each of the following factors, while the other factors remain

unchanged. (5 pts)

1.

An increase in acceptable audit risk.

An increase in inherent risk.

A decrease in control risk.

An increase in planned detection risk.

2.

3.

4.

5.

An increase in tolerable misstatement.

6. Discuss how auditors use the audit risk model when planning an audit. (5 pts)

7. True or False (5 pts.)

a. If, when obtaining an understanding of control activities of a relatively small client, the auditor

identified no control activities, the auditor would probably set a high assessment of control risk.

b. When a company designs and implements internal controls, cost of the controls is not a valid

consideration.

c. Auditing standards prohibit reliance on the work of internal auditors due to the lack of

independence of the internal auditors.

d. When documenting their understanding of a client's internal controls, auditors are required to use

narratives.

e. To issue an unqualified opinion on internal control over financial reporting, there must be no

identified material weaknesses and no restrictions on the scope of the audit.

09:39 PM

Search the web and Windows

M

22/09/2021

日

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage