D21 6-1 Problem Set: Module Six - x Variable factory overhead Fixed factory overhead Selling and administrative expenses: Variable selling and administrative expenses Fixed selling and administrative expenses ← → C v2.cengagenow.com/ilrn/takeAssignment/takeAssignment Main.do?invoker=&take AssignmentSession Locator-assignment-take&inprogress=false Sales CengageNOWv2 | Online teac x If required, round interim per-unit calculations to the nearest cent. Feedback ✓ Cost of goods sold Gross profit Selling and administrative expenses Check My Work 142,000 95,000 a. Prepare an income statement according to the absorption costing concept. Gallatin County Motors Inc. Absorption Costing Income Statement For the Month Ended July 31 $172,500 66,800 Assignment Score: 83.87% Cengage Learning $1,280,000 ✓ 888,000 X 239,300 ✓ 1,113,000 239,300 x + Correct Check My Work a. Under absorption costing, the cost of goods manufactured includes direct materials, direct labor, and factory overhead costs. Both fixed and variable factory costs are included as part of factory avachand All work saved. Email Instructor 12 Previous Next :> Save and Exit Submit Assignment for Grading ⠀ (?

D21 6-1 Problem Set: Module Six - x Variable factory overhead Fixed factory overhead Selling and administrative expenses: Variable selling and administrative expenses Fixed selling and administrative expenses ← → C v2.cengagenow.com/ilrn/takeAssignment/takeAssignment Main.do?invoker=&take AssignmentSession Locator-assignment-take&inprogress=false Sales CengageNOWv2 | Online teac x If required, round interim per-unit calculations to the nearest cent. Feedback ✓ Cost of goods sold Gross profit Selling and administrative expenses Check My Work 142,000 95,000 a. Prepare an income statement according to the absorption costing concept. Gallatin County Motors Inc. Absorption Costing Income Statement For the Month Ended July 31 $172,500 66,800 Assignment Score: 83.87% Cengage Learning $1,280,000 ✓ 888,000 X 239,300 ✓ 1,113,000 239,300 x + Correct Check My Work a. Under absorption costing, the cost of goods manufactured includes direct materials, direct labor, and factory overhead costs. Both fixed and variable factory costs are included as part of factory avachand All work saved. Email Instructor 12 Previous Next :> Save and Exit Submit Assignment for Grading ⠀ (?

Financial & Managerial Accounting

14th Edition

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter18: Activity-Based Costing

Section: Chapter Questions

Problem 18.3TIF: Communication The controller of New Wave Sounds Inc. prepared the following product profitability...

Related questions

Question

eBook

Show Me How

Question Content Area

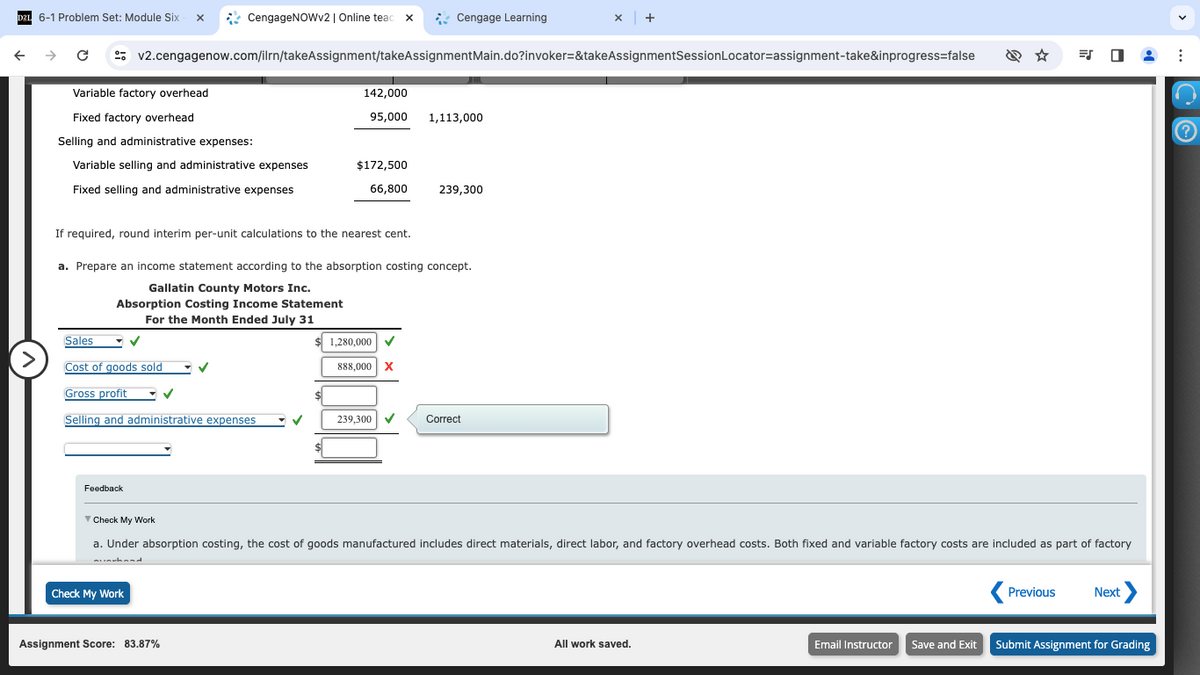

Income Statements under Absorption Costing and Variable Costing

Gallatin County Motors Inc. assembles and sells snowmobile engines. The company began operations on July 1 and operated at 100% of capacity during the first month. The following data summarize the results for July:

| Sales (8,000 units) | $1,280,000 | |||

| Production costs (10,000 units): | ||||

| Direct materials | $592,000 | |||

| Direct labor | 284,000 | |||

| Variable factory overhead | 142,000 | |||

| Fixed factory overhead | 95,000 | 1,113,000 | ||

| Selling and administrative expenses: | ||||

| Variable selling and administrative expenses | $172,500 | |||

| Fixed selling and administrative expenses | 66,800 | 239,300 |

Transcribed Image Text:D21 6-1 Problem Set: Module Six - x

Variable factory overhead

Fixed factory overhead

Selling and administrative expenses:

Variable selling and administrative expenses

Fixed selling and administrative expenses

← → C v2.cengagenow.com/ilrn/takeAssignment/takeAssignment Main.do?invoker=&take AssignmentSession Locator-assignment-take&inprogress=false

Sales

CengageNOWv2 | Online teac x

If required, round interim per-unit calculations to the nearest cent.

Feedback

✓

Cost of goods sold

Gross profit

Selling and administrative expenses

Check My Work

142,000

95,000

a. Prepare an income statement according to the absorption costing concept.

Gallatin County Motors Inc.

Absorption Costing Income Statement

For the Month Ended July 31

$172,500

66,800

Assignment Score: 83.87%

Cengage Learning

$1,280,000 ✓

888,000 X

239,300 ✓

1,113,000

239,300

x +

Correct

Check My Work

a. Under absorption costing, the cost of goods manufactured includes direct materials, direct labor, and factory overhead costs. Both fixed and variable factory costs are included as part of factory

avachand

All work saved.

Email Instructor

12

Previous

Next :>

Save and Exit Submit Assignment for Grading

⠀

(?

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,