Q: Present work in Excel Consider the following: Financed amount: $385,000 Cost of funds:…

A: Loan Amortization: It represents a process of paying the amount of the loan using equal payments.…

Q: which maret is not part of capital market Options are corportae securities market loan market…

A: Capital markets provide a platform for companies and governments to raise funds for their…

Q: The Wooden World Inc. is planning to start a 3-year project. It will be designing and selling wooden…

A: As per our guidelines, we are supposed to answer only 3 sub-parts (if there are multiple sub-parts…

Q: You purchase an ordinary annuity with 4% interest and will receive regular quarterly payments of…

A: The interest rate is 4% Quarterly rate, the rate is 4%4= 1% Regular Quarterly payment, PMT is $4500…

Q: Dj 1 finance An ARM is made for $240,000 for 30 years with the following terms: Initial interest…

A: STEP 1 Interest is stated to be 7% for the first year. Interest rates are determined for each of the…

Q: The bond indenture is a legal document, and it includes many provisions. For instance, the call…

A: Bond Indenture is a legal contract associated with a bond. Bond indenture contract includes terms…

Q: 1. High Land Property Development Corp has a P10,000 note receivable from a customer due in three…

A: We can solve these questions by using formula of time value of money. 1. To solve this question we…

Q: Which of the following is correct for the owner of a call option, valued at £5, on XYZ with a strike…

A: Call Option: The call option represents a contract where the buyer has the right to purchase the…

Q: If a taxpayer 2022 household income of $60,000 places the taxpayer at 250% of the federal poverty…

A: The Federal Poverty Level (FPL) is a gauge of the yearly income necessary that households and…

Q: How did you compute the remaining quarterly periods and quarterly rate to come up with an answer of…

A: This is a follow up question with clarification regarding calculation of certain parameters. We will…

Q: Describe any two valuation multiples.

A: The purpose of valuation multiples is to increase the comparability of different organizations by…

Q: Freddie Mac owns 3 mortgages, each of which will pay off $1 million in present value 60% of the time…

A: CMO refers to a security that is sold to investors and is backed by a group of mortgages. The…

Q: Abraham, 28 years old has graduated five years ago from one reputable university in UK. His majoring…

A: The concept of money's time worth indicates that any sum of money is worth more now as compared to…

Q: A company considers buying a new electric forklift truck that would cost $18,000, having operating…

A: The company has many alternatives to choose the best one. The annual worth method helps the company…

Q: Cookie Dough Corporation has two different bonds currently outstanding. Bond M has a face value of…

A: The bond price is the value or the consideration paid by the potential investor of bond to purchase…

Q: Use the information for the question below Alaska North Slope Crude Oil (ANS) West Texas…

A: In a barter system, one product is exchanged for another product, and one product is valued in terms…

Q: 2.Consider a portfolio of 3 bond A and 2 Annuity B, the yield rate is i-5% for A and B. Bond A:…

A: HONOR CODE: Since you have posted a question with multiple sub-parts, we will provide the solution…

Q: Which of the following investment rules may not use all possible cash flows in its calculation? A…

A: Profitability Index: PI represents the measure of a project's or an investment's attractiveness.…

Q: If you withdraw part of your money from a certificate of deposit before the date of maturity, you…

A: Interest is the return earned on the investment. When an amount is withdrawn early, the bank levies…

Q: Johnstone Company is facing several decisions regarding investing and financing activities. Address…

A: Several questions based on time value of money concepts have been asked. In each of these questions,…

Q: 2. The interest rate in European bank is 5% now, and the exchange rate is currently 1.05 dollars per…

A: Under uncovered interest rate parity theory, the interest rate differential between 2 countries will…

Q: (Without loss of generality assume that the expected/maximal exposures mentioned here correspond to…

A: Economic capital refers to the amount of money a company sets aside for covering any risks that it…

Q: Alfred Home Construction is considering the purchase of five dumpsters and the transport truck to…

A: The concept of the time value of money (TVM) states that money held today is worth more than holding…

Q: You are looking into buying an extended vehicle warranty on your car because someone suggested it…

A: Here present value is sum of all years discounted cash flow, to calculate the PVIF, 1/(1+discount…

Q: An engineering project has an investment amount of $126379 with an annual net profit of $53949 for 6…

A: The PV of a project refers to the value of its cash flows after they have been discounted to the…

Q: 1. (a) On 1 July 2015, an investor buys a corporate bond issued by Krazy Building plc. The bond is…

A: Bond Price: The bond price reflects the current price at which the bond is trading. The bond price…

Q: Which of the following exposure does not have cash flow effect? Group of answer choices Transaction…

A: The transaction that results in either cash inflow or cash outflow is supposed to affect cash flow.…

Q: Delta Corporation has the following capital structure: Debt (K) Preferred stock (Kp) Common equity…

A: Capital Structure: It refers to how a firm finances its overall business operations and growth.…

Q: Harry Dukee has been presented with an investment opportunity which will yield end of year cash…

A: Capital budgeting is a tool for the decision-making of the project, With the help of the concept of…

Q: Mender Co. will be receiving 700,000 Australian dollars in 180 days. Currently, a 180-day call…

A: Data given: Amount to be received in 180 days = 700,000 Australian dollars 180-day call option:…

Q: Benefit cost analysis may be conducted with real or nominal dollars and real or nominal discount…

A: The benefit-cost analysis is the process of finding out the suitability of a project by comparing…

Q: Q2: A robot arm which costs RM X to purchase and will provide RM Y benefits for each year. The…

A: Net present value (NPV) is a capital budgeting tool that helps to decide on whether the capital…

Q: Which of the following does not appear in a corporate income statement? a) The income or loss from…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: 1、 A bond has a quoted price $1091.59. It has a face value of $1,000, a annual coupon is $50, and a…

A: Current yield: The current yield of the bond is calculated by dividing the coupon payment by the…

Q: Suppose that an FI holds two loans with the following characteristics.…

A: A collection of numerous investment alternatives that an investor holds is regarded as a portfolio.…

Q: Pierre is a freelance chef. He works as a personal cook, a caterer for special events, and a menu…

A: Given: Pierre is a self-employed person. Since Pierre is a self-employed person, he can be able to…

Q: Account Company X Company Y Company Z Cost of goods sold $4,590,000 $9,292,500 $7,098,000 $803,600…

A: Average number of days to sell inventory = (Average inventory/Cost of goods sold) ×365 days

Q: If an individual saved no money for the year from income sources, could their net worth increase? a.…

A: Several statements have been provided explaining why net worth may or may not go up if a person…

Q: The company cost of capital depends on current profits and cashflows, which measures what investors…

A: The corporate cost of capital is reflective of the cost of average projects of the company and…

Q: Let's assume today is Feb 15, 2020 and call and put options for 10,000 euros at $1.3700 per euro are…

A: The contract that provides its buyer with a right to purchase or sell the underlying possession on a…

Q: David has a savings account with a 1,000 balance today. The account earns an annual percentage rate…

A: Compound interest is the interest which gets reinvested along with principal to get the interest on…

Q: Shearson PLC's stock sells for $42 per share. The company wants to sell some 15-year, annual…

A: Bond valuation: The bond valuation includes the calculation of all the present values of all cash…

Q: A five-year bond is issued with a face value of GHC3000.The bond pays coupon semiannually at 10%.…

A: a) Price of the bond = Coupon * [1-[1/1(1+r)^n ] /r Duration = weight * time ( weight being the…

Q: The buyer of a 2 year CDS pays 5000 Euros every quarter to the seller of the swap. The notional…

A: A credit default swap (CDS) is a derivative instrument that acts like an insurance against default.…

Q: Calculate the Internal rate of return of Project Diggy Calculate the Modified Internal rate of…

A: IRR is the internal rate of return. This is a criterion used to determine the profitability of the…

Q: If you leave $5500 in an account earning 9% interest, compounded daily, how much money will be in…

A: Principal amount (P) = $ 5,500 Interest rate (R) = 9% or .09 For compounded daily, Interest rate per…

Q: Lin-ay sang Subay is considering a P600,000 investment in a new equipment that is anticipated to…

A: The payback period is the period within which the project recovers its initial investment from the…

Q: Assume that F, and Fy are the futures prices of two contracts on the same non-dividend- paying…

A: The future price of a contract is the agreed-upon price of the underlying commodity which is…

Q: Project Diggy cost P15,000 and its expected to produce cash flows of P4,500 per year for 5 years.…

A: IRR and MIRR are capital budgeting techniques used to evaluate whether it is profitable to invest in…

Q: a. Explain SWOT analysis on business risks exposure of McDonalds in Japan. b. Explain market…

A: (A) SWOT Analysis is a strategic planning tool used to evaluate the Strengths, Weaknesses,…

Step by step

Solved in 3 steps

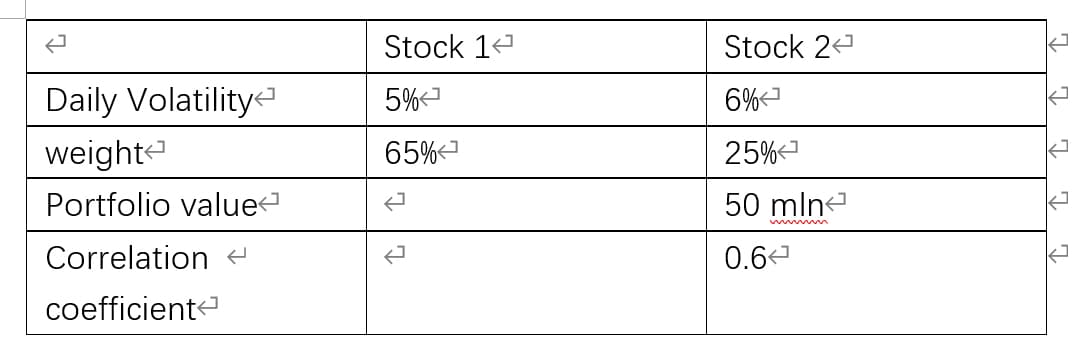

- What does the volatility value represents?Compare and contrast the risk versus expected rate of return tradeoff, the security market line, and determination of beta on this basis. Include explanation of all the constituents, namely security market line, risk measure, expected rate of return, risk-free rate of return, and market rate of return. Include hypothetical examples for better clarity. What is the weighted average cost of capital (WACC) and its significance?_______ is a measure of risk while _______ is a measure of risk and liquidity. NPV; IRR IRR; NPV PI; payback Payback; PI

- The Capital Asset Pricing Model (CAPM) describes a relationship between the expected return of,,, a)An individual share and its variance risk b)An individual share and its standard deviation risk c)An individual share and its undiversifiable risk d)An individual share and its diversifiable riskWhat is a characteristic line? How is this line used to estimate a stocks beta coefficient? Write out and explain the formula that relates total risk, market risk, and diversifiable risk.The slope of the Security Market Line equals to ____, and the slope of Capital Allocation Line equals to____. Select one: A. Beta; Sharpe Ratio B. Market Risk Premium; Sharpe Ratio C. Risk free rate; Volatility D. Market Risk Premium; Volatility

- The VIX measures Select one: a.Realized volatility B. Current volatility C. Historical volatility D. Implied volatilityCritically discuss the application of EWMA, GARCH and asymmetric GARCH models to volatility estimation in financial engineering.Compare and contrast the risk versus expected rate of return tradeoff, the security market line, and determination of beta on this basis. Include explanation of all the constituents, namely security market line, risk measure, expected rate of return, risk-free rate of return, and market rate of return. Include hypothetical examples for better clarity. What is the weighted average cost of capital (WACC) and its significance? Can you think of two hypothetical examples for better clarity?

- What is the difference between CAPM beta and cash-flow beta (from certainty equivalency approach)? Thank you!Which one of the following is most closely related to the net present value profile? A: Payback B: Discounted payback C: Profitability index D: Average accounting return E: Internal rate of returnWhat is the CAPM beta? How is it different from Cash Flow beta? Provide intuitive explanation and formulae for both.