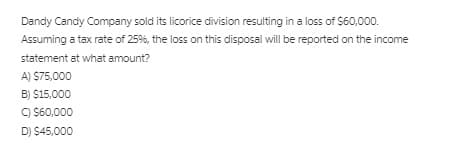

Dandy Candy Company sold its licorice division resulting in a loss of $60,000. Assuming a tax rate of 25%, the loss on this disposal will be reported on the income statement at what amount? A) S75,000 B) $15,000 C) $60,000 D) $45,000

Q: On June 30, Flores Corporation discontinued its operations in Mexico. On September 1, Flores…

A: Solution: Discontinued operations section of Flores's statement of comprehensive income:

Q: stan Itd sold inventories during the current period to its wholly owned susidiary. marcia Itd for…

A: Elimination Entry: These are the entries where effect of intercompany transactions are eliminated…

Q: Esquire Comic Book Company had income before tax of $1,600,000 in 2021 before considering the…

A: Calculation of Income from continuing operations: Income before considering additional items…

Q: Sol Limited. reported earnings of $410,000 in 20X8. The company has $81,000 of depreciation expense…

A: SOL Limited's Earnings = $410000 in 20x8 Depreciation expense = $81000 CCA claimed = $122000 Tax…

Q: Esquire Comic Book Company had income before tax of $1,000,000 in 2018 before considering the…

A:

Q: Cathy Company sold a segment of its business at a gain of $150,000 on December 31, 2021. Cathy…

A: In the income statement, revenue from discontinued operations is shown along with its corresponding…

Q: OVE INC. has a policy of using non-current assets until they can no longer operate and are…

A: Explanation of Concept Deferred Tax Assets / Deferred tax Liability : are to be calculated when…

Q: On June 30, Monty Corp. discontinued its operations in Mexico. On September 1, Monty disposed of the…

A: Discontinued operation's gain or loss is always reported net of tax.In this case the pretax loss is…

Q: The manager of Q Corporation is recommending the closure of Branch B in eler to eliminate its net…

A: Answer: We do not agree with manager, as if Branch B is closed Net operating income for company will…

Q: machine division, to date, has not been a profitable business segment for the cofmipany. AS 2018,…

A: GIVEN Sale value 850000 Book value 950000

Q: Gordon Brown Co’s Profit before tax was Rs7 million and a statement of financial position total of…

A: SOLUTION AUDIT IS THE EXAMINATION OF OR INSPECTION OF VARIOUS BOOKS OF ACCOUNTS BY AN AUDITOR…

Q: ABC COMPANY Income Statement shows $ 297,500 profit for the year 2019. The following information are…

A: if expenses in income statements are undervalued then income will be overbooked so add the portion…

Q: Sandhill Co. sold its licorice division resulting in a loss of $101000. Assuming a tax rate of 25%,…

A: Solution: Loss on disposal is reported on the income statement by the amount of loss net of taxes.

Q: JoeBlow Co. had revenue and expenses from ongoing business operations for the current year of…

A: Income statement refers to those financial statements which showcases the company's revenues and…

Q: Metlock, Inc. disposes of an unprofitable segment of its business. The operation of the segment…

A: Income statement: The income statement is one of the three primary financial statements used to…

Q: Esquire Comic Book Company had income before tax of $1,350,000 in 2021 before considering the…

A: Income statement is the financial statement which is prepared by the entities to depict the…

Q: Consider the following information for Belle Corp. Selling and Administrative Expenses 50,000.00;…

A: An operating profit is defined as the total income of the company from their business functions at a…

Q: Sandwich Express incurred the following costs related to its purchase of a bread machine.Cost of the…

A: Cost of equipment: It can be defined as the cost of buying the equipment, deducting any discount…

Q: ABC company recorded a net loss of P215,000 for the year just ended. Total operating expenses was…

A: Gross profit = net income(loss) + Total operating expenses Net sales = Gross profit + cost of sales…

Q: ccur on March 31, 2013, at an estimated gain of $375,500. The segment had actual and estimated…

A: Operating profit: Operating profit: operating profit can be defined as profit earned from ordinary…

Q: On December 31, Strike Company sold one of its batting cages for $21,135. The equipment had an…

A: SOLUTION- WORKING NOTE- CALCULATION OF BOOK VALUE OF…

Q: Esquire Comic Book Company had income before tax of $1,000,000 in 2021 before considering the…

A: Income Statement: This is a financial statement that shows the net income earned or net loss…

Q: Southeast Airlines had pretax earnings of $65 million. Included in this amount is income from…

A: Compute income from continuing operations as shown below:

Q: Jacobs sold products to customers for 100 thousand. Total cost was 60 thousand. What is the most…

A: When inventory is sold, the total assets decrease with the carrying cost of inventory in the…

Q: Dandy Candy Company sold its loorice division resulting in a loss of S80,000. Assuming a tax rate of…

A: The loss on disposal of assets is reported in Income statement at pre-tax figure.

Q: Windsor, Inc. disposes of an unprofitable segment of its business. The operation of the segment…

A: Income statement: The income statement is one of the three primary financial statements used to…

Q: spose of a component of its business. component was sold on November 30, . Enron's income for 2011…

A: Discontinued of Business Operation: when any firm or company not able to carried out its business…

Q: Frederickson Office Supplies recently reported $12,500 of sales, $7,250 of operating costs other…

A: EBT It generally helps in measuring the entity's operating as well as non-operating profits before…

Q: 10. In 2021, Segment X of Special Company had sales of P5,000,000 (represents 30% of the total…

A: Profit is the amount earned by an entity or segment after deduction of all the outlays and losses…

Q: Big company committed to sell its comic book division (a component of the business) on September 1,…

A: Discontinued Operations is the division of a company which has been shut down because it started…

Q: g loss on disposal of $1,200 $16,400 less…

A: One of the three basic financial statements that reflects a company's success over time is the…

Q: In 2021, Segment X of Special Company had sales of P5,000,000 (represents 30% of the total company’s…

A: Gross profit is determined by deducting cost of sales from the total revenue. Net profit is computed…

Q: years ago, you purchased product for factory The product was purchased for $3, 000 The product was…

A: Please refer to the image below.

Q: Arreaga Corp. has a tax rate of 40 percent and income before non-operating items of €262,000. It…

A: GIVEN Arreaga Corp. has a tax rate of 40 percent and income before non-operating items of…

Q: Swifty, Inc. decided on January 1 to discontinue its telescope manufacturing division. On July 1,…

A: Solution: Loss from disposal on discontinuation = Sale value of assets - book value = 610000 -…

Q: Southeast Airlines had pretax earnings of $65 million, including a gain on disposal of a…

A: Compute income from continuing operations as shown below:

Q: A chemical company has a total income of 1.62 million per year and total expenses of 716057 not…

A: Income Tax charges for the first year of operation = 254,380

Q: On June 30, Pronghorn Corp discontinued its operations in Mexico. During the year, the operating…

A: Income statement is one of the financial statements. It is prepared to depict the profitability…

Q: 12. Arreaga Corp. has a tax rate of 40 percent and income before non-operating items of €262,000. It…

A: Income tax is a type of tax levied by authorities on income earned by businesses and individuals…

Q: From the following particulars of Sriman Ltd., calculate the remuneration of Managing Director at 5%…

A: Companies Act describes about various rules for determining the remuneration payable to managing…

Q: hannon Polymers uses straight-line depreciation for financial reporting purposes for equipment…

A: Journal entry is the book of original entry in which all the financial transactions of the business…

Q: 1. On November 30, 2020, Clorox Corp. approved a plan to dispose of its Floor Cleaning Products…

A: PLEASE LIKE THE ANSWER Clorox Corp. Income Statement…

Q: Kobe’s Clinics provides health services and career counseling. Net income from the health services…

A: The income statement is the financial statement of the business which shows the profits or losses…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- The Bookbinder Company had 500,000 cumulative operating losses prior to the beginning of last year. It had 100,000 in pre-tax earnings last year before using the past operating losses and has 300,000 in the current year before using any past operating losses. It projects 350,000 pre-tax earnings next year. a. How much taxable income was there last year? How much, if any, cumulative losses remained at the end of the last year? b. What is the taxable income in the current year? How much, if any, cumulative losses remain at the end of the current year? c. What is the projected taxable income for next year? How much, if any, cumulative losses are projected to remain at the end of next year?JoeBlow Co. had revenue and expenses from ongoing business operations for the current year of $1,000,000 and $700,000, respectively. During the year the company sold a money losing division that had revenues and expenses of $100,000 and $200,000, respectively (these amounts are NOT included in the regular ongoing business revenues and expenses shown above). The division was sold at a small profit of $30,000. Assume all items are subject to a tax rate of 30%. Prepare an income statement for JoeBlow Co. for the current year.The following information is related to Dickinson Company for 2020. Retained earnings balance, January 1, 2020 $ 980,000 Sales revenue 25,000,000 Cost of goods sold 16,000,000 Interest revenue 70,000 Selling and administrative expenses 4,700,000 Write-off of goodwill 820,000 Income taxes for 2020 1,244,000 Gain on the sale of investments 110,000 Loss due to flood damage 390,000 Loss on the disposition of the wholesale division (net of tax) 440,000 Loss on operations of the wholesale division (net of tax) 90,000 Dividends declared on common stock 250,000 Dividends declared on preferred stock 80,000 Dickinson Company decided to discontinue its entire wholesale operations (considered a discontinued operation) and to retain its manufacturing operations. On September 15, Dickinson sold the wholesale operations to Rogers Company. During 2020, there were 500,000 shares of common stock outstanding all year. Instructions Prepare a multiple-step income statement…

- 6. BB Company had a net income after tax of P3,500,000 for the year ended December 31, 2021 after giving effect to the following events which occurred during the year. The decision was made on May 31 to discontinue the bottles manufacturing segment. The bottle manufacturing segment was sold on June 30. Operating profit from January 1 to May 30 for the bottle manufacturing segment amounted to P950,000 before tax benefit. Bottle manufacturing equipment with a book value of P1,900,000 was sold for P1,150,000. The tax rate was 30%. For the year ended December 31, 2021, how much was the company’s after tax income from continuing operations?Arreaga Corp. has a tax rate of 40 percent and income before non-operating items of €262,000. It also has the following items (gross amounts). Unusual loss € 37,000 Discontinued operations loss 101,000 Gain on disposal of equipment 8,000 Change in accounting principle increasing prior year's income 53,000 What is the amount of income tax expense Arreaga would report on its income statement? a. €104,800 b. €93,200 c. €111,200 d. €74,000Toodles Inc. had sales of $1,840,000. Cost of goods sold, administrative and selling expenses, and depreciation expenses were $1,180,000, $185,000 and $365,000 respectively. In addition, the company had an interest expense of $280,000 and a tax rate of 35 percent. (Ignore any tax loss carryback or carry forward provisions.) What was Toodles’s OCF?

- The following information is provided about PT Caltex: - Revenue from operations IDR 430,000,000 - Loss on the decrease in inventory Rp.12,000,000 - Sales Expense IDR 62,000,000 - Interest expense of IDR 20,000,000 - The tax rate is 30% Then the profit of PT Caltex is.... a. IDR 287,000,000 b. IDR 410,000,000 c. IDR 430,000,000 d. IDR 250,000,000 Do not give answer in imageSoutheast Airlines had pretax earnings of $65 million, including a gain on disposal of a discontinued operation of $10 million. The company’s tax rate is 40%. What is the amount of income tax expense that Southeast should report in its income statement? How should the gain on disposal of a discontinued operation be reported?Mainline Clinic, a for-profit business, had revenues of $11.1 million last year. Expenses other than depreciation totaled 67 percent of revenues, and depreciation expense was $1.3 million. All revenues were collected in cash during the year, and all expenses other than depreciation were paid in cash. Mainline must pay taxes at a rate of 39 percent of pretax (operating) income. Now, suppose the company changed its depreciation calculation procedures (still within GAAP) such that its depreciation expense doubled. How would this change affect Mainline’s net income? If net income would go down, enter the amount of the change as a negative number. If net income would go up, enter the amount of the change as a positive number.

- Southeast Airlines had pretax earnings of $65 million. Included in this amount is income from discontinued operations of $10 million. The company’s tax rate is 25%. What is the amount of income tax expense that Southeast would report in its income statement for continuing operations? How should the gain on disposal of a discontinued operation be reported?Gordon Brown Co’s Profit before tax was Rs7 million and a statement of financial position total of Rs23 million.Gordon Brown owns a number of its retail premises, which it revalues annually. This year several of its shops rose sharply in value due to inflated property prices in their locality. Gordon Brown does not revalue its factory premises, which are held in the statement of financial position at Rs 2.7 million. Prepare an unmodified opinion with BASIS OF OPINION, EMPHASIS OF MATTER and KEY AUDIT MATTER PARAGRAPH to give your view on this situation.Outlook Corporation sells gas stoves. Its sales had a total of P250,000 during its first year of operation. All its sales were installment sales and it managed to collect only P80,000 in the said year.Outlook repossessed one gas stove after a customer defaulted in payment. The balance of the receivable pertaining to the repossessed stove was P25,000 at the time of repossession. How much is the deferred gross profit at year end if the gross margin ratio is 25%?a. P145,000 c. P170,000b. P36,250 d. P42,500