Daniel, age 38, is single and has the following income and expenses in 2021: Salary income $65,000 Net rent income 6,000

Daniel, age 38, is single and has the following income and expenses in 2021: Salary income $65,000 Net rent income 6,000

Chapter6: Deductions And Losses: In General

Section: Chapter Questions

Problem 34P

Related questions

Question

b. Should Daniel itemize his deductions from AGI or take the standard deduction?

Because Daniel's total itemized deductions (after any limitations) are_______, he would benefit from ___

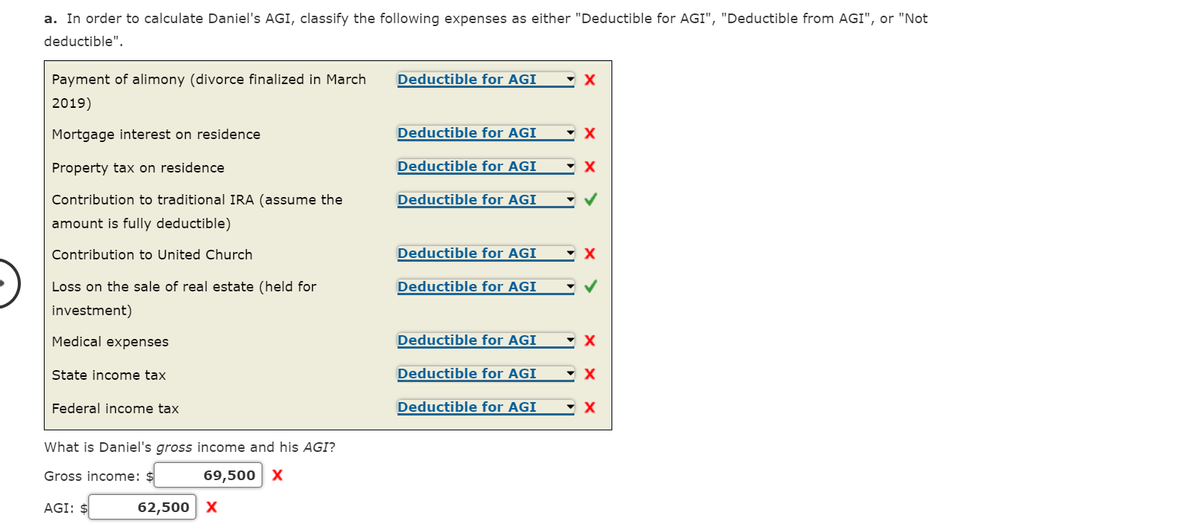

Transcribed Image Text:a. In order to calculate Daniel's AGI, classify the following expenses as either "Deductible for AGI", "Deductible from AGI", or "Not

deductible".

Payment of alimony (divorce finalized in March

Deductible for AGI

2019)

Mortgage interest on residence

Deductible for AGI

Property tax on residence

Deductible for AGI

Contribution to traditional IRA (assume the

Deductible for AGI

amount is fully deductible)

Contribution to United Church

Deductible for AGI

X

Loss on the sale of real estate (held for

Deductible for AGI

investment)

Medical expenses

Deductible for AGI

State income tax

Deductible for AGI

Federal income tax

Deductible for AGI

What is Daniel's gross income and his AGI?

Gross income: $

69,500 X

AGI: $

62,500 x

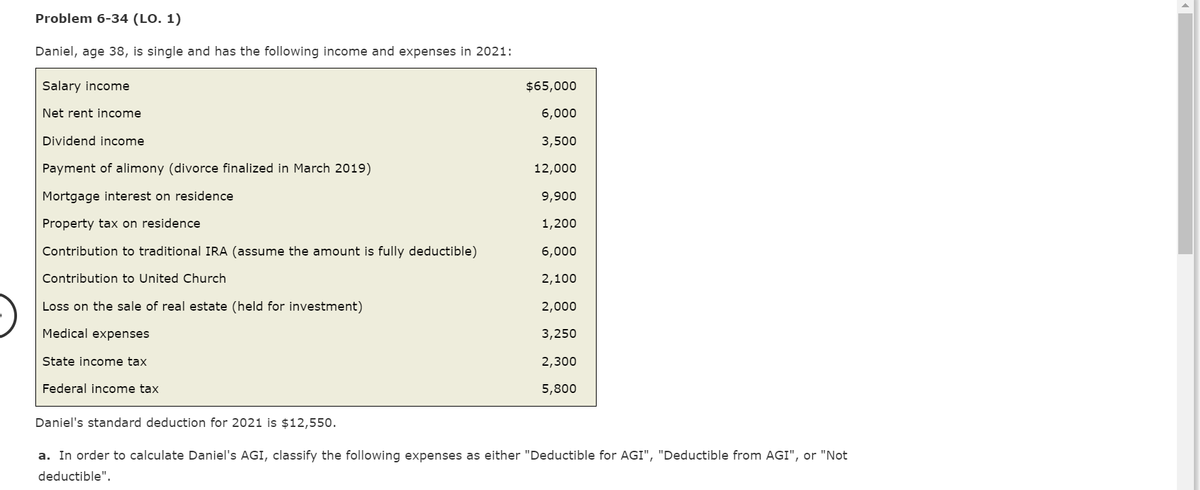

Transcribed Image Text:Problem 6-34 (LO. 1)

Daniel, age 38, is single and has the following income and expenses in 2021:

Salary income

$65,000

Net rent income

6,000

Dividend income

3,500

Payment of alimony (divorce finalized in March 2019)

12,000

Mortgage interest on residence

9,900

Property tax on residence

1,200

Contribution to traditional IRA (assume the amount is fully deductible)

6,000

Contribution to United Church

2,100

Loss on the sale of real estate (held for investment)

2,000

Medical expenses

3,250

State income tax

2,300

Federal income tax

5,800

Daniel's standard deduction for 2021 is $12,550.

a. In order to calculate Daniel's AGI, classify the following expenses as either "Deductible for AGI", "Deductible from AGI", or "Not

deductible".

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT