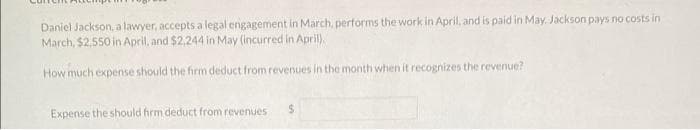

Daniel Jackson, a lawyer, accepts a legal engagement in March, performs the work in April, and is paid in May. Jackson pays no costs in March, $2.550 in April, and $2,244 in May (incurred in April) How much expense should the firm deduct from revenues in the month when it recognizes the revenue? Expense the should firm deduct from revenues

Q: QUESTION ONE 1.1 Calculate the economic order quantity (EOQ) per annum. Economic order quantity…

A: Economic Order Quantity: EOQ is the short form of Economic order quantity. It represents the minimum…

Q: 29. T/F. Only Comprehensive and Value-for-Money audits are true performance audits.

A: Value for money audit is done for non profit organization to ensure whether they operate effective…

Q: Required Record the transactions in T-accounts.

A: Fanning Cola Corporation produces a new soft drink brand, Sweet Spring, using two production…

Q: Unit of Units Cost $2.10 2.70 Number Date Transaction Apr. 1 Beginning inventory Apr.20 Purchase 430…

A: Introduction: LIFO: LIFO stands for Last in First out. Which means last received inventory to be…

Q: On July 1, Runner's Sports Store paid $9,000 to Acme Realty for 6 months' rent beginning July 1 and…

A: Rent expense for the period = Total amount of rent paid x no. of months expired / Total period for…

Q: The inventory profit for 2020 and 2021 is given below, Consideration transferred Add: Non…

A: In this question, student has ask that how the value of cost price that is $193,750 is calculated,…

Q: Marigold Corp. unadjusted trial balance includes the following balances (assume normal balances):…

A: In this question, we will calculate the amount of bad debt expense in the company record .

Q: Can you help me with the match terms, please? Thank u :) Modified retrospective app

A: The question is related to the Accounting Approches.

Q: The following describes the job responsibilities of two employees of Barney Manufacturing.Joan…

A: The duties that an individual does at work in accordance with their specific function are referred…

Q: Apex Chemicals Ltd acquires a delivery truck at a cost of $36,500 on 1 January 2016. The truck is…

A: Depreciation is systematic allocation of the cost of an asset throughout it's useful life.

Q: Franklin Company established a predetermined fixed overhead cost rate of $36 per unit of product.…

A: Fixed overhead spending variance- The fixed cost spending variance is the distinction among the…

Q: Beginning inventory, purchases, and sales data for tennis rackets are as follows: April 3 Inventory…

A: Inventory valuation is based on the flow of exemption used by the company. There are many methods…

Q: Balance Sheets show the Flow of Assets and Liabilities between one accounting period and another.…

A: Answer:- True Explanation:- Balance sheet is one of the most important financial statement of an…

Q: BTL Company purchased a tractor at a cost of $90,000. The tractor has an estimated salvage value of…

A: Depreciation is considered as an expense charge on the value of the Asset. It can be calculated by…

Q: The construction of a house property was completed on 28.2.2018. The assessee has taken a loan of…

A: GIVEN: A loan was taken out by a house property on the 1st of May 2017 and according to a question…

Q: For each scenario, use the items in the tables to indicate whether the item will improve or decrease…

A: Credit card is the card through which the holder of the card gets the loan from the bank as per the…

Q: arise by ratificatio

A: Agency by Ratification is defined as where someone approves or accepts of some one else's deeds on…

Q: For each of the following payments, indicate the form (Form W-2, W-4, W-3, W-2G, 1099-B, 1099-DIV,

A: In USA IRS [ Internal Revenue Service ]is the tax authority and the…

Q: Transaction: On August 1, the business, Design Thinking Ltd, provided consulting services for a…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: Calculate the interest expenses for the last 5 years (2016-2020)

A: Interest expenses are the finance costs in the income statement of a company.

Q: 6.Dalian Company provides the following information: Price per unit $20.00 Variable cost per unit…

A: Break even point in units = Fixed cost/contribution margin per unit

Q: The pool rate is defined as the cost per unit of the cost driver for a particular activity cost…

A: The question is related to the Activity Based Costing. The details are given regarding the same.

Q: 2) Troy Ltd purchased a new machine on 1 October 2016 at a cost of $114,000. The entity estimated…

A: Formula: Straight line method depreciation = ( Asset cost - Salvage value ) / Useful life

Q: Part A KM Sdn. Bhd. (KM) produces two different types of high quality handbags, Luxury and Superior.…

A: Cost allocation is acknowledged as the technique of distribution of manufacturing overheads to…

Q: A business purchased a motor car on 1 July 20OX3 for $20,000. It is to be depreciated at 20 per cent…

A: The errors in accounting that affect the profit are called the error of commission and error of…

Q: Candle Light Bus Lines Ltd. runs a series of bus routes between cities across Canada. A new route,…

A: A flexible budget is prepared to match the level of actual income and expenses. It is prepared by…

Q: The comparative balance sheets and income statement of Piura Manufacturing follow Additional…

A: I am answering the first three sub-parts of the question as per bartleby guidelines. Please…

Q: Companies keep a permanent record of transactions, and every transaction is documented. If you are…

A: The business keeps a record of all transactions, tracking them in chronological order, as they…

Q: An advantage of the scattergraph method is that ita. is objective.b. is easier to use than the…

A: The scattergraph approach seems to be a visual depiction of an expense's cost as well as activity…

Q: 1. (For items 1 and 2). Read and analyze the following transactions taken from the book of XYZ…

A: Journal entries: Journal entries are recorded for showing the monetary transactions initiated by a…

Q: Between Absorption Costing and Variable Costing method, which one do you think is more practical to…

A: Absorption costing considers fixed manufacturing overheads and variable overheads together to find…

Q: Metlock, Inc. Iends Grouper industries $45600 on August 1, 2022, accepting a 9-month, 15% interest…

A: Adjusting entries are prepared by management to ensure the accrual basis accounting system. It is…

Q: Smith-Kline Company maintains inventory records at selling prices as well as at cost. For 2021, the…

A: In the given question, the inventory records of Smith-Kline Company is mentioned. We have to find…

Q: osure requirements for lease by lesse 56. a. General Information about the lease b. A description of…

A: As per IFRS 16, Lease accounting and disclosure treatments are given.

Q: the owners choose to invest in bonds instead, they look at a $57,750.00 bond set to mature in 6…

A: Price of bond is the present value of coupon payment plus present value of the par value of the bond…

Q: Arabica Manufacturing Company uses a predetermined manufacturing overhead rate based on a percentage…

A: The cost per unit can be calculated by dividing the total cost by total unit produced.

Q: Swift Company purchased a machine on January 1, 2016, for $300,000. At the date of acquisition, the…

A: Depreciation Depreciation refers to the allocation of the cost of an asset to its estimated life.…

Q: ear for es 5-8

A: The average annual growth =annual growth in the period'A-2000' total number of periods

Q: Farris Corporation, which has only one product, has provided the following data concerning its most…

A: Under variable costing all variable costs are assigned to a product and fixed overhead costs are not…

Q: Use the following to answer questions 8 – 10 (Round answers to the nearest dollar) BZ Corp issues…

A:

Q: fiscal year end is November 30. Accounts Payable-$3,500, Accounts Receivable-$2,300, Cash-$5000,…

A: Balance sheet is considered to be important part of financial statement which shows the entities…

Q: Identifying Fixed, Variable, Mixed, and Step CostsConsider each of the following independent…

A: As per our protocol we provide solution to the one question or to the first three sub-parts only but…

Q: Incorporating Stakeholder Impacts into Business SustainabilityAnalyses and DecisionsJack’s Apps…

A: A good growing company is one that is constantly bringing invitations and carrying out necessary…

Q: With respect to conversion costs, how many equivalent units were calculated for the product that was…

A: First step is to find out the physical units Units started 40,000 Completed…

Q: Another team member who is preparing the Budgeted Balance Sheet for the business for the same…

A: The expected trade receivables and payables calculation help the company to manage its cash flow and…

Q: 1.Explains the importance and role of the business fund (business activities) in government…

A: 1. The importance and role of the business fund (business activities) in government entities are ;…

Q: me the firm offers a 2 percent discount for pay

A: An account receivable is defined as it is money that has not been paid by customers after using the…

Q: Q-4: Joel Turner owned 200 shares of GM convertible preferred stock at $20 par value. He converted…

A: The preferred stock are the shares which get the fixed rate of dividend before any other share gets…

Q: Select the graph (A through L) that best matches the numbered (1 through 7) italicized descriptions…

A: Given:

Q: Journey Company entered into agreement with its creditor to exchange its equity instrument and land…

A: Liability: Liability is an amount which a company has to reimburse after a certain period of time.…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Kelsey Gunn is the only employee of Arsenault Company. His pay rate is 23.00 per hour with an overtime rate of 1 times for hours over 40 in a workweek. For the week ending March 31, 20--, he worked 48 hours. Calculate his gross pay for the week using the overtime premium approach to calculate the overtime pay. Since the company holds back one week of pay, Gunn will not be paid until April 7, 20--. What adjusting entry would the company make in order to record Gunns salary in the first quarter of this year? a. Regular pay....................................................................... ________ b. Overtime premium pay..................................................... ________ c. Gross pay.......................................................................... ________ d. Adjusting entryAllan indicates that, at year-end, customers owe him $1,000 accrued service revenue, which he expects to collect early next year. These revenues have not been recorded. During the year, he collected $4,100 service revenue in advance from customers, but the business has earned only $800 of that amount. During the year he has incurred $2,400 of advertising expense, but he has not yet paid for it. In addition, he has used up $2,100 of the supplies. Allan determines that depreciation on equipment was $7,000 for the year. At December 31, he owes his employee $1,200 accrued salary. The rent paid in advance on Jan 2 for $2,800 relates to the period January 2019 through to February 2020. The owner made no capital investments during the year. Allan expresses concern that drawing during the year might have exceeded the business’s net income. To get a loan to expand the business, Allan must show the bank that the business’s owner’s equity has grown from its original $40,000 balance. You and Allan…Allan indicates that, at year-end, customers owe him $1,000 accrued service revenue, which he expects to collect early next year. These revenues have not been recorded. During the year, he collected $4,100 service revenue in advance from customers, but the business has earned only $800 of that amount. During the year he has incurred $2,400 of advertising expense, but he has not yet paid for it. In addition, he has used up $2,100 of the supplies. Allan determines that depreciation on equipment was $7,000 for the year. At December 31, he owes his employee $1,200 accrued salary. The rent paid in advance on Jan 2 for $2,800 relates to the period January 2019 through to February 2020. The owner made no capital investments during the year. Allan expresses concern that drawing during the year might have exceeded the business’s net income. To get a loan to expand the business, Allan must show the bank that the business’s owner’s equity has grown from its original $40,000 balance. You and Allan…

- Allan indicates that, at year-end, customers owe him $1,000 accrued service revenue, which he expects to collect early next year. These revenues have not been recorded. During the year, he collected $4,100 service revenue in advance from customers, but the business has earned only $800 of that amount. During the year he has incurred $2,400 of advertising expense, but he has not yet paid for it. In addition, he has used up $2,100 of the supplies. Allan determines that depreciation on equipment was $7,000 for the year. At December 31, he owes his employee $1,200 accrued salary. The rent paid in advance on Jan 2 for $2,800 relates to the period January 2019 through to February 2020. The owner made no capital investments during the year. Allan expresses concern that drawing during the year might have exceeded the business’s net income. To get a loan to expand the business, Allan must show the bank that the business’s owner’s equity has grown from its original $40,000 balance. You and Allan…The following two events occurred for Trey Co. on October 31, the end of its fiscal year. a. Trey rents a building from its owner for $2,800 per month. By a prearrangement, the company delayed paying October’s rent until November 5. On this date, the company paid the rent for both October and November. b. Trey rents space in a building it owns to a tenant for $850 per month. By prearrangement, the tenant delayed paying the October rent until November 8. On this date, the tenant paid the rent for both October and November. Required 1. Prepare adjusting entries that the company must record for these events as of October 31. 2. Assuming Trey does not use reversing entries, prepare journal entries to record Trey’s payment of rent on November 5 and the collection of the tenant’s rent on November 8. 3. Assuming that the company uses reversing entries, prepare reversing entries on November 1 and the journal entries to record Trey’s payment of rent on November 5 and the collection of the…Danny Floro works as a caretaker with a monthly salary of P5,000 in the house of Atty. Panfilo Salango. In the current month, Atty. Salango successfully defended the former against a vehicular accident case. The prevailing lawyer’s fee of Atty. Salango is P6,000, which they agreed that Mr. Floro, instead of paying his employer, shall not receive cash for the said month. How much is compensation income of Floro in the current month?

- An employee is paid every two weeks. She worked the last week of December and the first week of January, and got paid $2,000 on January 10th. How would this be recorded under the cash and accrual methods? Group of answer choices Under the accrual method, one-half of the amount paid - $1,000 – is an expense in December and the other half is an expense in January; under the cash method, the $2,000 is an expense in January. Under the accrual method, $2,000 is an expense in January and under the cash method $2,000 is an expense in January. Under the accrual method, $2,000 is an expense in December and under the cash method $2,000 is an expense in JanuaryAn entity has two office employees Ben and Dan who earn P250 and P400 per day, respectively. They were paid every Friday for a 5-day work week that begins on a Monday. Assuming that in 2018, December 31 fell on a Wednesday; Ben worked from Monday to Wednesday while Dan reported to work on Monday and Wednesday. How much salaries should be accrued on December 31?Juma Wakili operates professional firm offering legal services. Some of his clients are required to pay in advance for the services, while others are billed after the services have been rendered. Advance payments are credited to an account entitled Unearned Legal Fees, which represents unearned revenue. The business adjusts its accounts and closes its accounts at the end of each quarter. At March 31, 2021, the end of the first quarter of the year, the unadjusted trial balance appeared as follows: Sh’000’ Sh’000’ Cash 17,150 Fees receivable 37,800 Unexpired insurance 1,600 Prepaid rent 5,400 Office supplies 1,620 Office equipment 17,100 Accumulated depreciation: office equipment 5,700 Accounts payable 3,900 Unearned fees 24,000 Juma Wakili Capital 45,300 Juma Wakili drawings 3,200 Legal fees earned 33,320 Depreciation expense 0 Rent expense 3,000 Office supplies expense 450 Insurance expense 800 Repairs expense 1,200 Travel expense 3,400 Salaries expense 19,500 112,220 112,220…

- . Assume that a lawyer bills her clients $15,000 on June 30, for services rendered during June. The lawyer collects $8,500 of the billings during July and the remainder in August. Under the accrual basis of accounting, when would the lawyer record the revenue? A. June, $15,000; July, $0; and August, $0 B. June, $0; July $6,500; and August, $8,500 C. June, $8,500; July $6,500; and August, $0 D. June, $0; July, $8,500; and August, $6,500Justin Mathews is a waiter at the Delixe Lounge. In his first weekly pay in March, he earned $300.00 for the $40 hours he worked. In addition, he reports his tips for February to his employer ($500), withholds the appropriate taxes from his tips in March. Calculate his net take home pay assuming the employer withheld federal income tax married filing jointly.Blane commenced business on 1 January 20X6 and prepares her financial statements to 31 December every year. For the year ended 31 December 20X6, bad debts written off amounted to £1,400. It was also found necessary to create a provision for doubtful debts of £2,600. In 20X7, debts amounting to £2,200 proved bad and were written off. J Sweeny, whose debt of £210 was written off as bad in 20X6, settled her account in full on 30 November 20X7. As at 31 December 20X7 total debts outstanding were £92,000. It was decided to bring the provision up to 4% of this figure on that date. In 20X8, £3,800 debts were written off during the year, and another recovery of £320 was made in respect of debts written off in 20X6. As at 31 December 20X8, total debts outstanding were £72,000. The provision for doubtful debts is to be increased to 5% of this figure. You are required to show for the years 20X6, 20X7 and 20X8, the (a) Bad Debts Account. (b) Bad Debts Recovered Account. (c) Provision…