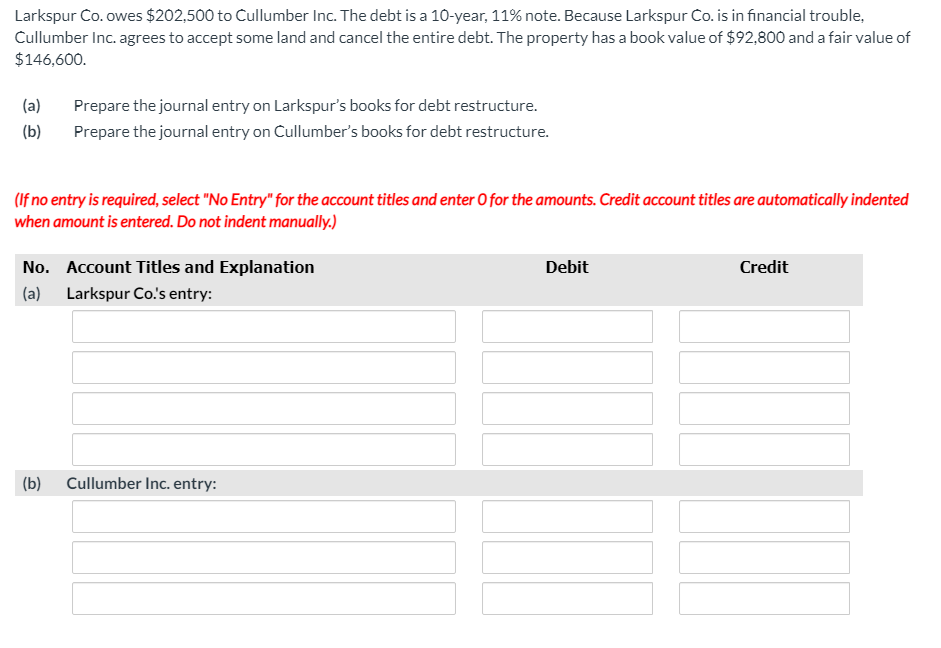

Daniel Perkins is the sole shareholder of Sheffield Inc., which is currently under protection of the U.S. bankruptcy court. As a “debtor in possession,” he has negotiated the following revised loan agreement with United Bank. Sheffield Inc.’s $674,000, 11%, 10-year note was refinanced with a $674,000, 5%, 10-year note. (a) What is the accounting nature of this transaction? Choices: Troubled debt restructuring or Extinguishment of debt? (b) Prepare the journal entry to record this refinancing: (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answers to 0 decimal places e.g. 58,971.) (1) On the books of Sheffield Inc. (2) On the books of United Bank.

Daniel Perkins is the sole shareholder of Sheffield Inc., which is currently under protection of the U.S. bankruptcy court. As a “debtor in possession,” he has negotiated the following revised loan agreement with United Bank. Sheffield Inc.’s $674,000, 11%, 10-year note was refinanced with a $674,000, 5%, 10-year note.

(a) What is the accounting nature of this transaction? Choices: Troubled debt restructuring or Extinguishment of debt?

(b) Prepare the

| (1) | On the books of Sheffield Inc. | |

| (2) | On the books of United Bank. |

Please fill in all the boxes displayed in the image- thank you!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps