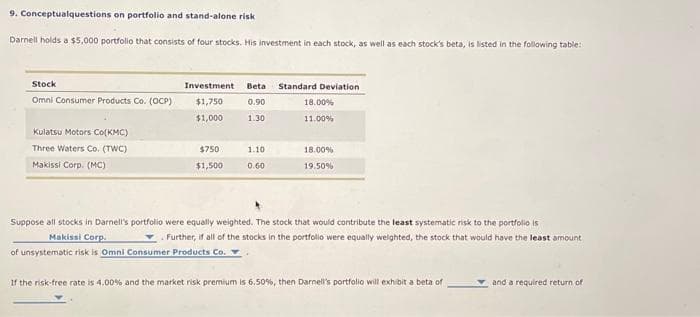

Darnell holds a $5,000 portfolio that consists of four stocks. His investment in each stock, as well as each stock's beta, is listed in the following table: Stock Omni Consumer Products Co. (OCP) Kulatsu Motors Co(KMC) Three Waters Co. (TWC) Makissi Corp. (MC) Investment $1,750 $1,000 $750 $1,500 Beta Standard Deviation 0.90 1.30 1.10 0.60 18.00% 11.00% 18.00% 19.50% Suppose all stocks in Darnell's portfolio were equally weighted. The stock that would contribute the least systematic risk to the portfolio is Further, if all of the stocks in the portfolio were equally weighted, the stock that would have the least amount of unsystematic risk is Omni Consumer Products Co. Makissi Corp. If the risk-free rate is 4.00% and the market risk premium is 6.50%, then Darnell's portfolio will exhibit a beta of and a required return of

Q: re projected to grow by 25 percent. Interest expense will remain constant; t id the dividend payout…

A: External funding required is the amount of finance needed in the form of debt or equity to increase…

Q: A corporate bond makes payments of $96.70 semi-annually for ten years with a final payment of…

A: We are given that the bond makes semi-annual payments of $96.70 for 10 years and a final payment of…

Q: A recent edition of The Wall Street Journal reported interest rates of 2.85 percent, 3.20 percent,…

A: As per the given information:To determine:Expected one-year rates during Year 6

Q: A real estate investor is considering the purchase of an apartment building that currently provides…

A: Present value is the current value of all future cash flows discounted at the rate of interest for…

Q: person owes a credit institution $20,000 that must be paid in 3 years with interest at 12% effective…

A: A person owes a credit institution $20,000 and must be paid in 3 years at 12% effective rate and…

Q: Consider the following series of payments which start at time t = 0: 5, 7, 9, 11... What is the…

A: Interest rate = 8%Payment at t0 = 5Payment at t1 = 7Payment at t2 = 9Payment at t3 = 11Payment at t4…

Q: rates in the table for the following question. As you leave Halifax, you convert 378 Canadian…

A: When anyone travels to another country than one needs the currency of that country and one has to…

Q: which of the which of the following statements always apply to corporations a. unlimited liability…

A: A business can run through several legal types and forms. Some of the popular forms in which a…

Q: The payback period method has been criticized for not taking the time value of money into account.…

A: Discussion on payback period method:Payback period: It represents the period required to recover the…

Q: (a) Construct a data table that will show Lindsay the balance of her retirement account for various…

A: Present value is the discounted value of the future cash flows and final value is the future value…

Q: ITLOS Petroleum is considering the commercial phase of an oil operation in the Tano Basin of Ghana.…

A: The difference between the value of cash today and the worth of cash at a future date is known as…

Q: Panhandle Industries Inc. currently pays an annual common stock dividend of $3.20 per share. The…

A: Here,CurrentDividend is $3.20 per shareDividend past 12 years is $1.60Dividend Payout Ratio is…

Q: Find the amount (future value) of the ordinary annuity. (Round your answer to the nearest cent.)…

A: The given details are:Weekly annuity: $300Period (years): 7.5Annual interest rate: 3.5%Compounding:…

Q: 5. Mr. Johnson wants to buy insurance against his house burning down. The insurance will pay M…

A: Expected return is amount of profit or loss that is expected to be earned on the annual premium that…

Q: Listed below is the return probability distribution associated with the stocks of XYZ Company and…

A: The covariance between two stocks refers to the relationship between the stocks measured by the…

Q: Assume that Almond Milk Company has a $1,000 face value bond with a stated coupon rate of 8.01…

A: Premium recovery period is another name for the payback premium term. This demonstrates the…

Q: On January 3, 2011, Marvel purchased 3,000 shares in equity growth fund at an offering price of…

A: First we need to determine the amount invested by Marvel. This can be determined with the formula…

Q: You plan to retire after working for 45 years. You estimate you need 1 million to retire and live…

A: Future value refers to the anticipated value of an investment or asset at a specific point in the…

Q: Bond valuation and yield to maturity Personal Finance Problem Mark Goldsmith's broker has…

A: Bond valuation refers to the value of bond that is determined by accumulating the present value of…

Q: your supplier offers 3/5 net 28, what is the implied interestrate if you choose to forgo the…

A: So implied interest rate is important part of decision making process and they are calculated by…

Q: now the following about your client’s fixed income portfolio. The portfolio is worth $1,600,000.…

A: Duration of bond shows how much the weighted period of the bond is required to recover all cash…

Q: D3) Finance The current SOFRs for 3-month, 6-month and 9-month are 10.96%, 11.25% and 11.45%,…

A: To annualize the swap rate for the 9-month interest rate swap, you can use the formula for…

Q: Use the following information for Ingersoll, Incorporated. Assume the tax rate is 21 percent. Sales…

A: The cash flow from assets is calculated as the deduction of the changes in net working capital and…

Q: The following information relates to a company listed on Luse- Mungwi PLC ZMK Million 4 000 Issued…

A: WACC stands for "Weighted Average Cost of Capital." It's a financial metric used to calculate the…

Q: You approach your broker to borrow money against securities held in your portfolio. Even though the…

A: The Capital Market Line (CML) is a graphical representation in the capital asset pricing model…

Q: Chang Corp. has $375,000 of assets, and it uses only common equity capital (zero debt). Its sales…

A: Profit margin is a financial metric that measures a company's profitability by expressing its net…

Q: An Exchange Traded Fund (ETF) is a security that represents a portfolio of individual stocks.…

A: Here,StockCurrent Market PriceNo. of SharesHPQ$252SHLD$442GE$114

Q: company has a $36 million equity portfolio with a beta of 0.9. The futures price on the S&P index…

A: Number of contracts = Value of portfolio * (Targeted beta- existing beta) / (Lot size* value of…

Q: Air Asia has 1.4 million shares of stock outstanding. The stock currently sells for $20 per share.…

A: Formula used to calculate Weighted Average Cost of Capital:Weighted Average Cost of Capital=Wt. of…

Q: Find the final amount in the following retirement account, in which the rate of return on the…

A: Present value is an estimate of the present value of future cash values that may be received at a…

Q: Assume you manage a risky portfolio with an expected rate of return of 15% and a standard deviation…

A: Risk aversion is a behavioral trait in finance where individuals or investors demonstrate a…

Q: Why do we use an after-tax figure for the cost of debt but not for the cost of equity? Explain your…

A: Debt-Companies issue debts in the form of bonds for the purpose of raising capital for various…

Q: As of Dec 01, 2020, Pfizer announced that the Federal Drug Administration has approved its new…

A: “Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only…

Q: 3) The outstanding bonds of International Plastics mature in 6 years and pay semiannual interest…

A: Compound = n = semiannually = 2Time = nper = 6 * 2 = 12Coupon Payment = pmt = $33.50Face Value = fv…

Q: (Capital Asset Pricing Model) CSB, Inc. has a beta of 0.758. If the expected market the risk-free…

A: The Capital Asset Pricing Model (CAPM) measures the relationship between the expected return and the…

Q: The balance sheet and income statement shown below are for Koski Inc. Note that the firm has no…

A: The Price-to-Earnings (P/E) ratio is a financial metric used to assess the valuation of a company's…

Q: KroBank issues a zero coupon bond and it has to pay the face value of the bond of $100 M due in…

A: The goal for KroBank is to ensure that it has enough funds to meet the $100 M liability due in…

Q: A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a…

A: The expected return of the portfolio refers to the average profit provided by the portfolio to its…

Q: On January 20 2021 index is at 800 units. The variance of the index returns is 10% while the risk…

A: Options are financial contracts that provide the holder the right, but not the obligation, to buy…

Q: Suppose that the current one-year rate (one-year spot rate) and expected one-year T-bill rates over…

A: The given spot rates are:1R1=0.3%E(2r1)=1.3%,E(3r1) =8.9%E(4r1)=9.25% Required: Calculate the…

Q: Answer the following questions based on the information in the table. Assume a tax rate of 30…

A: The ROE of a company refers to the return that the company provides to its shareholders for their…

Q: Explain how the concept of comparable risk is incorporated into the discount rate.

A: The concept of comparable risk is fundamental to determining the appropriate discount rate to use…

Q: ago, your purchase it for $170,000 today The CCA rate applicable to both machines is 30%; neither…

A: Net present value NPV is the difference between the present value of cash flow and the initial…

Q: A bond with a nominal of EUR 400 000 000 and a maturity of 2 years has a coupon of 4.24%. The price…

A: Nominal Value of Bond is EUR400,000,000Present Value of Bond is 96.5% of Nominal ValueCoupon Rate is…

Q: Find expected return and variance for(a), according to SIM, and the expected return according to…

A: The single-index model is used to determine the risk and return on security with respect to the…

Q: ing investing in government bonds. The current price of a P100 bond with 10 years to maturity is…

A: Yield to maturity is the rate of return realized on the bond when bond is held till the maturity of…

Q: Bond Liquidity A High B 8 High C 2 Low D 8 Low Based on the table above, what is the default risk…

A: Default risk premium risk refers to the compansatory payment, incase of default of the borrower in…

Q: You are given the following information for Troiano Pizza Company: sales $78,500; costs $38,200;…

A: sales = $78,500 costs = $38,200addition to retained earnings = $6,950 dividends paid = $2,490…

Q: Claire needs to borrow $6000 to pay for NHL season tickets for her family. She borrows from the…

A: Loans are paid by the monthly payments and these carry the payment for interest and payment for loan…

Q: Bond valuation and yield to maturity Personal Finance Problem Mark Goldsmith's broker has shown…

A: A bond refers to an instrument used by companies to raise debt capital from non-traditional sources.…

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

- Brandon is an analyst at a wealth management firm. One of his clients holds a $10,000 portfolio that consists of four stocks. The investment allocation in the portfolio along with the contribution of risk from each stock is given in the following table: Stock Investment Allocation Beta Standard Deviation Atteric Inc. (AI) 35% 0.750 23.00% Arthur Trust Inc. (AT) 20% 1.500 27.00% Li Corp. (LC) 15% 1.100 30.00% Transfer Fuels Co. (TF) 30% 0.500 34.00% Brandon calculated the portfolio’s beta as 0.8775 and the portfolio’s expected return as 8.83%. Brandon thinks it will be a good idea to reallocate the funds in his client’s portfolio. He recommends replacing Atteric Inc.’s shares with the same amount in additional shares of Transfer Fuels Co. The risk-free rate is 4%, and the market risk premium is 5.50%. According to Brandon’s recommendation, assuming that the market is in equilibrium, how much will the portfolio’s required return change? (Note: Round your…Rafael is an analyst at a wealth management firm. One of his clients holds a $10,000 portfolio that consists of four stocks. The investment allocation in the portfolio along with the contribution of risk from each stock is given in the following table: Stock Investment Allocation Beta Standard Deviation Atteric Inc. (AI) 35% 0.900 23.00% Arthur Trust Inc. (AT) 20% 1.400 27.00% Li Corp. (LC) 15% 1.100 30.00% Transfer Fuels Co. (TF) 30% 0.300 34.00% Rafael calculated the portfolio’s beta as 0.850 and the portfolio’s required return as 8.6750%. Rafael thinks it will be a good idea to reallocate the funds in his client’s portfolio. He recommends replacing Atteric Inc.’s shares with the same amount in additional shares of Transfer Fuels Co. The risk-free rate is 4%, and the market risk premium is 5.50%. According to Rafael’s recommendation, assuming that the market is in equilibrium, how much will the portfolio’s required return change? (Note: Do not round…Brandon is an analyst at a wealth management firm. One of his clients holds a $5,000 portfolio that consists of four stocks. The investment allocation in the portfolio along with the contribution of risk from each stock is given in the following table: Stock Investment Allocation Beta Standard Deviation Atteric Inc. (AI) 35% 0.750 38.00% Arthur Trust Inc. (AT) 20% 1.500 42.00% Li Corp. (LC) 15% 1.100 45.00% Baque Co. (BC) 30% 0.300 49.00% Brandon calculated the portfolio’s beta as 0.818 and the portfolio’s required return as 8.4990%. Brandon thinks it will be a good idea to reallocate the funds in his client’s portfolio. He recommends replacing Atteric Inc.’s shares with the same amount in additional shares of Baque Co. The risk-free rate is 4%, and the market risk premium is 5.50%. According to Brandon’s recommendation, assuming that the market is in equilibrium, how much will the portfolio’s required return change? (Note: Do not round your…

- Ariel holds a $7,500 portfolio that consists of four stocks. Her investment in each stock, as well as each stock’s beta, is listed in the following table: Stock Investment Beta Standard Deviation Perpetualcold Refrigeration Co. (PRC) $2,625 0.80 15.00% Kulatsu Motors Co. (KMC) $1,500 1.90 11.50% Western Gas & Electric Co. (WGC) $1,125 1.15 16.00% Mainway Toys Co. (MTC) $2,250 0.50 28.50% Suppose all stocks in Ariel’s portfolio were equally weighted. Which of these stocks would contribute the least market risk to the portfolio? Mainway Toys Co. Western Gas & Electric Co. Kulatsu Motors Co. Perpetualcold Refrigeration Co. Suppose all stocks in the portfolio were equally weighted. Which of these stocks would have the least amount of stand-alone risk? Perpetualcold Refrigeration Co. Western Gas & Electric Co. Kulatsu Motors Co. Mainway Toys Co. If the risk-free rate is 4% and the…Ariel holds a $7,500 portfolio that consists of four stocks. Her investment in each stock, as well as each stock’s beta, is listed in the following table: Stock Investment Beta Standard Deviation Perpetualcold Refrigeration Co. (PRC) $2,625 0.80 15.00% Kulatsu Motors Co. (KMC) $1,500 1.90 11.50% Western Gas & Electric Co. (WGC) $1,125 1.15 16.00% Mainway Toys Co. (MTC) $2,250 0.50 28.50% Suppose all stocks in Ariel’s portfolio were equally weighted. Which of these stocks would contribute the least market risk to the portfolio? Mainway Toys Co. Western Gas & Electric Co. Kulatsu Motors Co. Perpetualcold Refrigeration Co. Suppose all stocks in the portfolio were equally weighted. Which of these stocks would have the least amount of stand-alone risk? Perpetualcold Refrigeration Co. Western Gas & Electric Co. Kulatsu Motors Co. Mainway Toys Co. If the risk-free rate is 4% and the market risk…Elle holds a $10,000 portfolio that consists of four stocks. Her investment in each stock, as well as each stock’s beta, is listed in the following table: Stock Investment Beta Standard Deviation Omni Consumer Products Co. (OCP) $3,500 0.80 9.00% Kulatsu Motors Co. (KMC) $2,000 1.90 11.00% Western Gas & Electric Co. (WGC) $1,500 1.10 16.00% Makissi Corp. (MC) $3,000 0.30 28.50% Suppose all stocks in Elle’s portfolio were equally weighted. Which of these stocks would contribute the least market risk to the portfolio? Kulatsu Motors Co. Omni Consumer Products Co. Western Gas & Electric Co. Makissi Corp. Suppose all stocks in the portfolio were equally weighted. Which of these stocks would have the least amount of stand-alone risk? Makissi Corp. Omni Consumer Products Co. Kulatsu Motors Co. Western Gas & Electric Co. If the risk-free rate is 7% and the market risk premium is 8.5%,…

- Portfolio risk and return Emma holds a $7,500 portfolio that consists of four stocks. Her investment in each stock, as well as each stock’s beta, is listed in the following table: Stock Investment Beta Standard Deviation Andalusian Limited (AL) $2,625 0.80 15.00% Kulatsu Motors Co. (KMC) $1,500 1.90 11.00% Water and Power Co. (WPC) $1,125 1.10 16.00% Makissi Corp. (MC) $2,250 0.50 28.50% If the risk-free rate is 7% and the market risk premium is 8.5%, what is Emma’s portfolio’s beta and required return? Fill in the following table: If the risk-free rate is 7% and the market risk premium is 8.5%, what is Emma’s portfolio’s beta and required return? Fill in the following table: BETA 0.9750 REQUIRED RETURN 0.8288 867.50% 0.6533 2,232.50% 1.4625 15.29% 1,895.96%Portfolio risk and return Emma holds a $7,500 portfolio that consists of four stocks. Her investment in each stock, as well as each stock’s beta, is listed in the following table: Stock Investment Beta Standard Deviation Andalusian Limited (AL) $2,625 0.80 15.00% Kulatsu Motors Co. (KMC) $1,500 1.90 11.00% Water and Power Co. (WPC) $1,125 1.10 16.00% Makissi Corp. (MC) $2,250 0.50 28.50% Suppose all stocks in Emma’s portfolio were equally weighted. Which of these stocks would contribute the least market risk to the portfolio? Kulatsu Motors Co. Makissi Corp. Andalusian Limited Water and Power Co. Suppose all stocks in the portfolio were equally weighted. Which of these stocks would have the least amount of stand-alone risk? Water and Power Co. Makissi Corp. Andalusian Limited…Portfolio risk and return Ariel holds a $7,500 portfolio that consists of four stocks. Her investment in each stock, as well as each stock’s beta, is listed in the following table: Stock Investment Beta Standard Deviation Andalusian Limited (AL) $2,625 0.80 9.00% Kulatsu Motors Co. (KMC) $1,500 1.90 12.00% Water and Power Co. (WPC) $1,125 1.20 16.00% Makissi Corp. (MC) $2,250 0.30 28.50% Suppose all stocks in Ariel’s portfolio were equally weighted. Which of these stocks would contribute the least market risk to the portfolio? Makissi Corp. Water and Power Co. Andalusian Limited Kulatsu Motors Co. Suppose all stocks in the portfolio were equally weighted. Which of these stocks would have the least amount of stand-alone risk? Kulatsu Motors Co. Andalusian Limited Water and Power Co. Makissi Corp. If the risk-free rate is 4% and the market risk premium is 5.5%, what is Ariel’s portfolio’s…

- Portfolio beta and weights Brandon is an analyst at a wealth management firm. One of his clients holds a $5,000 portfolio that consists of four stocks. The investment allocation in the portfolio along with the contribution of risk from each stock is given in the following table: Stock Investment Allocation Beta Standard Deviation Atteric Inc. (AI) 35% 0.750 38.00% Arthur Trust Inc. (AT) 20% 1.500 42.00% Li Corp. (LC) 15% 1.100 45.00% Baque Co. (BC) 30% 0.300 49.00% Brandon calculated the portfolio’s beta as 0.818 and the portfolio’s required return as 8.4990%. Brandon thinks it will be a good idea to reallocate the funds in his client’s portfolio. He recommends replacing Atteric Inc.’s shares with the same amount in additional shares of Baque Co. The risk-free rate is 4%, and the market risk premium is 5.50%. According to Brandon’s recommendation, assuming that the market is in equilibrium, how much will the portfolio’s required return change?…. Portfolio beta and weights Brandon is an analyst at a wealth management firm. One of his clients holds a $5,000 portfolio that consists of four stocks. The investment allocation in the portfolio along with the contribution of risk from each stock is given in the following table: Stock Investment Allocation Beta Standard Deviation Atteric Inc. (AI) 35% 0.750 38.00% Arthur Trust Inc. (AT) 20% 1.500 42.00% Li Corp. (LC) 15% 1.100 45.00% Baque Co. (BC) 30% 0.300 49.00% Brandon calculated the portfolio’s beta as 0.818 and the portfolio’s required return as 8.4990%. Brandon thinks it will be a good idea to reallocate the funds in his client’s portfolio. He recommends replacing Atteric Inc.’s shares with the same amount in additional shares of Baque Co. The risk-free rate is 4%, and the market risk premium is 5.50%. Suppose instead of replacing Atteric Inc.’s stock with Baque Co.’s stock, Brandon considers replacing Atteric Inc.’s stock with the equal…Cheyenne holds a $7,500 portfolio that consists of four stocks. Her investment in each stock, as well as each stock’s beta, is listed in the following table: Stock Investment Beta Standard Deviation Omni Consumer Products Co. (OCP) $2,625 1.00 9.00% Kulatsu Motors Co. (KMC) $1,500 1.70 11.50% Three Waters Co. (TWC) $1,125 1.15 20.00% Mainway Toys Co. (MTC) $2,250 0.30 25.50% Suppose all stocks in Cheyenne’s portfolio were equally weighted. Which of these stocks would contribute the least market risk to the portfolio? Three Waters Co. Omni Consumer Products Co. Kulatsu Motors Co. Mainway Toys Co. Suppose all stocks in the portfolio were equally weighted. Which of these stocks would have the least amount of stand-alone risk? Mainway Toys Co. Three Waters Co. Kulatsu Motors Co. Omni Consumer Products Co. If the risk-free rate is 7% and the market risk premium is 8.5%, what is Cheyenne’s…