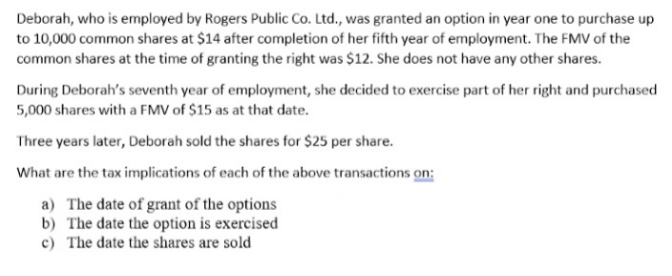

Deborah, who is employed by Rogers Public Co. Ltd., was granted an option in year one to purchase up to 10,000 common shares at $14 after completion of her fifth year of employment. The FMV of the common shares at the time of granting the right was $12. She does not have any other shares. During Deborah's seventh year of employment, she decided to exercise part of her right and purchased 5,000 shares with a FMV of $15 as at that date. Three years later, Deborah sold the shares for $25 per share. What are the tax implications of each of the above transactions on: a) The date of grant of the options b) The date the option is exercised c) The date the shares are sold

Deborah, who is employed by Rogers Public Co. Ltd., was granted an option in year one to purchase up to 10,000 common shares at $14 after completion of her fifth year of employment. The FMV of the common shares at the time of granting the right was $12. She does not have any other shares. During Deborah's seventh year of employment, she decided to exercise part of her right and purchased 5,000 shares with a FMV of $15 as at that date. Three years later, Deborah sold the shares for $25 per share. What are the tax implications of each of the above transactions on: a) The date of grant of the options b) The date the option is exercised c) The date the shares are sold

Chapter19: Deferred Compensation

Section: Chapter Questions

Problem 52P

Related questions

Question

100%

Transcribed Image Text:Deborah, who is employed by Rogers Public Co. Ltd., was granted an option in year one to purchase up

to 10,000 common shares at $14 after completion of her fifth year of employment. The FMV of the

common shares at the time of granting the right was $12. She does not have any other shares.

During Deborah's seventh year of employment, she decided to exercise part of her right and purchased

5,000 shares with a FMV of $15 as at that date.

Three years later, Deborah sold the shares for $25 per share.

What are the tax implications of each of the above transactions on:

a) The date of grant of the options

b) The date the option is exercised

c) The date the shares are sold

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT