Debt-deflation leads to lower income because: O falling prices redistribute income from debtors to creditors, which leads to a decline in the total average consumption. O falling prices makes creditors feel wealthier than debtors, which leads to a rise in their investment instead of saving. O a rise in the saving rate leads to a lower amount of real debt in the economy, depressing consumption and therefore income. O falling prices redistribute income from creditors to debtors, which leads to a decline in the average consumption. O a fall in the saving rate leads to higher interest rates and lower income.

Debt-deflation leads to lower income because: O falling prices redistribute income from debtors to creditors, which leads to a decline in the total average consumption. O falling prices makes creditors feel wealthier than debtors, which leads to a rise in their investment instead of saving. O a rise in the saving rate leads to a lower amount of real debt in the economy, depressing consumption and therefore income. O falling prices redistribute income from creditors to debtors, which leads to a decline in the average consumption. O a fall in the saving rate leads to higher interest rates and lower income.

Fundamentals of Financial Management, Concise Edition (with Thomson ONE - Business School Edition, 1 term (6 months) Printed Access Card) (MindTap Course List)

8th Edition

ISBN:9781285065137

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter6: Interest Rates

Section: Chapter Questions

Problem 7Q

Related questions

Question

7.

Debt-deflation leads to lower income because:

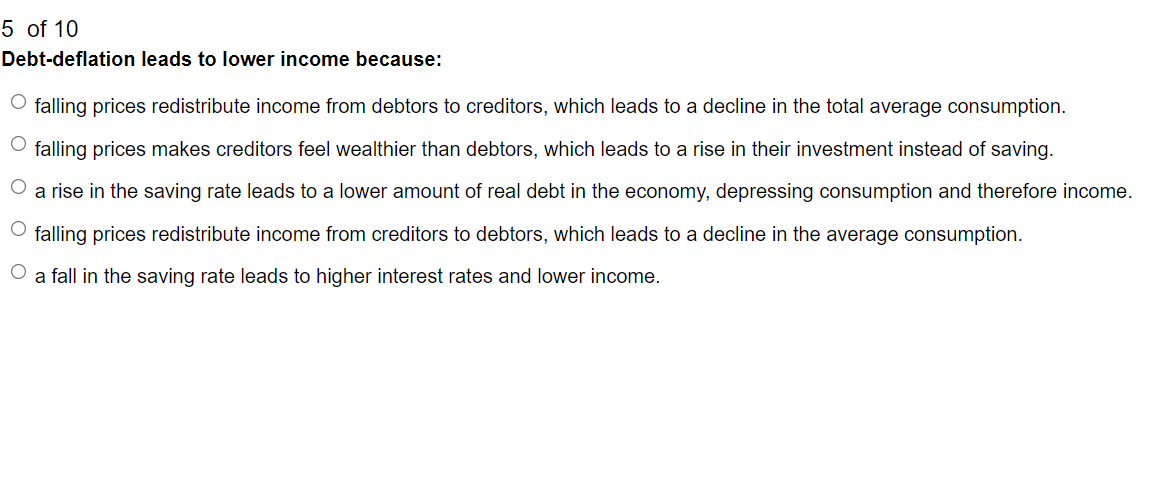

Transcribed Image Text:5 of 10

Debt-deflation leads to lower income because:

O falling prices redistribute income from debtors to creditors, which leads to a decline in the total average consumption.

O falling prices makes creditors feel wealthier than debtors, which leads to a rise in their investment instead of saving.

O a rise in the saving rate leads to a lower amount of real debt in the economy, depressing consumption and therefore income.

O falling prices redistribute income from creditors debtors, which leads to a decline in the average consumption.

O

a fall in the saving rate leads to higher interest rates and lower income.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning