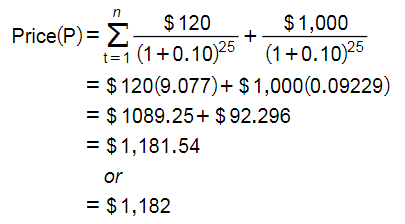

Debt: $2,500,000 par value of outstanding bond that pays annually 12% coupon rate with an annual before-tax yield to maturity of 10%. The bond issue has face value of $1,000 and will mature in 25 years.Ordinary shares: 65,000 outstanding ordinary shares. The firm plans to pay a $7.50 dividend per share in the next financial year. The firm is maintaining 3% annual growth rate in dividend, which is expected to continue indefinitely. Preferred shares: 40 000 outstanding preferred shares with face value of $100, paying fixed dividend rate of 14%.Company tax rate is 30% Compute the weighted average cost of capital (WACC) under the traditional tax systemfor the firm, using dividend constant growth model for calculation the cost of ordinaryequity

Debt: $2,500,000 par

Compute the weighted average cost of capital (WACC) under the traditional tax system

for the firm, using dividend constant growth model for calculation the

equity

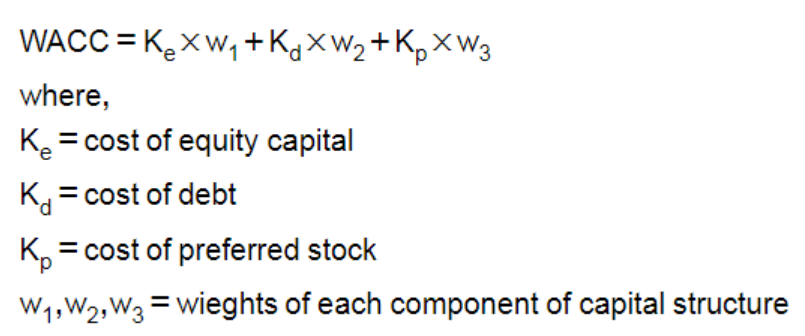

The weighted average cost of capital (WACC) is also known as the Composite Cost of Capital or Average cost of Capital and is the minimum rate of return generated from investment to meet the expectations of the investors.

The formula for WACC is:

Calculating the rates of the different components:

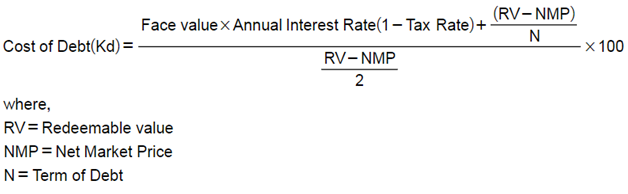

Cost of debt:

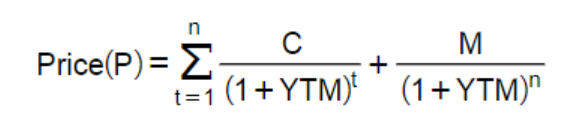

Calculation of market price of the bond:

Cost of equity:

Cost of preferred debt:

Step by step

Solved in 3 steps with 4 images