Debt ratio is ____________%. n.Debt to Equity ratio is ___________%. o.Net profit margin is _____%.

Debt ratio is ____________%. n.Debt to Equity ratio is ___________%. o.Net profit margin is _____%.

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter2: Financial Statements, Cash Flow,and Taxes

Section: Chapter Questions

Problem 1Q: Define each of the following terms:

Annual report; balance sheet; income statement

Common...

Related questions

Question

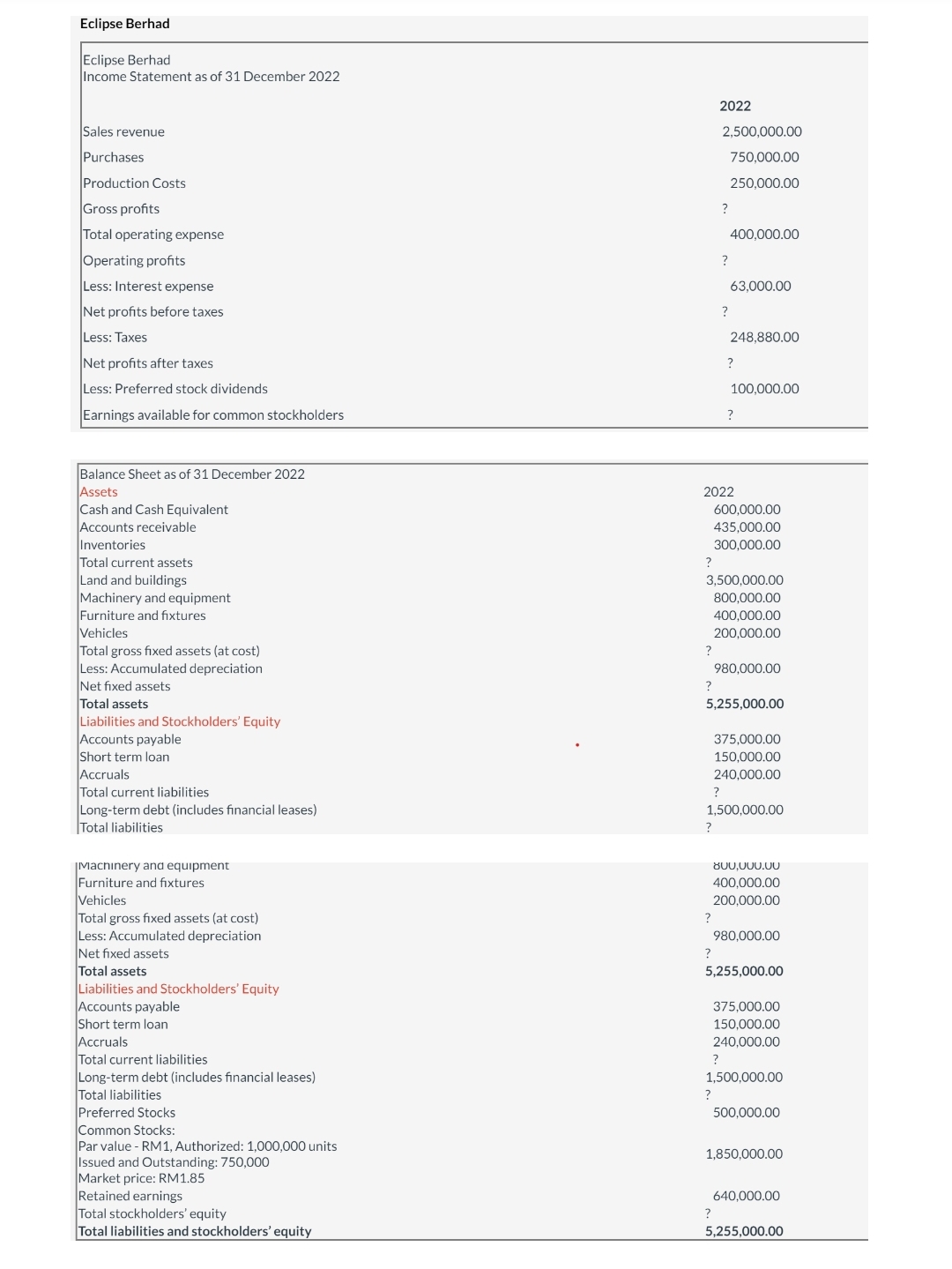

m.Debt ratio is ____________%.

n.Debt to Equity ratio is ___________%.

o.Net profit margin is _____%.

Transcribed Image Text:Eclipse Berhad

Eclipse Berhad

Income Statement as of 31 December 2022

Sales revenue

Purchases

Production Costs

Gross profits

Total operating expense

Operating profits

Less: Interest expense

Net profits before taxes

Less: Taxes

Net profits after taxes

Less: Preferred stock dividends

Earnings available for common stockholders

Balance Sheet as of 31 December 2022

Assets

Cash and Cash Equivalent

Accounts receivable

Inventories

Total current assets

Land and buildings

Machinery and equipment

Furniture and fixtures

Vehicles

Total gross fixed assets (at cost)

Less: Accumulated depreciation

Net fixed assets

Total assets

Liabilities and Stockholders' Equity

Accounts payable

Short term loan

Accruals

Total current liabilities

Long-term debt (includes financial leases)

Total liabilities

Machinery and equipment

Furniture and fixtures

Vehicles

Total gross fixed assets (at cost)

Less: Accumulated depreciation

Net fixed assets

Total assets

Liabilities and Stockholders' Equity

Accounts payable

Short term loan

Accruals

Total current liabilities

Long-term debt (includes financial leases)

Total liabilities

Preferred Stocks

Common Stocks:

Par value - RM1, Authorized: 1,000,000 units

Issued and Outstanding: 750,000

Market price: RM1.85

Retained earnings

Total stockholders' equity

Total liabilities and stockholders' equity

?

?

?

?

2022

?

?

2,500,000.00

750,000.00

250,000.00

2022

?

?

?

?

3,500,000.00

800,000.00

400,000.00

?

63,000.00

?

248,880.00

?

100,000.00

5,255,000.00

?

600,000.00

435,000.00

300,000.00

?

400,000.00

200,000.00

1,500,000.00

980,000.00

375,000.00

150,000.00

240,000.00

800,000.00

400,000.00

200,000.00

5,255,000.00

980,000.00

375,000.00

150,000.00

240,000.00

1,500,000.00

500,000.00

1,850,000.00

640,000.00

5,255,000.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning