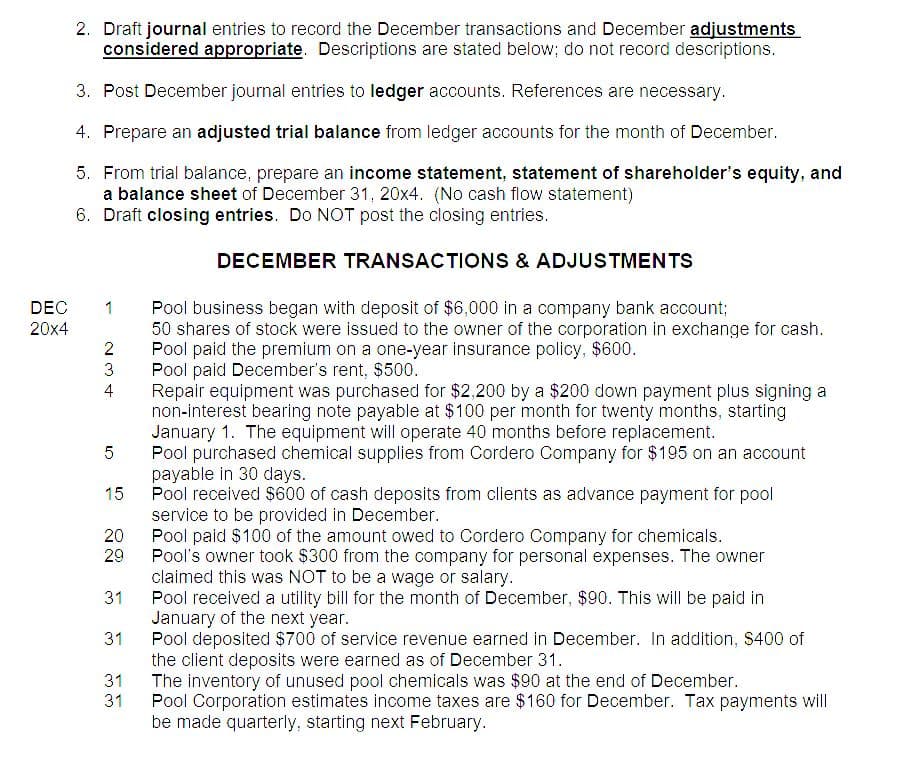

DEC 20x4 2. Draft journal entries to record the December transactions and December adjustments considered appropriate. Descriptions are stated below; do not record descriptions. 3. Post December journal entries to ledger accounts. References are necessary. 4. Prepare an adjusted trial balance from ledger accounts for the month of December. 5. From trial balance, prepare an income statement, statement of shareholder's equity, and a balance sheet of December 31, 20x4. (No cash flow statement) 6. Draft closing entries. Do NOT post the closing entries. 1 Pool business began with deposit of $6,000 in a company bank account; 50 shares of stock were issued to the owner of the corporation in exchange for cash. 2 Pool paid the premium on a one-year insurance policy, $600. 234 3 5 15 20 29 31 31 31 ب بن DECEMBER TRANSACTIONS & ADJUSTMENTS 31 Pool paid December's rent, $500. Repair equipment was purchased for $2,200 by a $200 down payment plus signing a non-interest bearing note payable at $100 per month for twenty months, starting January 1. The equipment will operate 40 months before replacement. Pool purchased chemical supplies from Cordero Company for $195 on an account payable in 30 days. Pool received $600 of cash deposits from clients as advance payment for pool service to be provided in December. Pool paid $100 of the amount owed to Cordero Company for chemicals. Pool's owner took $300 from the company for personal expenses. The owner claimed this was NOT to be a wage or salary. Pool received a utility bill for the month of December, $90. This will be paid in January of the next year. Pool deposited $700 of service revenue earned in December. In addition, $400 of the client deposits were earned as of December 31. The inventory of unused pool chemicals was $90 at the end of December. Pool Corporation estimates income taxes are $160 for December. Tax payments will be made quarterly, starting next February.

Bad Debts

At the end of the accounting period, a financial statement is prepared by every company, then at that time while preparing the financial statement, the company determines among its total receivable amount how much portion of receivables is collected by the company during that accounting period.

Accounts Receivable

The word “account receivable” means the payment is yet to be made for the work that is already done. Generally, each and every business sells its goods and services either in cash or in credit. So, when the goods are sold on credit account receivable arise which means the company is going to get the payment from its customer to whom the goods are sold on credit. Usually, the credit period may be for a very short period of time and in some rare cases it takes a year.

Please assist with this assignment. All accounts needed are shown in the T accounts image.

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

shouldn't there also be an adjustment for