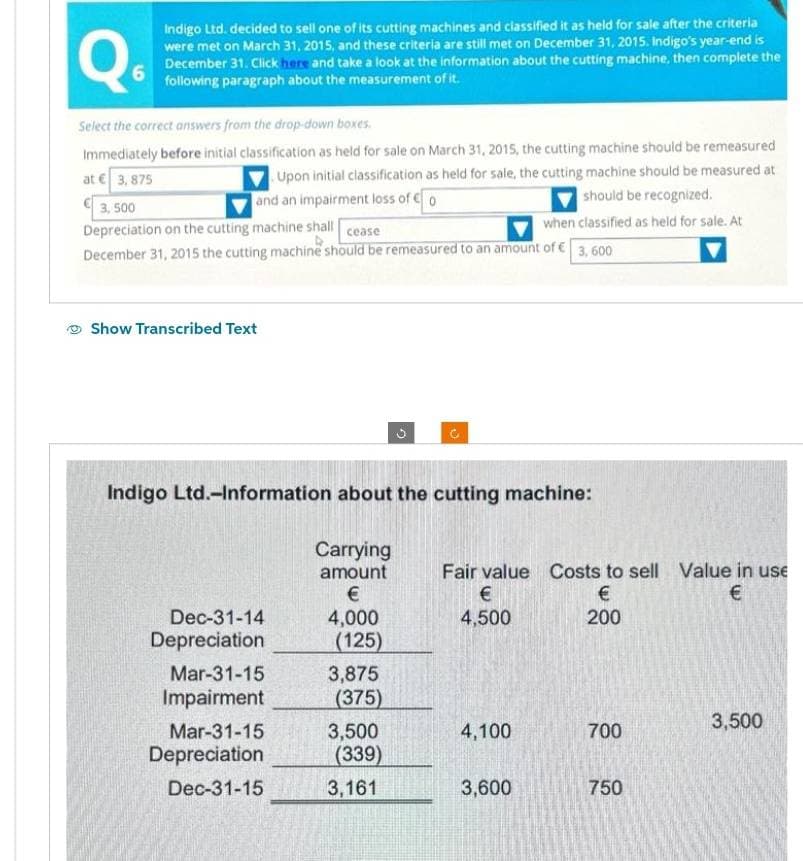

Dec-31-14 Depreciation Mar-31-15 Impairment Mar-31-15 Depreciation Dec-31-15 Carrying amount € 4,000 (125) 3,875 (375) 3,500 (339) 3,161 Fair value Costs to sell Value in use € € 4,500 4,100 3,600 € 200 700 750 3,500

Dec-31-14 Depreciation Mar-31-15 Impairment Mar-31-15 Depreciation Dec-31-15 Carrying amount € 4,000 (125) 3,875 (375) 3,500 (339) 3,161 Fair value Costs to sell Value in use € € 4,500 4,100 3,600 € 200 700 750 3,500

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 8P: At the beginning of 2020, Holden Companys controller asked you to prepare correcting entries for the...

Related questions

Question

Transcribed Image Text:Q₁

6

Indigo Ltd. decided to sell one of its cutting machines and classified it as held for sale after the criteria

were met on March 31, 2015, and these criteria are still met on December 31, 2015. Indigo's year-end is

December 31. Click here and take a look at the information about the cutting machine, then complete the

following paragraph about the measurement of it.

Select the correct answers from the drop-down boxes.

Immediately before initial classification as held for sale on March 31, 2015, the cutting machine should be remeasured

at €3,875

Upon initial classification as held for sale, the cutting machine should be measured at

and an impairment loss of € 0

should be recognized.

3,500

Depreciation on the cutting machine shall cease

December 31, 2015 the cutting machine should be remeasured to an amount of € 3, 600

Show Transcribed Text

Dec-31-14

Depreciation

Indigo Ltd.-Information about the cutting machine:

Mar-31-15

Impairment

Mar-31-15

Depreciation

Dec-31-15

Carrying

amount

€

4,000

(125)

3,875

(375)

G

3,500

(339)

3,161

Fair value Costs to sell Value in use

€

€

200

€

4,500

when classified as held for sale. At

4,100

3,600

700

750

3,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning