December 31, 2011 Cash 137,000 Bonds payable (due 2050) 100,000 Accounts payable 22,000 Dividends 20,000 Treasury stock, common (22,000 shares) 98,000 Preferred stock ($10 par) 80,000 Land 220,000 Paid-in Capital in excess of par value, preferred 8,000 Equipment 240,000 Accounts receivable 90,000 Common stock ($1 par) 400,000 Sales 940,000 Merchandise Inventory 70,000 Cost of Goods Sold 720,000 Unearned Revenue 18,000 Allowance for doubtful accounts 15,000 Operating expenses 95,000 Accumlated depreciation- equipment 40,000 paid in capital in excess of par value, common 40,000 Retained Earnings (1/1/2011) 27,000 1. The total debt percentage on December 31,2011 is 2. The gross margin percent for 2011 is

December 31, 2011 Cash 137,000 Bonds payable (due 2050) 100,000 Accounts payable 22,000 Dividends 20,000 Treasury stock, common (22,000 shares) 98,000 Preferred stock ($10 par) 80,000 Land 220,000 Paid-in Capital in excess of par value, preferred 8,000 Equipment 240,000 Accounts receivable 90,000 Common stock ($1 par) 400,000 Sales 940,000 Merchandise Inventory 70,000 Cost of Goods Sold 720,000 Unearned Revenue 18,000 Allowance for doubtful accounts 15,000 Operating expenses 95,000 Accumlated depreciation- equipment 40,000 paid in capital in excess of par value, common 40,000 Retained Earnings (1/1/2011) 27,000 1. The total debt percentage on December 31,2011 is 2. The gross margin percent for 2011 is

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 24E

Related questions

Question

December 31, 2011

| Cash | 137,000 |

| Bonds payable (due 2050) | 100,000 |

| Accounts payable | 22,000 |

| Dividends | 20,000 |

| 98,000 | |

| 80,000 | |

| Land | 220,000 |

| Paid-in Capital in excess of par value, preferred | 8,000 |

| Equipment | 240,000 |

| Accounts receivable | 90,000 |

| Common stock ($1 par) | 400,000 |

| Sales | 940,000 |

| Merchandise Inventory | 70,000 |

| Cost of Goods Sold | 720,000 |

| Unearned Revenue | 18,000 |

| Allowance for doubtful accounts | 15,000 |

| Operating expenses | 95,000 |

| Accumlated |

40,000 |

| paid in capital in excess of par value, common | 40,000 |

| 27,000 |

1. The total debt percentage on December 31,2011 is

2. The gross margin percent for 2011 is

Expert Solution

Step 1

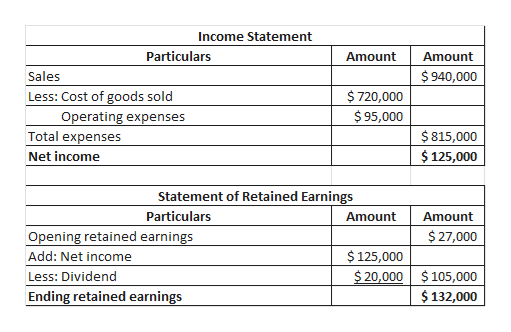

Prepare income statement and statement of retained earnings:

Step 2

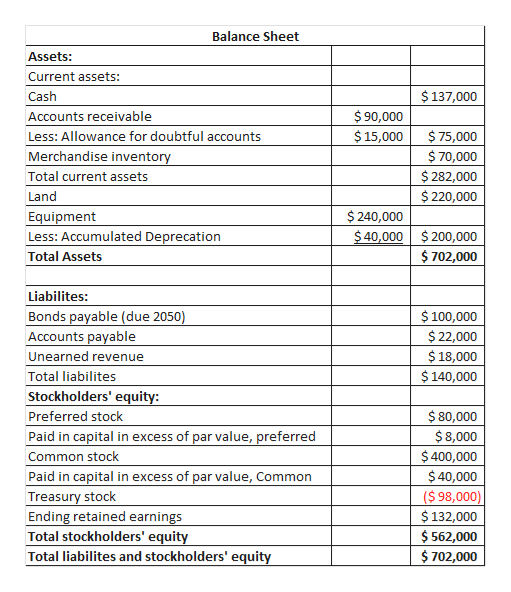

Prepare balance sheet:

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning