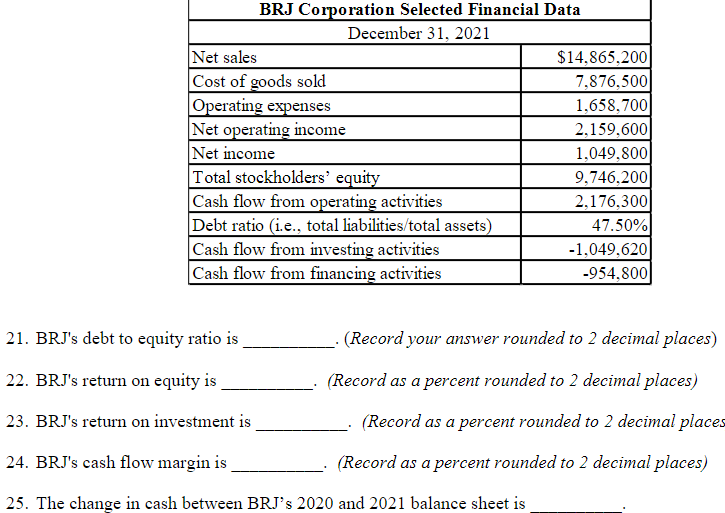

December 31, 2021 Net sales Cost of goods sold Operating expenses Net operating income Net income Total stockholders' equity Cash flow from operating activities Debt ratio (i.e., total liabilities/total assets) Cash flow from investing activities Cash flow from financing activities $14,865,200 7,876,500 1,658,700 2,159,600 1,049,800 9,746,200 2,176,300 47.50% -1,049,620 -954,800 21. BRJ's debt to equity ratio is _ - (Record your answer rounded to 2 decimal places) 22. BRJ's return on equity is , (Record as a percent rounded to 2 decimal places) 23. BRJ's return on investment is (Record as a percent rounded to 2 decimal place 24. BRJ's cash flow margin is (Record as a percent rounded to 2 decimal places) 25. The change in cash between BRJ's 2020 and 2021 balance sheet is

December 31, 2021 Net sales Cost of goods sold Operating expenses Net operating income Net income Total stockholders' equity Cash flow from operating activities Debt ratio (i.e., total liabilities/total assets) Cash flow from investing activities Cash flow from financing activities $14,865,200 7,876,500 1,658,700 2,159,600 1,049,800 9,746,200 2,176,300 47.50% -1,049,620 -954,800 21. BRJ's debt to equity ratio is _ - (Record your answer rounded to 2 decimal places) 22. BRJ's return on equity is , (Record as a percent rounded to 2 decimal places) 23. BRJ's return on investment is (Record as a percent rounded to 2 decimal place 24. BRJ's cash flow margin is (Record as a percent rounded to 2 decimal places) 25. The change in cash between BRJ's 2020 and 2021 balance sheet is

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 103.4C

Related questions

Question

answer only first three sub parts thnku

Transcribed Image Text:BRJ Corporation Selected Financial Data

December 31, 2021

Net sales

$14,865,200

Cost of goods sold

Operating expenses

Net operating income

Net income

Total stockholders' equity

Cash flow from operating activities

Debt ratio (i.e., total liabilities/total assets)

Cash flow from investing activities

Cash flow from financing activities

7,876,500

1,658,700

2,159,600

1,049,800

9,746,200

2,176,300

47.50%

-1,049,620

-954,800

21. BRJ's debt to equity ratio is

(Record your answer rounded to 2 decimal places)

22. BRJ's return on equity is

(Record as a percent rounded to 2 decimal places)

23. BRJ's return on investment is

(Record as a percent rounded to 2 decimal places

24. BRJ's cash flow margin is

(Record as a percent rounded to 2 decimal places)

25. The change in cash between BRJ's 2020 and 2021 balance sheet is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning