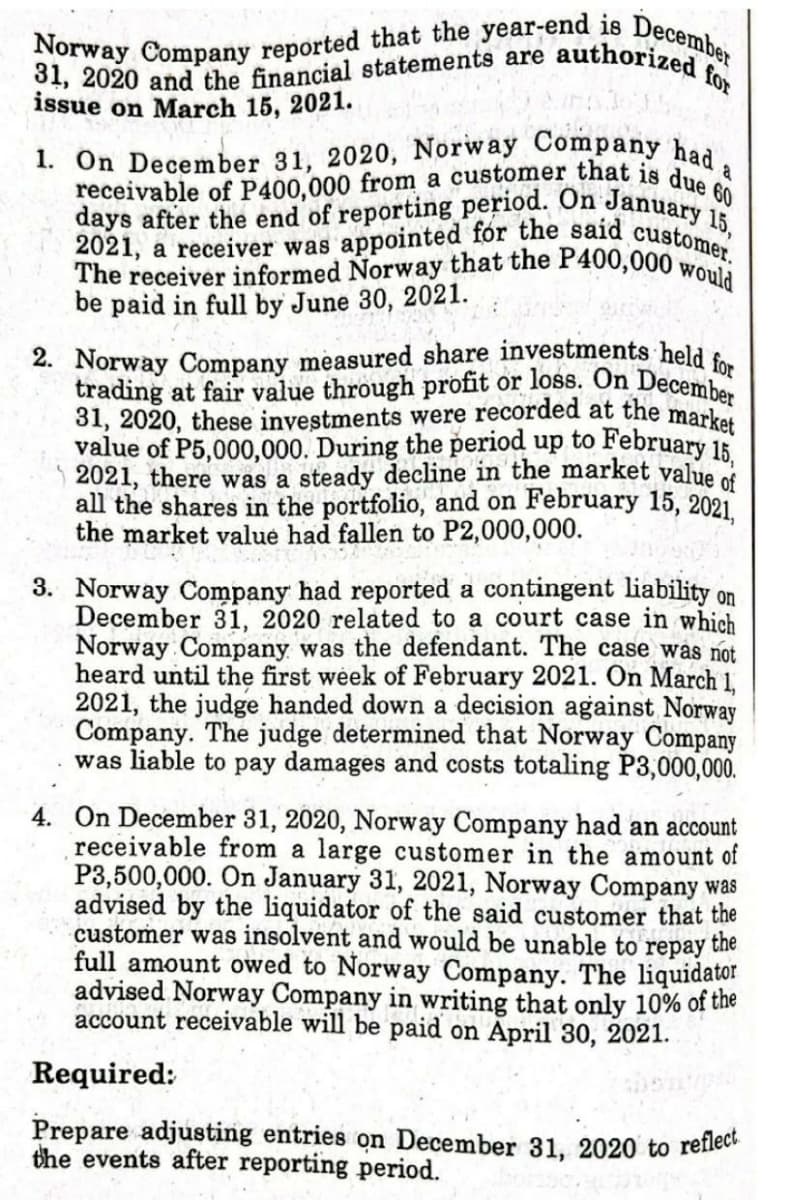

December Norway Company reported that the year-end is ! receivable of P400,000 from a customer that is due 60 2021, a receiver was appointed for the said customer. authorized for 31, 2020 and the financial statements are issue on March 15, 2021. 1. On December 31, 2020, Norway Company haa 15, days after the end of reporting period. On January The receiver informed Norway that the P400,000 be paid in full by June 30, 2021. would 2. Norway Company measured share investments held trading at fair value through profit or loss. On Decembe 31, 2020, these investments were recorded at the marka value of P5,000,000. During the period up to February 15 2021, there was a steady decline in the market value of all the shares in the portfolio, and on February 15, 2021. the market value had fallen to P2,000,000. 3. Norway Company had reported a contingent liability on December 31, 2020 related to a court case in which Norway Company was the defendant. The case was not heard until the first week of February 2021. On March 1, 2021, the judge handed down a decision against Norway Company. The judge determined that Norway Company was liable to pay damages and costs totaling P3,000,000. 4. On December 31, 2020, Norway Company had an account receivable from a large customer in the amount of P3,500,000. On January 31, 2021, Norway Company was advised by the liquidator of the said customer that the customer was insolvent and would be unable to repay the full amount owed to Norway Company. The liquidator advised Norway Company in writing that only 10% of the account receivable will be paid on Ãpril 30, 2021. Required: Prepare adjusting entries on December 31, 2020 to reflect the events after reporting period.

December Norway Company reported that the year-end is ! receivable of P400,000 from a customer that is due 60 2021, a receiver was appointed for the said customer. authorized for 31, 2020 and the financial statements are issue on March 15, 2021. 1. On December 31, 2020, Norway Company haa 15, days after the end of reporting period. On January The receiver informed Norway that the P400,000 be paid in full by June 30, 2021. would 2. Norway Company measured share investments held trading at fair value through profit or loss. On Decembe 31, 2020, these investments were recorded at the marka value of P5,000,000. During the period up to February 15 2021, there was a steady decline in the market value of all the shares in the portfolio, and on February 15, 2021. the market value had fallen to P2,000,000. 3. Norway Company had reported a contingent liability on December 31, 2020 related to a court case in which Norway Company was the defendant. The case was not heard until the first week of February 2021. On March 1, 2021, the judge handed down a decision against Norway Company. The judge determined that Norway Company was liable to pay damages and costs totaling P3,000,000. 4. On December 31, 2020, Norway Company had an account receivable from a large customer in the amount of P3,500,000. On January 31, 2021, Norway Company was advised by the liquidator of the said customer that the customer was insolvent and would be unable to repay the full amount owed to Norway Company. The liquidator advised Norway Company in writing that only 10% of the account receivable will be paid on Ãpril 30, 2021. Required: Prepare adjusting entries on December 31, 2020 to reflect the events after reporting period.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 6P

Related questions

Question

Transcribed Image Text:1. On December 31, 2020, Norway Company had:

2021, a receiver was appointed for the said customer.

Norway Company reported that the year-end is December

The receiver informed Norway that the P400,000 would

days after the end of reporting period. On January 15,

authorized

receivable of P400,000 from a customer that is due 60

31, 2020, these investments were recorded at the market

31, 2020 and the financial statements are

issue on March 15, 2021.

for

be paid in full by June 30, 2021.

2. Norway Company measured share investments held .

trading at fair value through profit or loss. On December

value of P5,000,000. During the period up to February 15

2021, there was a steady decline in the market value of

all the shares in the portfolio, and on February 15, 2021.

the market value had fallen to P2,000,000.

3. Norway Company had reported a contingent liability on

December 31, 2020 related to a court case in which

Norway Company was the defendant. The case was not

heard until the first week of February 2021. On March 1,

2021, the judge handed down a decision against Norway

Company. The judge determined that Norway Company

was liable to pay damages and costs totaling P3,000,000.

4. On December 31, 2020, Norway Company had an account

receivable from a large customer in the amount of

P3,500,000. On January 31, 2021, Norway Company was

advised by the liquidator of the said customer that the

customer was insolvent and would be unable to

the

repay

full amount owed to Norway Company. The liquidator

advised Norway Company in writing that only 10% of the

account receivable will be paid on April 30, 2021.

Required:

Prepare adjusting entries on December 31, 2020 to reflec

the events after reporting period.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning