Deferred Revenue True or false: A reduction of the deferred revenue account can be interpreted as a leading indicator of lower future revenues. Explain OFalse. Revenue is recognized when the deferred revenue liability increases. If the deferred revenue account has decreased, more cash came in from customers and more revenue will be recognized in the future. OTrue. Revenue is recognized when the deferred revenue liability decreases. If the deferred revenue account has decreased, less cash came in from customers and less revenue will be recognized in the future. OFalse. Revenue is recognized when the deferred revenue liability decreases. If the deferred revenue account has decreased, less cash came in from customers and more revenue will be recognized in the future. OTrue. Revenue is recognized when the deferred revenue liability decreases. If the deferred revenue account has decreased, more cash came in from customers and less revenue will be recognized in the future.

Deferred Revenue True or false: A reduction of the deferred revenue account can be interpreted as a leading indicator of lower future revenues. Explain OFalse. Revenue is recognized when the deferred revenue liability increases. If the deferred revenue account has decreased, more cash came in from customers and more revenue will be recognized in the future. OTrue. Revenue is recognized when the deferred revenue liability decreases. If the deferred revenue account has decreased, less cash came in from customers and less revenue will be recognized in the future. OFalse. Revenue is recognized when the deferred revenue liability decreases. If the deferred revenue account has decreased, less cash came in from customers and more revenue will be recognized in the future. OTrue. Revenue is recognized when the deferred revenue liability decreases. If the deferred revenue account has decreased, more cash came in from customers and less revenue will be recognized in the future.

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter6: Audit Evidence

Section: Chapter Questions

Problem 17RQSC

Related questions

Question

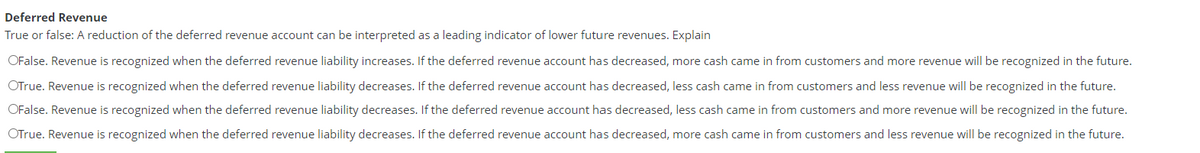

Transcribed Image Text:Deferred Revenue

True or false: A reduction of the deferred revenue account can be interpreted as a leading indicator of lower future revenues. Explain

OFalse. Revenue is recognized when the deferred revenue liability increases. If the deferred revenue account has decreased, more cash came in from customers and more revenue will be recognized in the future.

OTrue. Revenue is recognized when the deferred revenue liability decreases. If the deferred revenue account has decreased, less cash came in from customers and less revenue will be recognized in the future.

OFalse. Revenue is recognized when the deferred revenue liability decreases. If the deferred revenue account has decreased, less cash came in from customers and more revenue will be recognized in the future.

OTrue. Revenue is recognized when the deferred revenue liability decreases. If the deferred revenue account has decreased, more cash came in from customers and less revenue will be recognized in the future.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage