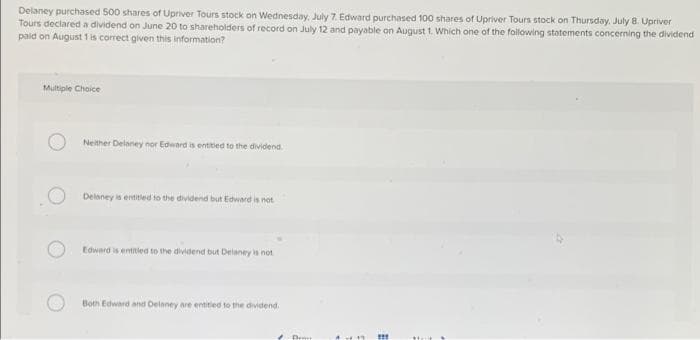

Delaney purchased 500 shares of Upriver Tours stock on Wednesday, July 7. Edward purchased 100 shares of Upriver Tours stock on Thursday, July 8. Upriver Tours declared a dividend on June 20 to shareholders of record on July 12 and payable on August 1. Which one of the following statements concerning the divie paid on August 1 is correct given this information? Multiple Choice Neither Delaney nor Edward is entitled to the dividend Delaney is entitled to the dividend but Edward is not Edward is entitled to the dividend but Delaney is not Both Edward and Delaney are entitled to the dividend

Delaney purchased 500 shares of Upriver Tours stock on Wednesday, July 7. Edward purchased 100 shares of Upriver Tours stock on Thursday, July 8. Upriver Tours declared a dividend on June 20 to shareholders of record on July 12 and payable on August 1. Which one of the following statements concerning the divie paid on August 1 is correct given this information? Multiple Choice Neither Delaney nor Edward is entitled to the dividend Delaney is entitled to the dividend but Edward is not Edward is entitled to the dividend but Delaney is not Both Edward and Delaney are entitled to the dividend

Chapter9: Acquisitions Of Property

Section: Chapter Questions

Problem 33P

Related questions

Question

D6)

Transcribed Image Text:Delaney purchased 500 shares of Upriver Tours stock on Wednesday, July 7. Edward purchased 100 shares of Upriver Tours stock on Thursday, July 8. Upriver

Tours declared a dividend on June 20 to shareholders of record on July 12 and payable on August 1. Which one of the following statements concerning the dividend

paid on August 1 is correct given this information?

Multiple Choice

Neither Delaney nor Edward is entitled to the dividend

Delaney is entitled to the dividend but Edward is not

Edward is entitled to the dividend but Delaney is not

Both Edward and Delaney are entitled to the dividend

Dean

***

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you