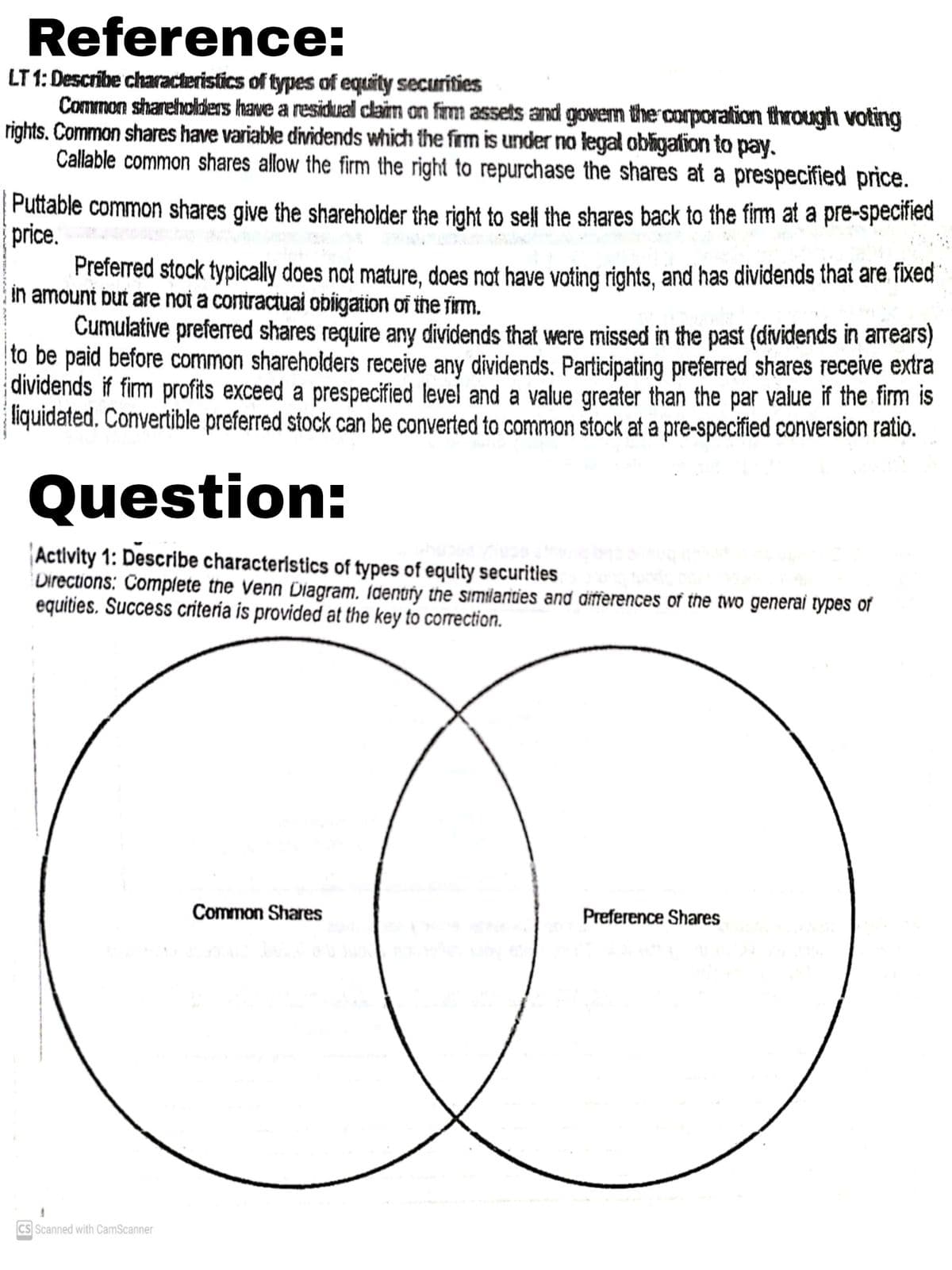

: Describe characteristics of types of equity securities Directions: Complete the Venn Diagram. Identify the similandies and differences of the two general types of equities.

Reference:

LT 1: Describe characteristics of types of equity securities Common shareholders have a residual claim on firm assets and govern the corporation through voting rights. Common shares have variable dividends which the firm is under no legal obligation to pay. Callable common shares allow the firm the right to repurchase the shares at a prespecified price.

Puttable common shares give the shareholder the right to sell the shares back to the firm at a pre-specified price. Preferred stock typically does not mature, does not have voting rights, and has dividends that are fixedn amount but are not a contractual obligation of the firm.

Cumulative

Question:

Activity 1: Describe characteristics of types of equity securities Directions: Complete the Venn Diagram. Identify the similandies and differences of the two general types of equities.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps